2025-801 Local High-Risk Program

The State Auditor Is Removing the High-Risk Designation From Two Cities and Retaining the Designation for One Other

Published: October 7, 2025Report Number: 2025-801

October 7, 2025

2025‑801

The Governor of California

President pro Tempore of the Senate

Speaker of the Assembly

State Capitol

Sacramento, California 95814

Dear Governor and Legislative Leaders:

This audit report updates the status of the cities of Calexico, Compton, and Richmond as high‑risk entities as part of our office’s high‑risk local government agency audit program. Our prior audits of these cities identified areas of high risk related to the cities’ financial conditions, financial stability, and administrative deficiencies, among other issues. For this statutory audit, we reviewed the extent to which each city has addressed recommendations from our prior audits, we assessed trends in the cities’ financial conditions, and we determined whether we should continue to designate any of these cities as high‑risk local government agencies.

This report concludes that the cities of Calexico and Richmond have taken satisfactory corrective action and addressed key deficiencies we identified in our previous reports. Therefore, we are removing their high‑risk designations. We may subsequently reevaluate whether Richmond or Calexico should be identified as high risk if situations change and these cities appear to be at risk of not being able to meet their financial obligations or provide efficient and effective services to the public, among other concerns.

Although the city of Compton has taken steps to improve its overall operational health, we are not removing its high‑risk designation at this time. We will continue to monitor Compton and the actions it takes to address the areas of high risk we have identified. When the city’s actions result in sufficient progress toward resolving or mitigating such risks, we will remove its high‑risk designation.

Respectfully submitted,

GRANT PARKS

California State Auditor

Prior Relevant Reports Issued by the California State Auditor

| Calexico |

| October 2022, City of Calexico: Past Overspending and Ongoing Administrative Deficiencies Limit Its Ability to Serve the Public, Report 2021-805 |

| Compton |

| October 2022, City of Compton: Financial Mismanagement and a Lack of Leadership Have Threatened Compton’s Ability to Serve the Public, Report 2021-802 |

| Richmond |

| November 2022, City of Richmond: Anticipated Deficits, High Pension Debt, and Mismanagement of Its Housing Authority Cause the City to Be High Risk, Report 2021-806 |

Selected Abbreviations Used in This Report

| CIP | Capital improvement plan |

| GFOA | Government Finance Officers Association |

| HCD | California Department of Housing and Community Development |

| HUD | U.S. Department of Housing and Urban Development |

| OPEB | Other postemployment benefits |

| PCI | Pavement Condition Index |

Introduction

The California State Auditor’s High Risk Local Government Agency Audit Program

State law authorizes the California State Auditor (State Auditor) to establish a local high-risk program to assess, audit, and ultimately issue reports about local government agencies that we identify as being at high risk for potential waste, fraud, abuse, or mismanagement, or that we identify as having major challenges associated with their economy, efficiency, or effectiveness. State law requires that all audits we conduct as part of this program initially be approved by the Joint Legislative Audit Committee. If, as a result of an audit, we designate an agency as high risk, that agency must submit to us a corrective action plan that addresses the conditions that caused us to make the designation. In this report, we refer to those conditions as high‑risk areas. An agency’s corrective action plan is due no later than 60 days after the publication of an audit that concluded the agency was high risk, and agencies must then submit periodic updates on the status of that plan every six months thereafter.

We remove the high-risk designation when an agency has taken satisfactory corrective action. To assess local agencies’ progress in addressing their high-risk areas, we may conduct assessments of the agency’s progress at six-month intervals that correspond with the corrective action plan updates that the local agencies provide. Also, state law requires that we issue an audit report on high-risk local government entities every three years, unless we have removed their high-risk designation. For this audit, we reviewed the three cities listed in the text box to determine the extent to which each city has addressed prior audit recommendations, assess trends in the city’s financial condition, and determine whether we should continue to identify any of these cities as high-risk local government agencies.

