2025-048 Cannabis Business Licensing

The State’s Grant Funding Assisted Businesses, but a Lack of Preparedness Limited the Grant’s Impact

Published: November 20, 2025Report Number: 2025-048

November 20, 2025

2025‑048

The Governor of California

President pro Tempore of the Senate

Speaker of the Assembly

State Capitol

Sacramento, California 95814

Dear Governor and Legislative Leaders:

As required by the Budget Act of 2021, my office conducted an audit of the Local Jurisdiction Assistance Grant Program (Grant Program), and the following report details the audit’s findings and conclusions. In general, we determined that all cities and counties (local jurisdictions) that received funding from the Grant Program made progress in reducing the number of provisional licenses among their cannabis businesses, but we had concerns about how two local jurisdictions spent some of the Grant Program funds.

The Department of Cannabis Control (DCC) and 17 local jurisdictions have made significant strides in transitioning cannabis businesses from provisional to annual licenses. As of June 30, 2025, the number of provisional licenses dropped dramatically from more than 4,600 in January 2023 to fewer than 300. DCC expects to complete the remaining transitions without major obstacles, and four of the five local jurisdictions we spoke with believe that they will finalize transitions for responsive businesses by the end of 2025. However, there are concerns about the use of Grant Program funding. At least $35.7 million remained unspent or was disallowed across local jurisdictions. DCC has closed out six jurisdictions, returning $4.1 million to the General Fund, but it is still reviewing the remaining 11. The final amount of unspent funds may change depending on whether DCC identifies additional unallowable expenditures. In addition, although the Grant Program’s purpose is to help businesses meet the requirements needed to attain annual state licensure, DCC approved Humboldt County’s use of Grant Program funds to provide subgrants to cannabis businesses that already held annual state licenses. Further, the city of Oakland made a $2,000 purchase of computer equipment that did not comply with its grant agreement.

While DCC and the 17 local jurisdictions largely achieved the program’s goal of transitioning businesses to annual licenses, it remains unclear how much of that success we can attribute directly to the Grant Program funding. Challenges such as limited staffing, lack of experience managing large grants, and unclear guidance on fund usage hindered the program’s effectiveness. These issues suggest that DCC could have benefited from clearer administrative guidance at the program’s outset.

Respectfully submitted,

GRANT PARKS

California State Auditor

Selected Abbreviations Used in This Report

| CEQA | California Environmental Quality Act |

| DCC | Department of Cannabis Control |

| DGS | Department of General Services |

Key Observations

- The Department of Cannabis Control (DCC) and the 17 local jurisdictions made substantial progress in transitioning cannabis businesses from provisional to annual state licenses. As of June 30, 2025, the number of provisional licenses in those jurisdictions had decreased from more than 4,600 in January 2023 to fewer than 300. DCC does not anticipate significant barriers to transitioning the remaining provisional licenses, and most of the local jurisdictions we interviewed believe that they will complete most transitions for responsive cannabis businesses by the end of 2025.

- The 17 local jurisdictions had at least $35.7 million in unspent or disallowed Local Jurisdiction Assistance Grant Program (Grant Program) funding. As of June 30, 2025, DCC had completed its analysis of expenditures, a process referred to as closing out, for six of the 17 local jurisdictions, returning $4.1 million of unspent and disallowed Grant Program funds to the State’s General Fund. However, because DCC was still in the process of closing out the remaining 11 jurisdictions as of September 2025, the total amount of unspent Grant Program funds is subject to change depending on whether DCC determines that any of these local jurisdictions spent funds on unallowable uses.

- Of the three local jurisdictions we reviewed, we are concerned with how two spent Grant Program funds. Although the Grant Program’s purpose is to help businesses meet the requirements needed to attain annual state licensure, DCC approved Humboldt County’s use of Grant Program funds to provide subgrants to cannabis businesses that already held annual state licenses. We also found that Oakland made a $2,000 purchase of computer equipment that did not comply with its grant agreement with DCC.

- Although DCC largely met the intent of the Grant Program to transition cannabis businesses from provisional to annual state licenses, it remains unclear how much of that success we can attribute directly to the Grant Program funding. DCC’s insufficient staffing and inexperience with managing a large grant may have contributed to delays in local jurisdictions’ ability to effectively use Grant Program funding. DCC struggled to reach a shared understanding with some local jurisdictions on the allowable uses of Grant Program funding which affected local jurisdictions’ ability to spend all of their Grant Program funds. The issues we identified in this and previous reports indicate that DCC may have benefited from clearer and earlier guidance on government grant administration at the outset of the Grant Program.

Agency Comments

DCC agreed to implement both of our recommendations.

Background

For a more detailed background on the Grant Program and cannabis business licenses, refer to the Introduction of Report 2024-048, Cannabis Business Licensing: Jurisdictions Have Made Progress to Meet Goals of the Local Jurisdiction Assistance Grant Program, but Some Inappropriate Expenditures Persist, February 2025.