Cities Included In This 2025 Local High-Risk Follow-Up Audit

Calexico (Imperial County)

Compton (Los Angeles County)

Richmond (Contra Costa County)

Overall, this audit concludes that the cities of Calexico and Richmond have taken satisfactory corrective action and addressed key deficiencies we identified in our prior reports. Therefore, we are removing their high-risk designation. In accordance with the laws and regulations pertaining to the local high-risk program, we may subsequently reevaluate whether Richmond or Calexico should be identified as high risk if situations change and these cities appear to be at risk of not being able to meet their financial obligations or provide efficient and effective services to the public, among other concerns. Although Compton has taken steps to improve its overall operational health, we are not removing the high-risk designation from that city at this time. In this report, we have made additional recommendations to Compton whenever the current circumstances of its high-risk areas indicated that our previous recommended corrective actions were no longer relevant or sufficient. When our existing recommendations from our previous audit continue to be applicable to the city’s circumstances, we do not make any new recommendations.

General Areas of Importance to This Local High-Risk Audit

Although this audit addresses the specific risks pertaining to three cities, two topic areas are applicable to more than one city. We present background information about each of these areas below.

Guidance on Reserves for General Purpose Governments

According to the Government Finance Officers Association (GFOA), it is essential that governments maintain adequate levels of general fund balances to mitigate current and future risks such as revenue shortfalls and unanticipated expenditures. As a best practice, the GFOA recommends that governments, regardless of size, maintain an unrestricted balance in their general fund of no less than two months of regular general fund operating revenue or regular general fund operating expenditures. We use the term unrestricted when discussing funding over which the government has discretion (i.e., no constraints) regarding how the funds can be spent. For the purpose of our report, we refer to unrestricted general fund balances as general fund reserves.

Other Postemployment Benefits

City governments can provide compensation packages to employees who have completed their active service. The Governmental Accounting Standards Board defines other postemployment benefits (OPEB) as retirement health benefits provided separately from or through a pension plan, as well as other benefits such as life insurance or long-term care benefits as long as the city provided those benefits separately from a pension plan. OPEB may include medical, dental, vision, hearing, and other health-related benefits paid after the termination of employment. According to the GFOA, the cost of OPEB and defined benefit pension plans can represent a significant challenge to city governments’ funding and long-term stability. To ensure that these benefits are sustainable over the long term, the GFOA recommends that governments evaluate key items specifically related to OPEB, including the structure of benefits offered.

Agency’s Proposed Corrective Action

Compton indicated that it has made progress in addressing the findings pertaining to staffing, fiscal planning, infrastructure maintenance, and financial reporting. The city shared its intent to continue implementing corrective actions to address recommendations from our 2022 audit, although it did not submit a corrective action plan as part of its response. We look forward to receiving Compton’s plan by December 2025.

Audit Results

The City of Calexico’s Financial Condition Has Significantly Improved, and the State Auditor Is Removing the City’s High‑Risk Designation

| Risk Areas as Reported In October 2022 | State Auditor’s Current Assessment of Calexico’s Progress In Addressing the Risk Area* |

|---|---|

| Calexico Has Not Taken Steps to Help Ensure Financial Stability | |

| 1. Lack of safeguards to prevent overspending | Fully Addressed |

| 2. Lack of certain best practices for reducing financial risk | Fully Addressed |

| 3. Did not regularly update service fees | Pending |

| The City Lacks a Robust, Accessible Budget Process | |

| 4. Shortsighted budget practices | Fully Addressed |

| 5. Budgets presented in a format that limits residents’ engagement | Partially Addressed |

| Calexico’s Unresolved Administrative Deficiencies Have Led to Frozen Grant Funds and Compromised the City’s Operations | |

| 6. Mismanagement of grants | Partially Addressed |

| 7. Lack of staff prepared to fill key roles | Pending |

* In accordance with state law, we used our professional judgment to assess the city’s progress in addressing each of the risk areas in the table. We determined whether the steps the city took and the overall conditions relevant to each risk area meant that the city fully or partially addressed the risk areas, or whether substantial action relevant to the risk area was still pending. We explain the statuses identified in this table in more detail below.

Fully addressed: The city has taken sufficient action to address the risk area when we consider its effort in combination with the related conditions at the time of this audit.

Partially addressed: The city has taken positive action to address the risk area, but its effort is incomplete when we consider it in combination with the related conditions at the time of this audit.

Pending: The city has not taken substantial action to address the risk area and, at the time of this audit, the conditions that created high risk for the city continue to exist.

HIGH-RISK AREA #1

Lack of Safeguards to Prevent Overspending

Status: We conclude that the city has fully addressed this risk area by consistently keeping its general fund expenditures below its revenue, maintaining a growing general fund reserve above the recommended minimum level, and continuing to adopt budgets only after the issuance of its audited annual financial statements.

Our 2022 audit found that Calexico had spent more from its general fund than the fund’s revenue over the course of fiscal years 2012–13 through 2015–16, causing a deficit in its general fund. We also reported that the city had rebounded from this period. In the fiscal years following 2015–16, the city’s unrestricted general fund balance began trending positively. However, at the time of our 2022 audit, the city’s general fund balance was still below the minimum level recommended by the Government Finance Officers Association (GFOA). To avoid repeating the mistakes of previous fiscal years, we recommended that the city adopt a policy that allows the city council to approve its annual budget only if it has audited financial statements for the most recently completed fiscal year, a general ledger that identifies current fund balances, and a current bank reconciliation when city staff present the annual budget.

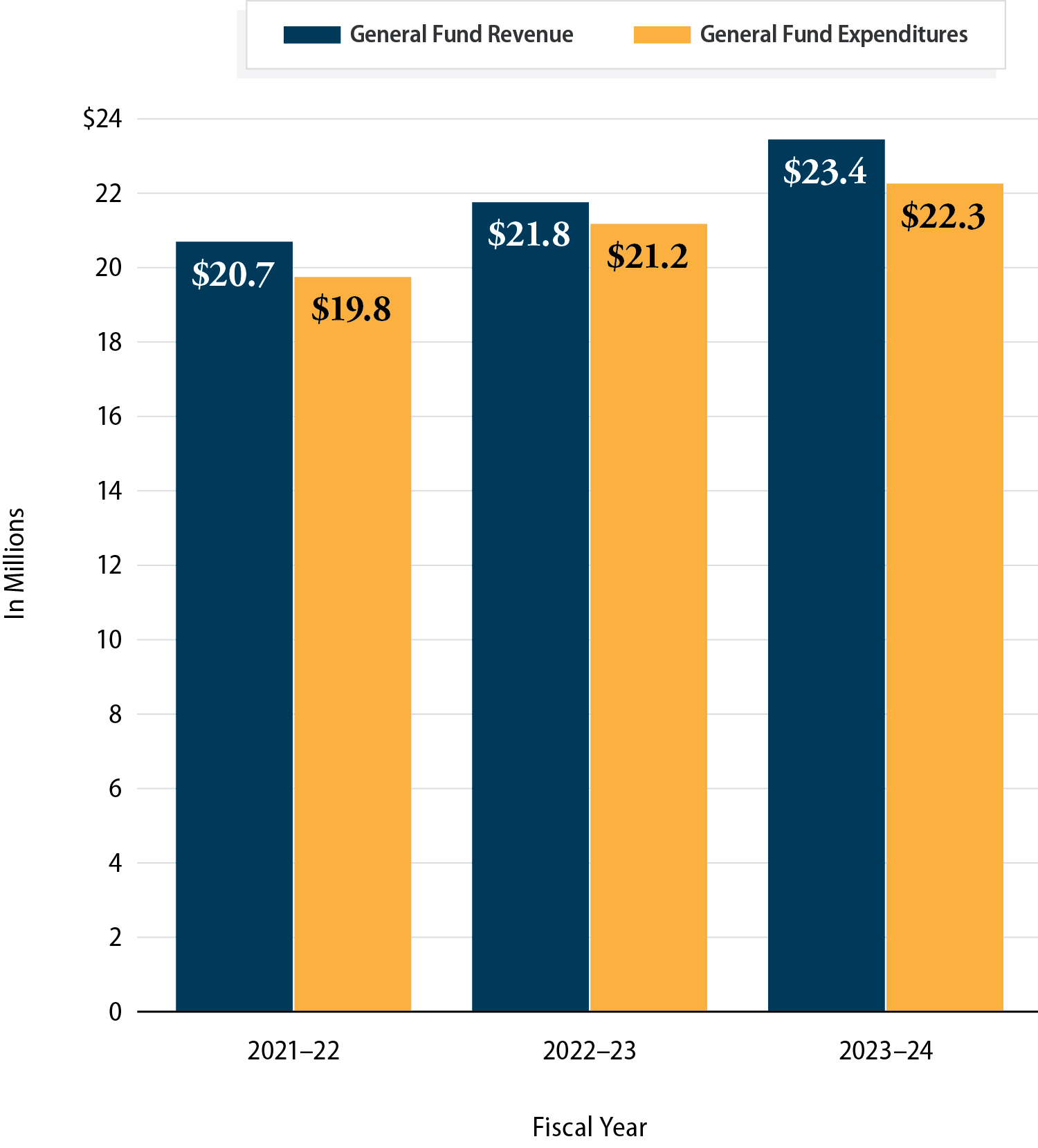

The city has not adopted a policy requiring audited financial statements, or the other items listed above, before adopting its budgets as we recommended. Instead, Calexico has included in its budgets for fiscal years 2023–24 through 2025–26 a resolution that requires city staff to report information quarterly and at the point of budget adoption about the status of the city’s audited financial statements, the general ledger, and bank reconciliations. Since the conclusion of our previous audit, the city has provided quarterly budget reports to the city council. Additionally, general fund revenue has exceeded expenditures during each of the eight fiscal years from 2016–17 through 2023–24. Figure 1 shows the revenue and expenditures from the general fund from fiscal years 2021–22 through 2023–24.

Figure 1

Calexico’s General Fund Revenue Has Remained Higher Than Its Expenditures

Source: Calexico’s audited financial statements.

Note: We present revenue as reported in the city’s financial statements. There were no transfers into the general fund in these fiscal years. We calculated expenditures by combining the expenditures and transfers out of the general fund in each fiscal year.

A vertical bar graph titled “Calexico’s General Fund Revenue Has Remained Higher Than Its Expenditures.” It compares Calexico’s general fund revenue and expenditures from for its fiscal years 2021-22, 2022-23, and 2023-24. In fiscal year 2021-22, Calexico’s general fund revenue was $20.7 million dollars and expenditures were $19.8 million. In fiscal year 2022-23, its general fund revenue was $21 million and its expenditures were $21.2 million. In fiscal year 2023-24, its general fund revenue was $23.4 million and its expenditures were $22.3 million. The source of this information is Calexico’s audited financial statements. The note states: we present revenue as reported in the city’s financial statements. There were no transfers into the general fund in these fiscal years. We calculated expenditures by combining the expenditures and transfers out of the general fund in each fiscal year.