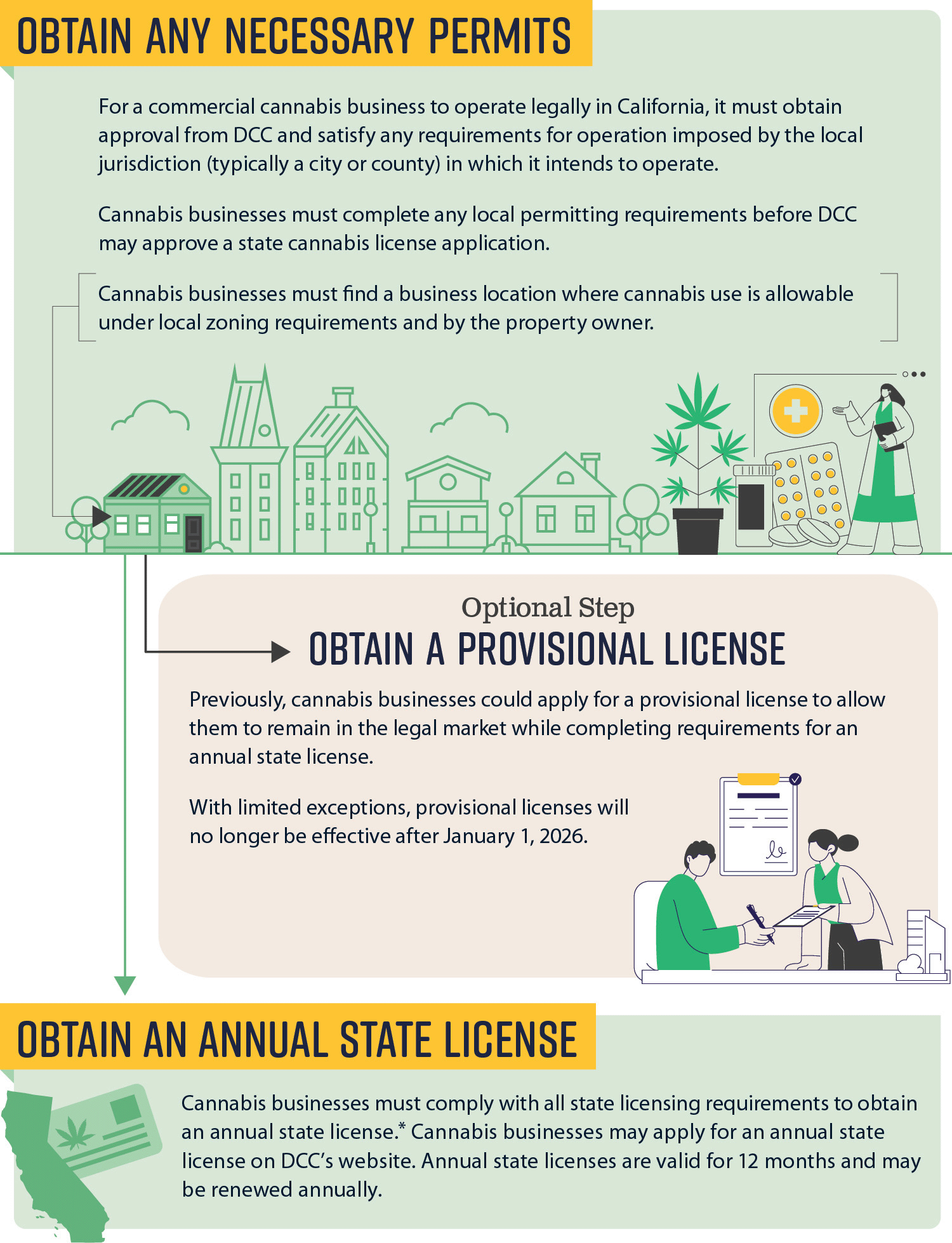

In November 2016, California voters legalized the nonmedical use of cannabis for adults age 21 or older.1 To legally operate in California, cannabis businesses must complete key steps to obtain licenses from the State, as Figure 1 shows. The State initially issued provisional licenses to encourage cannabis businesses to enter the newly regulated market. As a condition of receiving a provisional license, a cannabis business must be actively working to obtain local permits and pursuing compliance with the California Environmental Quality Act (CEQA).2 State law requires most types of cannabis businesses to obtain annual state licenses by January 1, 2026, and provisional licenses for those types of cannabis businesses will no longer be effective after that date.3

Figure 1

Cannabis Businesses Must Complete Key Steps to Conduct Business in California

Source: State law.

* License requirements can vary by cannabis business type.

Figure 1 is a flowchart that describes two required key steps and one optional key step for a commercial cannabis business to operate legally in California. These steps are:

Obtain Any Necessary Permits

For a commercial cannabis business to operate legally in California, it must obtain approval from DCC and satisfy any requirements for operation imposed by the local jurisdiction (typically a city or county) in which it intends to operate.

Cannabis businesses must complete any local permitting requirements before DCC may approve a state cannabis license application.

Cannabis businesses must find a business location where cannabis use is allowable under local zoning requirements and by the property owner.

Optional Step: Obtain a Provisional License

Previously, cannabis businesses could apply for a provisional license to allow them to remain in the legal market while completing requirements for an annual state license.

With limited exceptions, provisional licenses will no longe be effective after January 1, 2026

Obtain an Annual State License

Cannabis businesses must comply with all state licensing requirements to obtain an annual state license. License requirements can vary by cannabis business type. Cannabis businesses may apply for an annual state license on DCC’s website. Annual state licenses are valid for 12 months and may be renewed annually. The source for this figure is State law.

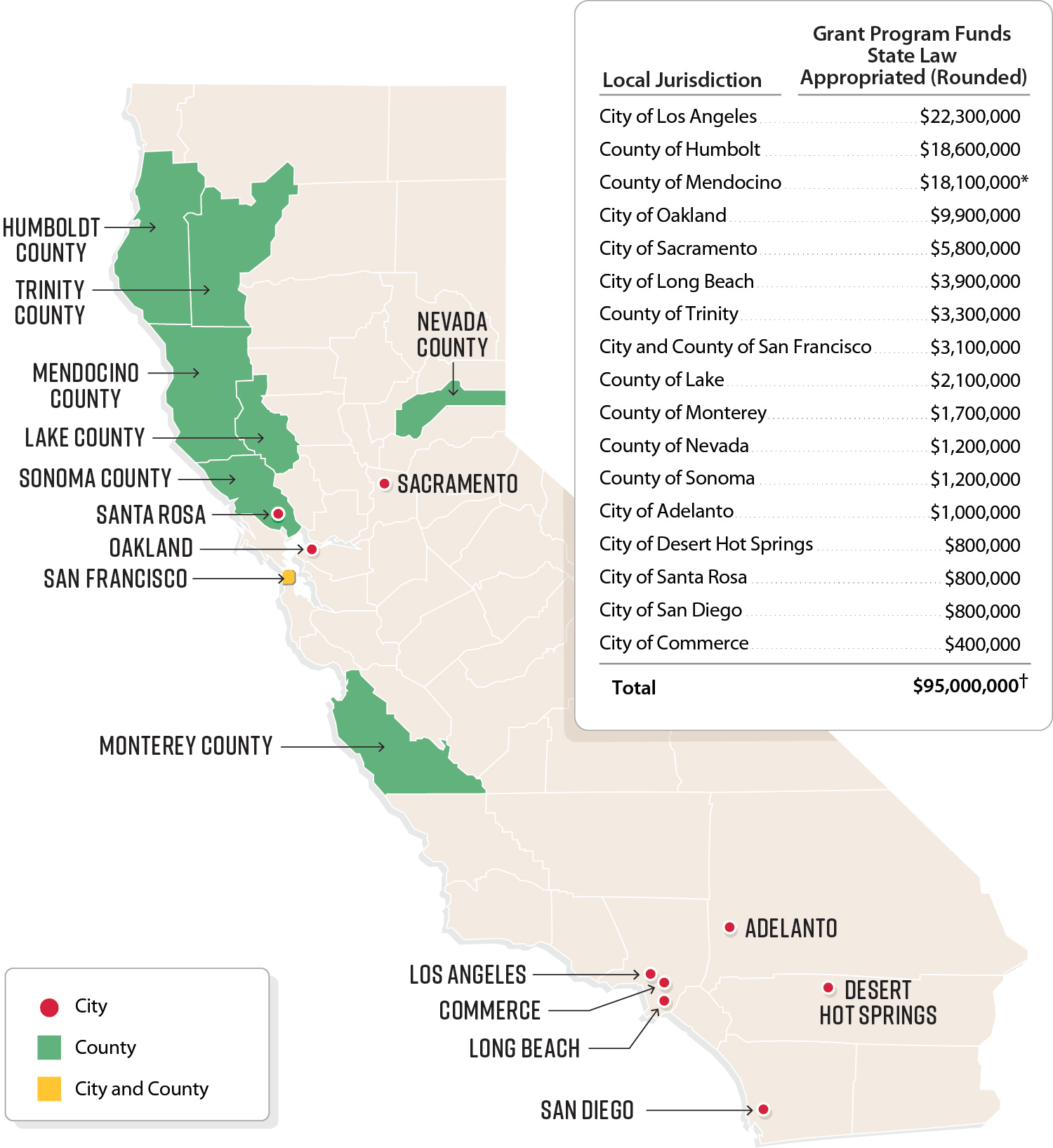

The Budget Act of 2021 (Budget Act) appropriated $100 million for the Grant Program to assist certain local jurisdictions in helping cannabis businesses transition from provisional to annual state licenses. The Budget Act designated 17 local jurisdictions that were eligible to receive Grant Program funding, as Figure 2 shows. Of the $100 million appropriated for the Grant Program, the Budget Act appropriated up to $5 million to DCC to administer the Grant Program. DCC administers the Grant Program through its Office of Grants Management.

Figure 2

Seventeen Local Jurisdictions Were Eligible to Receive Funding From the Grant Program

Source: State law.

* Although the Legislature appropriated $18.1 million for Mendocino County, the amount Mendocino County agreed to with DCC in its grant agreement was approximately $17.6 million.

† The total does not include the $5 million appropriated to DCC to administer the Grant Program.

Figure 2 shows that state law appropriated Grant Program funds to seventeen local jurisdiction, represented by a map of California that highlights the locations of those local jurisdictions. State law appropriated the following amounts of grant program funding to these jurisdictions:

City of Los Angeles – $22.3 million

County of Humboldt – $18.6 million

County of Mendocino – $18.1 million (Although the Legislature appropriated $18.1 million for Mendocino County, the amount Mendocino County agreed to with DCC in its grant agreements was approximately $17.6 million)

City of Oakland – $9.9 million

City of Sacramento – $5.8 million

City of Long Beach – $3.9 million

County of Trinity – $3.3 million

City and County of San Francisco – $3.1 million

County of Lake – $2.1 million

County of Monterey – $1.7 million

County of Nevada – $1.2 million

County of Sonoma – $1.2 million

City of Adelanto – $1 million

City of Desert Hot Springs – $800 thousand

City of Santa Rosa – $800 thousand

City of San Diego – $800 thousand

City of Commerce – $400 thousand

The total amount appropriated to the seventeen local jurisdictions is approximately $95 million. This total does not include the $5 million appropriated to DCC to administer the Grant Program.

The source for this figure is state law.

State law requires the California State Auditor (State Auditor) to annually conduct a performance audit of local jurisdictions receiving Grant Program funding, beginning on January 1, 2023, and concluding on January 1, 2026. We published two previous reports on cannabis business licensing, and we sent a letter in July 2023 to DCC’s director (management letter) to communicate preliminary issues we identified with DCC’s management of the Grant Program. The text box summarizes key findings from those issuances. Tables A.1 and A.2 in Appendix A list the recommendations from those reports and the State Auditor’s assessment of the implementation of those recommendations. In this audit, we focused on three local jurisdictions that received significant amounts of Grant Program funding and had high numbers of active provisional licenses remaining as of June 30, 2024. The three jurisdictions we selected for review are the cities of Los Angeles and Oakland and Humboldt County.

Summary of Key Issues Identified During Previous Grant Program Audits

July 2023 Management Letter for Report 2023-048:

- DCC approved questionable spending plans and advanced grant funds to recipients who were not prepared to receive them.

- DCC had not scrutinized grantee expenditures and did not monitor grantees’ progress toward defined goals.

- DCC misspent administrative funds and did not have sufficient staff with requisite knowledge to oversee the Grant Program.

Report 2023-048, Cannabis Business Licensing: Inadequate Oversight and Inappropriate Expenditures Weaken the Local Jurisdiction Assistance Grant Program, August 2024:

- DCC did not appropriately oversee the Grant Program.

- Some grantees did not manage their grant funds properly.

- The Grant Program may not achieve its goals, and DCC cannot determine the causes of delays in license processing.

Report 2024-048, Cannabis Business Licensing: Jurisdictions Have Made Progress to Meet Goals of the Local Jurisdiction Assistance Grant Program, but Some Inappropriate Expenditures Persist, February 2025:

- Despite some progress in reducing the number of provisional licenses, local jurisdictions continue to face challenges.

- Several local jurisdictions spent Grant Program funds for unallowable purposes.

- Nine of 17 local jurisdictions expect to meet Grant Program goals without spending all Grant Program funds.

Source: State Auditor reports 2023-048 and 2024-048 and a management letter.

Audit Results

DCC and Local Jurisdictions Transitioned a Significant Number of Provisional Licenses to Annual State Licenses

According to DCC’s state licensing data, DCC and the 17 local jurisdictions transitioned a significant number of provisional licenses to annual state licenses by June 30, 2025. We reviewed DCC’s licensing data to identify the number of active provisional licenses as of June 30, 2025, as well as the number of transitions to annual state licenses that occurred in each of the 17 local jurisdictions during fiscal year 2024–25. Table 1 shows that there were more than 4,600 provisional licenses in the 17 local jurisdictions as of January 1, 2023, but the local jurisdictions reduced that number to fewer than 300 by June 30, 2025.