The city’s positive financial outlook can also be observed through other measures. For example, the city’s general fund reserve grew for eight straight fiscal years and as of June 2024 was equal to 21 percent of its expenditures in fiscal year 2023–24, which is above the GFOA recommended minimum threshold. Further, at the end of each fiscal year from fiscal years 2021–22 through 2023–24, the city’s general fund cash balance exceeded its liabilities. Finally, by consistently adopting budgets after the release of its audited financial statements since its fiscal year 2020–21 budget, the city has demonstrated that it is aware of its financial condition when approving its future spending plans. As a result of its sustained performance in these areas, we conclude that the city has fully addressed this risk area.

HIGH-RISK AREA #2

Lack of Certain Best Practices for Reducing Financial Risk

Status: We conclude that the city has fully addressed this risk area by adopting budget resolution language regarding its reserves, increasing its liquid assets, and prefunding other postemployment benefits (OPEB) liabilities.

Our 2022 audit of Calexico found that the city had not adopted best practices that could help reduce the risk of financial distress. Specifically, the city did not have adequate reserves, and the reserves it did have were not liquid. Moreover, the city was not prefunding its OPEB liability. Our recommendations focused on updating the city’s reserve policy to ensure that it had sufficient reserves in its general fund, clearly defining when the reserves should be used and how the city will maintain the appropriate level, and ensuring that the city has sufficient liquidity to meet disbursement requirements. We also recommended that the city staff present options to the city council for reducing its OPEB liability and actions it could take to achieve such a reduction. As we further discuss, the city has addressed each of these concerns.

The GFOA recommends that governments maintain a minimum general fund reserve of no less than two months of regular general fund operating revenue or expenditures. According to the city’s fiscal year 2023–24 audited financial statements, Calexico’s general fund reserve is now above that threshold. The city’s recently adopted budget resolutions also include a fund balance reserve policy that aligns with the GFOA’s recommended minimum threshold. In addition, those resolutions establish that it is the policy of the city to build reserves in other funds and set aside an additional emergency reserve built from sales tax revenue. Further, according to the city’s fiscal year 2023–24 audited financial statements, Calexico had roughly $1.9 million in cash and investments in its general fund, enough to cover more than twice the general fund’s total liabilities.