DCC data show that the majority of the 17 local jurisdictions had 12 or fewer provisional licenses remaining, and Nevada County eliminated all of its remaining provisional licenses. Most jurisdictions had significantly fewer provisional licenses as of June 30, 2025, than the previous year. Although Los Angeles had the most provisional licenses remaining at 113, it had ended the previous fiscal year with 951 provisional licenses. The decrease is a marked improvement and contrasts with the projection in Report 2024-048, February 2025, in which we estimated that, based on its then-current rate of transition, Los Angeles would have 938 provisional licenses remaining as of January 1, 2026.

Most of the reduction in provisional licenses appears to have occurred through transitions to annual state licenses. Table 2 shows that the 17 local jurisdictions transitioned more than 1,700 provisional licenses to annual state licenses in fiscal year 2024–25. This amount is more than the 1,214 transitions that occurred in the year and a half leading up to June 30, 2024, and Mendocino County and Los Angeles were the primary drivers of the increase. Those two jurisdictions completed far fewer transitions during fiscal year 2023–24 but accounted for 70 percent of the transitions in fiscal year 2024–25.

According to the director of DCC, it does not anticipate significant barriers to transitioning the remaining provisional licenses by the statutory deadline of January 1, 2026. However, she stated that some businesses may continue to face challenges related to local processes, CEQA requirements, or business decisions outside of the licensing framework.

Four of the five local jurisdictions we interviewed believe that they will be able to transition most of their remaining provisional licenses to annual state licenses by the end of 2025 for those businesses that continue to participate in the process. We spoke with staff at the five local jurisdictions with 25 or more remaining provisional licenses as of June 30, 2025: the cities of Los Angeles and Oakland and the counties of Humboldt, Mendocino, and Sonoma. Sonoma County noted a lack of responsiveness or failure to complete required steps on the part of some cannabis businesses, but the county does not anticipate any problem with transitioning the remaining licenses for businesses that desire to transition and are adequately responsive. Similarly, Los Angeles believes that as long as cannabis businesses provide the necessary documents, the city should not have any problem transitioning the remaining active provisional licenses. When a cannabis business holding a provisional license does not respond to a jurisdiction’s requests in a timely manner, that business delays the local jurisdiction’s processing of the local permit application and subsequent issuance of an annual state license. Factors other than a lack of timely response can also result in delays. For instance, Humboldt County reported that it is working with 30 cannabis businesses with provisional licenses to resolve land-use compliance issues, which the deputy planning director stated are unlikely to be resolved by the end of 2025. In addition, the deputy planning director confirmed that Humboldt County is working with 12 other cannabis businesses with provisional licenses that could achieve compliance by the end of 2025 if they provide the necessary information to the county, though she explained that this is unlikely. If these cannabis businesses do not obtain annual state licensure by January 1, 2026, their provisional licenses will expire and they will not be eligible to conduct cannabis-related activities. However, Humboldt County’s deputy planning director stated that the county will continue to work with cannabis businesses that cooperate.

Local Jurisdictions Had at Least $35.7 Million in Unspent or Disallowed Grant Program Funding

Of the $95 million that the Budget Act appropriated for the 17 local jurisdictions, DCC disbursed to local jurisdictions $84 million in total Grant Program funds. DCC initially disbursed 80 percent of the total awarded funding to local jurisdictions in 2022 when the Grant Program started, withholding the remaining 20 percent until local jurisdictions had substantially met their annual goals to help cannabis businesses transition provisional licenses to annual state licenses. To receive the remaining 20 percent of the Grant Program funds, local jurisdictions had to submit a formal request to DCC. Of the seven jurisdictions that submitted requests, DCC awarded the remaining 20 percent to five of them, including the city of Desert Hot Springs and the counties of Humboldt, Mendocino, Monterey, and Trinity. DCC denied disbursement requests from the city of Oakland and Sonoma County because of concerns that these jurisdictions were spending funds outside the scope of the Grant Program.

We calculated that local jurisdictions collectively spent $59.3 million in Grant Program funds they received, leaving about $35.7 million, or 38 percent, unspent of the total $95 million appropriated to the Grant Program.4 However, as of September 2025, DCC was still in the process of closing out 11 of the 17 local jurisdictions’ grants. Closing out is a process in which DCC conducts a comprehensive internal analysis of each jurisdiction’s budget, expenditures, and supporting documentation to determine whether funds are subject to recapture. The Budget Act set forth allowable and unallowable uses for the Grant Program, as we describe in the text box. DCC may recapture Grant Program funds if jurisdictions did not spend or encumber the funds within the established time frame, used the funds for ineligible purposes, used the funds in a manner not in compliance with the jurisdiction’s approved budget, or if the jurisdiction failed to demonstrate progress toward addressing requirements necessary to attain annual licensure. If DCC determines that funds are subject to recapture, a local jurisdiction has 30 calendar days to provide additional documentation that substantiates that the Grant Program funds are allowable and not subject to recapture, propose a corrective action plan, or agree to return the disallowed Grant Program funds to DCC.

State Law Specifies Allowable and Unallowable Uses of Grant Program Funds

Allowable Uses:

- Local government review, technical support, and certification for application requirements.

- Local government or other professional preparation of environmental documents in compliance with CEQA for permits, licenses, or other authorizations to engage in commercial cannabis activity.

- Mitigation measures related to environmental compliance, including water conservation and protection measures.

- Other uses that further the intent of the program as determined by the DCC.

Unallowable Uses:

- Costs of fees related to litigation.

- Payment of fines or other penalties incurred for violations of environmental laws and regulations.

- State or local commercial cannabis license or application fees, excluding fees related to CEQA compliance and review.

- Supplanting existing cannabis-related funding.

- Other prohibited uses as determined by DCC.

Source: State law.

DCC has completed the close-out process for six of the 17 local jurisdictions that received Grant Program funds. Our review of deposit forms, check payments, and DCC’s documentation from the State Controller’s Office shows that DCC returned nearly $4.1 million in unspent and disallowed funds to the General Fund as of June 30, 2025, as Table 3 shows. DCC’s grants manager said that the department will not know the exact total of Grant Program funds it will return to the General Fund until it finishes its comprehensive reviews and resolves any rebuttals from the 11 local jurisdictions that are still in the close-out process. He estimated that DCC will complete the close-out process near the end of 2025. Table 3 shows that the 17 local jurisdictions had $24.7 million in unspent Grant Program funds, but this amount may increase if DCC determines during the close-out process that any of the remaining 11 jurisdictions used Grant Program funds for unallowable purposes. To the extent that DCC ultimately determines that a local jurisdiction used funds for ineligible or improper purposes, the jurisdiction must reimburse any disallowed expenses or risk late fees, interest charges, referral to collections, or legal action.

According to DCC’s grants manager, DCC will return the sum of unspent funds and disallowed funding to the State after it receives those funds from the local jurisdictions. However, he stated that because of the various types of expenditures made by each local jurisdiction and the process to work with local jurisdictions to determine eligibility, as of October 2025, DCC is unable to provide a clear timeline for when it expects to fully recapture all disallowed expenditures. According to our review of the State Controller’s Office documentation, DCC should return the funds to the General Fund by June 30, 2027. The extent to which local jurisdictions ultimately use Grant Program funding will indicate whether the program contributed to their success in transitioning provisional licenses to annual state licenses. DCC will need to proactively report the final amount publicly to allow the Legislature and the public the opportunity to consider this information when assessing the program’s impact on achieving its goals.

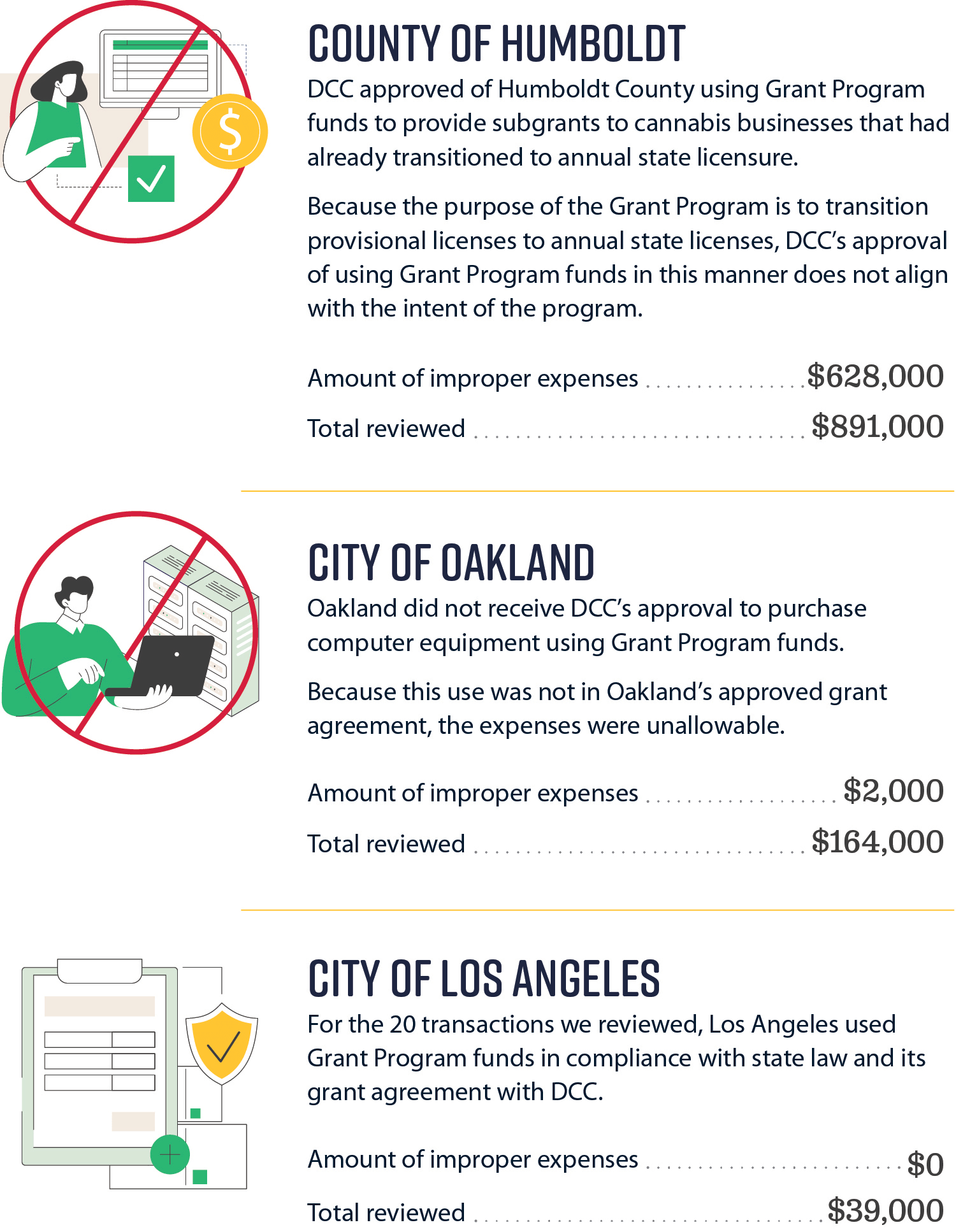

Two Local Jurisdictions Improperly Spent Grant Program Funds and Lacked Oversight of Subgrantees

For two of the three local jurisdictions we reviewed, we had concerns with how they spent some Grant Program funds. We selected three local jurisdictions that received large amounts of Grant Program funding and had high numbers of provisional licenses remaining: the cities of Los Angeles and Oakland and Humboldt County. We reviewed 20 transactions made by each selected local jurisdiction; examined invoices, receipts, and other supporting documentation; and evaluated the transactions against their grant agreements and the requirements in law to determine whether those transactions were allowable uses of Grant Program funding. As Figure 3 shows, although we did not identify any concerns with Los Angeles’ spending, we identified concerns with some of Humboldt County’s and Oakland’s spending.

Figure 3

Two of Three Local Jurisdictions We Reviewed Spent Some Grant Program Funds for Improper Purposes

Source: Auditor analysis of local jurisdictions’ grant agreements, selected transactions, and supporting documentation.

Figure 3 shows the three local jurisdictions whose Grand Program fund spending our office reviewed. These local jurisdictions are the County of Humboldt, the city of Oakland, and the city of Los Angeles. Two of the three local jurisdictions improperly spent grant funds.

County of Humboldt

DCC approved of Humboldt County using Grant Program funds to provide subgrants to cannabis businesses that had already transitioned to annual state licensure. Because the purpose of the Grant Program is to transition provisional licenses to annual state licenses, DCC’s approval of using Grant Program funds in this manner does not align with the intent of the program.

Amount of improper expenses – $628,000

Total reviewed – $891,000

City of Oakland

Oakland did not receive DCC’s approval to purchase computer equipment using Grant Program funds. Because this use was not in Oakland’s approved grant agreement, the expenses were unallowable.

Amount of improper expenses – $2,000

Total reviewed – $164,000

City of Los Angeles

For the 20 transactions we reviewed, Los Angeles used Grant Program funds in compliance with state law and its grant agreement with DCC.

Amount of improper expenses – $0

Total reviewed – $39,000 The source for this figure is auditor analysis of local jurisdictions’ grant agreements, selected transactions, and supporting documentation.

Although the 20 transactions we reviewed for Humboldt County met the requirements for allowability under state law because they were approved in the grant agreement between DCC and the county, we found that DCC approved Humboldt County’s use of Grant Program funds in a manner that did not always align with the purpose for which the Legislature appropriated these funds, as the text box shows. Among the 20 transactions we reviewed, we identified 14 instances totaling $628,000, in which Humboldt County provided subgrants to cannabis businesses that had already transitioned to annual state licensure. The businesses had transitioned more than a month to more than two years before receiving grant funds. The Grant Program’s purpose is to support local jurisdictions in assisting cannabis businesses with provisional licenses to meet those requirements that are necessary to attain an annual state license. According to DCC’s grant agreement with Humboldt County, the primary goal of its subgrant program was to assist provisional licensees to achieve compliance with local renewable energy and water conservation requirements, thereby enabling their transition to annual state licensure. However, the grant agreement stated that the subgrant applicants had provisional or annual licenses, which as it pertains to annual licensees, does not align with the Grant Program’s purpose.

DCC Approved Humboldt County to Use Grant Funds in a Manner That Did Not Always Align With the Purpose of the Grant Program

- Humboldt County provided subgrants to cannabis businesses to assist them with meeting local water conservation and renewable energy requirements. However, DCC allowed Humboldt County to provide subgrants to both provisionally licensed cannabis businesses and to cannabis businesses that had already transitioned to annual state licensure.

- DCC determined that Humboldt County’s use of funds in this manner furthered the intent of the Grant Program. If a business does not meet the local requirements, DCC stated that the cannabis business will lose its annual state license; thus, for the business to maintain annual state licensure, it must meet local permitting requirements.

- The Grant Program’s purpose is to support local jurisdictions in helping cannabis businesses with provisional licenses to meet those requirements that are necessary to attain an annual state license. Therefore, we disagree with DCC’s perspective because providing subgrants to cannabis businesses that already obtained annual state licensure does not align with the purpose of the Grant Program.

Source: Humboldt County’s grant agreement, supporting documentation, and DCC correspondence.

Although it has not yet completed its close-out review of Humboldt County’s expenditures, DCC determined that the use of subgrants in this manner furthered the intent of the Grant Program, explaining that if a business does not meet the local requirements, it will lose its annual state license; thus, for the business to maintain annual state licensure, it must meet local permitting requirements. We disagree with this perspective and highlighted our concern about DCC’s approval of Humboldt County’s subgrant programs in Report 2023-048, August 2024. As we concluded in that audit report, providing subgrants to cannabis businesses that had already obtained annual state licenses does not align with the purpose for which the Legislature appropriated these funds. Although state law authorizes local jurisdictions to use grant funding on uses that DCC determines furthers the intent of the Grant Program, DCC seems to have misinterpreted the legislative intent of the Grant Program in this instance. We caution DCC about interpreting legislative intent too broadly in its administration of future legislative directives, including other grants. However, we do not believe a recommendation is warranted in this instance because the June 30, 2025 deadline for spending Grant Program funds has already passed.

In addition, of the 20 Oakland transactions we reviewed, we identified one unallowable transaction. Specifically, Oakland used Grant Program funding to purchase computer equipment, which did not comply with the approved budget in its grant agreement with DCC. Oakland’s city administrator analyst explained that the city used Grant Program funds to purchase computer equipment for an employee whose responsibilities primarily involve reviewing licensing applications. In February 2024, Oakland submitted a request to amend its grant agreement to include, in part, a line item for equipment. However, DCC denied the city’s request in September 2024. As we discuss earlier in this section, DCC may recapture funds that do not comply with the jurisdiction’s approved budget. Because the approved grant agreement’s budget does not include equipment costs, Oakland’s use of nearly $2,000 in Grant Program funds for these purchases was unallowable. Although we discussed the issue with Oakland, we determined that a recommendation would essentially duplicate the recommendation we issued in our February 2025 report and, therefore, we did not find it necessary to make a recommendation.

Further, we found during our review that at least two local jurisdictions provided up-front grant funding to businesses without a clear mechanism for ensuring that the businesses would spend the Grant Program funding for allowable purposes or pay it back. Specifically, Oakland reported providing a total of $3 million in subgrants to cannabis businesses and entered into grant agreements with specific scopes of work for the businesses’ use of the award funds. Oakland disbursed the full subgrant award of $50,000 up front to cannabis businesses to provide them with the capital needed to transition from a provisional to an annual state license. In doing so, Oakland increased the risk that the subgrantees may misuse grant funds through fraud, waste, or abuse. For example, Oakland’s city administrator analyst explained that the city found that several subgrantees used grant funds for purposes outside of the scope of their grant agreements. If Oakland were to implement a similar grant program in the future, she said the city would improve oversight by disbursing only half the award up front, with the remaining half provided after subgrantees submit supporting receipts for their spending of the initial funds. Up-front Grant Program funding also accounted for more than $12 million at Humboldt County for the duration of the Grant Program. To the extent that other local jurisdictions provided up-front grant funding to businesses, additional Grant Program funding could be at an increased risk of fraud, waste, and abuse.

DCC was unable to determine whether other local jurisdictions provided up-front funding to subgrantees because it does not track this information. DCC’s grants manager indicated that it is up to local jurisdictions to ensure that businesses in their jurisdictions use grant funding for approved purposes. However, as the primary oversight agency for cannabis licensing, DCC should have provided guidance to the local jurisdictions for how to monitor spending by recipients of subgrants. Best practices from the federal Office of Management and Budget suggest limiting advance payments to the minimum amounts grantees need and timing those payments to the grantees’ actual, immediate cash requirements. Alternatively, agencies can reimburse subgrantees after receipt of the payment request, at which time the agency may determine whether the request is proper. DCC’s grants manager asserted that cannabis businesses required award funds up front so they could use the funding to become locally compliant and that most of these businesses do not have the capital to do it themselves. Although the intention of advance payments is to benefit businesses in need of immediate capital, doing so without adequate mechanisms in place to ensure that subgrantees spend the funds appropriately increases the risk that subgrantees could engage in fraud, waste, or abuse. In the next section, we discuss perspectives from local jurisdictions and DCC about how the Grant Program could have been improved, such as having state guidance available for grant administration, including guidance related to subgrant award administration.

Improved DCC Staffing Levels and Clearer Early Guidance Could Have Improved the Grant Program’s Effectiveness

Although DCC and the 17 local jurisdictions largely met the intent of the Grant Program, it remains unclear how much of that success we can attribute directly to the Grant Program funding. The intent of the Grant Program was to support local jurisdictions in assisting provisional license holders’ transition to annual state licenses issued by DCC. Although DCC and local jurisdictions significantly reduced provisional licenses over the course of the Grant Program, not all local jurisdictions sought the full extent of the funding available to them, and jurisdictions sometimes used that funding for unallowable purposes or for uses that did not align with the program’s intent. As of September 2025, DCC was still in the process of determining the allowability of local jurisdictions’ Grant Program expenditures, and DCC will require local jurisdictions to repay it for any unallowable uses, which could further reduce the amount of funding that DCC and jurisdictions actually used toward transitioning provisional to annual state licenses.

According to the director of DCC, the Grant Program provided valuable resources to local jurisdictions, enabling them to build or improve processes to support cannabis businesses in meeting certain requirements to secure annual licensure, including the businesses’ environmental compliance work. Although DCC’s director stated that DCC moved swiftly to establish a program responsive to local feedback and tailored to the diverse needs of local jurisdictions, its timeline for fulfilling amendment requests would have benefited from additional resources, clearer guidance, and quicker communication. She also stated that DCC would likely have been even more effective in administering the Grant Program if it had been fully staffed at the time, and DCC pointed out that its initial efforts to gain approval to hire additional grants management staff were unsuccessful.

In our previous audits, we discussed DCC’s staffing deficiencies during the early stages of its Grant Program administration. To allow its management to consider taking corrective action even before our initial audit Report 2023-048 was complete, we raised concerns in a management letter we provided to DCC that it did not have sufficient staff with the requisite knowledge to oversee the Grant Program. In Report 2023-048, we noted that DCC had just two people tasked with part-time administration of the $100 million Grant Program. Our report further stated that DCC’s limited number of grant management staff resulted in insufficient oversight of the grantees. However, in Report 2024-048, the following year, we reported that DCC had hired four additional staff members and had six people working on the Grant Program.

Nevertheless, DCC’s insufficient staffing and inexperience with managing a large grant may have contributed to delays in local jurisdictions’ ability to effectively use Grant Program funding. Most of the local jurisdictions we spoke with expressed frustration with how long it took for DCC to communicate its ultimate requirements and conditions for the Grant Program, which created uncertainty about how they could use grant funding. For example, Humboldt County’s deputy planning director stated that it was difficult to know what it was allowed to spend the funds on. She said that halfway through its agreement with DCC, the department informed Humboldt that the terms of the agreement would need to change and that its spending for the program was on hold during the several months it took to amend its agreement with DCC. These perspectives are supported by findings we previously reported. In Report 2023-048, we concluded that some local jurisdictions did not spend their funds because they were waiting for DCC to approve their grant agreement amendments, and we found that three local jurisdictions waited more than 100 days for a DCC decision.

We also found that DCC struggled to reach a shared understanding with some local jurisdictions on the allowable uses of Grant Program funding. Some of DCC’s close-out letters indicate that two local jurisdictions faced challenges over the term of the grant that affected their achievement of goals outlined in the agreement, including challenges with DCC’s denial of multiple grant agreement or budget amendments. Further, in Report 2024-048, we reported that two of the local jurisdictions we reviewed, including Los Angeles, might not spend all of the Grant Program funds because of disagreements with DCC regarding the use of those funds.

A primary reason DCC cited in its close-out letters for its determinations that certain local jurisdictions’ expenditures of grant funding were unallowable was a lack of sufficient supporting documentation for those expenditures from the local jurisdictions. Three of the six close-out letters DCC provided to local jurisdictions cited a lack of or late supporting documentation as a reason for significant amounts of disallowed funding. For example, DCC disbursed $333,000 in grant funding to the city of Commerce primarily for providing staff to assist cannabis businesses in acquiring their annual licenses. However, DCC recaptured all of the funding it disbursed, stating in its close-out letter to the city that DCC found the city’s supporting financial documentation to be insufficient, and that documentation did not make clear how the jurisdiction furthered the intent of the grant. DCC also explained that the documentation Commerce did provide lacked clear information, such as the services it provided or which provisional licenses it assisted.

In conclusion, we found that DCC and the local jurisdictions transitioned a significant number of provisional licenses to annual licenses, meeting the intent of the Grant Program. However, the issues we identified in this audit and in our previous reports indicate that DCC might have benefited from guidance on the administration of government grants at the outset of the Grant Program. The director of DCC agreed that in a situation similar to that of the initiation of this Grant Program, when a grant program with urgent timelines is administered by a department without an established grant administration function, standardized state-level grant administration guidance could help such agencies administer grant funds. As the state agency that serves as the business manager for the State, the Department of General Services (DGS) may be best suited to develop such guidance. DGS administers the State Administrative Manual, a resource for statewide policies, procedures, requirements, and information that provides a uniform approach to statewide management policy. DGS believes that it has the institutional knowledge and experience to create and make available statewide guidance for grant administration for state agencies that may lack experience or infrastructure to effectively administer large grant programs. However, DGS said that, depending on whether and when the Legislature were to direct it to create such guidance, it is not certain that it would have the available resources to do so.

Recommendations

Legislature

To increase the ability of state agencies that may lack the existing infrastructure to effectively administer legislative grant programs, the Legislature should consider directing DGS or another state agency with the appropriate expertise to create and make available statewide guidance for grant administration, including guidance for subgrantee monitoring. Such guidance might include the following:

- Clear instructions for departments on how to define both allowable and unallowable costs in grant agreements, and the types of supporting documentation required.

- Examples of common grant monitoring controls to prevent or detect improper spending and delays in grant execution.

- An overview of the potential risks state departments face when they advance state grant funds, and when doing so may create a high risk of fraud, waste, or abuse of grant funding.

DCC

To provide transparency into the effectiveness of the Grant Program and accountability for the use of public funds, DCC should immediately implement a process for publicly reporting on its website the final amounts of Grant Program funding it disbursed to each local jurisdiction, the amounts each jurisdiction used, as well as the amounts DCC determined jurisdictions may have used in unallowable ways and that are subject to recapture, and the amounts DCC will return to the General Fund after it has determined these amounts.

To reduce the risk of fraud, waste, and abuse of future grant program funds, DCC should, by June 2026, use best practices to develop guidance that grant recipients can use when making grant awards to subgrantees, including direction about limiting advance payments to the minimum amounts subgrantees need and timing those payments to the subgrantees’ actual, immediate cash requirements.

We conducted this performance audit in accordance with generally accepted government auditing standards and under the authority vested in the California State Auditor by Government Code section 8543 et seq. Those standards require that we plan and perform the audit to obtain sufficient, appropriate evidence to provide a reasonable basis for our findings and conclusions based on the audit objectives. We believe that the evidence obtained provides a reasonable basis for our findings and conclusions based on our audit objectives.

Respectfully submitted,

GRANT PARKS

California State Auditor

November 20, 2025

Staff:

Michelle Sanders, PMP, Audit Principal

Joshua Hooper, CFE, Senior Auditor

Savanna Rowe

Legal Counsel:

Jacob Heninger

Appendices

Appendix A

California State Auditor’s Assessments of Auditee Responses to Recommendations in the Two Prior Grant Program Audits

When an audit is completed and a report is issued, auditees that are state agencies are required to provide and auditees that are local governmental agencies are requested to provide information to the State Auditor regarding their progress in implementing recommendations from our reports. These progress reports are required at three intervals after the release of the report: 60 days, six months, and one year, and then, if not implemented, annually for up to three more years. Further, state law requires state agencies that have not fully implemented recommendations to no less than annually submit an update to the State Auditor explaining why they have not implemented them and when they expect to implement them. Tables A.1 and A.2 below are listings of each recommendation the State Auditor made in reports 2023-048, August 2024, and 2024-048, February 2025, respectively. They show the State Auditor’s most recent assessment of the auditee’s response based on our review of the supporting documentation as of October 2025. The State Auditor maintains this information on its website, and we have included links to the recommendations pages for the respective audits in the headers of each table.

Appendix B

Status of Provisional Licenses

Table B presents the number of transitions from provisional to annual state licenses and the number of active provisional licenses in each of the 17 local jurisdictions at different points from January 1, 2023, through June 30, 2025. In addition, Table B shows our estimate of the outcomes that occurred other than transitions to annual state licenses. Other outcomes may include licenses that expire, licenses that businesses surrender, licenses that DCC revokes, or multiple licenses that merge into a single license.

Appendix C

Scope and Methodology

We conducted this audit pursuant to the audit requirements contained in state law. The law requires our office to conduct a performance audit of the local jurisdictions receiving funds pursuant to the Grant Program, commencing January 1, 2023, and annually until January 1, 2026. Table C lists the audit objectives and the methods we used to address them. Unless otherwise stated in the table or elsewhere in the report, statements and conclusions about items selected for review should not be projected to the population.

Assessment of Data Reliability

The U.S. Government Accountability Office, whose standards we are statutorily obligated to follow, requires us to assess the sufficiency and appropriateness of computer-processed information we use to support our findings, conclusions, or recommendations. In performing this audit, we relied on electronic data files that we obtained from DCC’s licensing databases. To assess the reliability of these data, we reviewed existing information about the data, interviewed department officials knowledgeable about the data, and performed electronic testing of the data. Although we identified several issues in our testing, we took steps to manually correct for them in our analysis. However, we were unable to gain assurance that the data included all of the cannabis licenses issued and that key data fields were accurate. As a result of our assessments, we found DCC’s cannabis licensing data to be of undetermined reliability. Although this determination may affect the precision of the numbers we present, there is sufficient evidence in total to support our findings, conclusions, and recommendations.

Response to the Audit

Department of Cannabis Control

November 5, 2025

Mr. Grant Parks

California State Auditor

621 Capitol Mall, Suite 1200

Sacramento, CA 95814

Subject: Response to California State Auditor Report No. 2025-048

Dear Mr. Parks:

The Department of Cannabis Control (DCC) would like to commend your office for its continued professionalism and the valuable insight that it has provided to the department during its three audits of the Local Jurisdiction Assistance Grant (LJAG) Program. DCC recognizes that the recommendations stemming from these audits have resulted in stronger grant administration practices that have benefited the current LJAG Program and DCC’s future grant programs.

In the interest of transparency and accountability, DCC agrees to implement CSA’s first recommendation directing the department to publicly report, for each local jurisdiction, the final amounts of LJAG Program funds that were: (1) disbursed; (2) spent; (3) determined by DCC to be ineligible uses; and (4) already returned or scheduled to be returned to the General Fund. DCC anticipates publishing these final amounts on its website no later than Winter 2026.

Similarly, DCC agrees to implement CSA’s second recommendation directing the department to develop additional guidance governing future grantees’ use of awarded funds to provide subgrants to recipients beyond the initial awardee. DCC’s Administration Division will modify its existing Grant Administration Manual to include this enhanced guidance and will emphasize: (1) that future grantees limit the amount of funding advanced to subgrantees; and (2) that those advanced funds are consistent with the subgrantees’ immediate cash requirements. DCC’s Administration Division expects to complete these edits no later than March 2026.

We look forward to enacting the recommended corrections and will continue to provide updates at the required intervals. Should you have any questions or concerns related to DCC’s response, please reach out to the department at your earliest convenience.

Respectfully,

Nicole Elliott

Director

Footnotes

- The use of marijuana (cannabis) is still illegal under federal law. ↩︎

- The purposes of CEQA are, among other things, to inform governmental decision-makers and the public about potentially substantial environmental effects of proposed activities and to prevent significant, avoidable damage to the environment. ↩︎

- State law allows DCC to issue provisional licenses to local retail equity applicants who meet the requirements of a local jurisdiction’s local equity program until January 1, 2031. Such programs support participation in the cannabis industry by individuals or populations who have experienced negative or disproportionate effects from cannabis criminalization. ↩︎

- For the six jurisdictions that DCC closed out, we calculated the amount of spent Grant Program funds based on each jurisdiction’s actual grant award and the amounts that they returned to DCC, including disallowed and unspent Grant Program funds. For the other 11 jurisdictions that DCC was still closing out, we calculated the amount of spent Grant Program funds based on the expenditures each jurisdiction reported to DCC. ↩︎