Finally, the GFOA recommends that governments prefund OPEB liabilities by creating a qualified trust fund and contributing amounts to the trust fund over time. Our 2022 audit recommended that the city staff present the city council with options for reducing the city’s OPEB liability, such as by requiring employee contributions to the city’s OPEB trust fund. Although the city still does not require its employees to contribute to the plan, it has begun prefunding its OPEB obligation through an irrevocable trust, which is a legally restricted fund into which the city prepays that obligation. The city’s staff recommended this approach, noting that it was an efficient way to manage the city’s OPEB liability with its available resources. According to the city’s finance director, the city has not pursued negotiations with labor groups regarding employee contributions. The finance director said the city believes that, because of differences in the benefits available to certain employees, requiring employee contributions could create inequities. Nonetheless, by establishing an irrevocable trust, the city has begun to address its OPEB liability. As of June 2025, the city’s OPEB trust had a total value of approximately $1.4 million. Based on the above actions and the progress the city has made in addressing our concerns, we conclude that Calexico has fully addressed this risk area.

HIGH-RISK AREA #3

Did Not Regularly Update Service Fees

Status: We conclude that the city has not yet addressed this risk area because it has not adopted policies to periodically complete fee studies.

Our 2022 audit of Calexico found that it had not updated some of its fees and at times it did not charge sufficient amounts to cover the costs of certain services. To ensure that city fees and rates are sufficient to pay for the costs of providing services, we recommended that the city define in policy how frequently it should conduct fee and rate studies and clearly identify who is responsible for initiating these studies and making fee adjustments, as well as methods of oversight. The finance director—who has only been in her position since January 2025—explained that the city does not yet have a formal policy outlining how often the fee and rate studies should be conducted or which department is specifically responsible. She further explained that, apart from the water and sewer study described below, the city has not performed a study of the fees it charges for its services.

Our audit also recommended the city ensure that its next water rate study consider best practices like conservation pricing options, such as tiered rates or seasonal rates and special drought rates. The city conducted a water and sewer utility rate study that recommended raising some rates and considered peaking factors—the maximum daily water usage—that may affect cost of service, as well as customer classes or tiers. However, the city council declined to approve the new rates after the city clerk received more than one thousand written protests to the potential rate changes. According to the minutes from the council meeting, the decision was made, in part, to allow the council the time it needed to address the city’s concerns.

The city has allocated funding in its fiscal year 2025–26 budget for another water and sewer rate study. This budget notes that the city needs fee adjustments to support its water, wastewater, and airport funds. Although the city’s audited financial statements show that the expenses for the water and wastewater funds were less than operating revenue during fiscal years 2021–22 through 2023–24, the city’s budget indicates that the upcoming costs to support water and wastewater operations are relying on savings expected to be achieved from staff vacancies and deferred maintenance. Consequently, the city’s plan to study fee revenue that supports these funds remains important. The city plans to subsidize its airport operations—which are supported by fees—with $100,000 from the general fund—less than 1 percent of planned general fund spending—until it can devise an approach for making the airport self‑sufficient again.

The city’s finance director further indicated that the city is preparing to conduct a comprehensive user fee study, with the intention of first reviewing impact and development fees. During our 2022 audit, we noted that the city had last approved an update to these fees in 2006, with an additional modest increase occurring at another time the city could not determine. Therefore, the city would likely benefit from additional study of and adjustments to the impact and development fees it charges to best ensure that it generates revenue that aligns with its costs.

Nonetheless, as we describe in the next section, the city has updated or identified new fee-based sources of revenue on an ad hoc basis. Further, because the city’s general fund is its most discretionary source of funding, we also considered the status of the city’s general fund when assessing the risk that subsidized services pose to the city. As we describe earlier, the city’s general fund is in a generally positive condition, thereby allowing Calexico some flexibility to pursue a more comprehensive study of potential increases. Therefore, the city’s lack of progress in addressing this risk area does not override our determination of removing the city’s high-risk designation.

HIGH-RISK AREA #4

Shortsighted Budget Practices

Status: We conclude that the city has fully addressed this risk area because it has consistently generated sufficient revenue and made clearer the consequences of its budgetary decisions.

Our 2022 audit found that Calexico recognized that it needed additional revenue but had not identified how to generate that revenue. Additionally, we noted that the city did not direct departments to present information to the city council about the cost of delaying certain actions, such as repairing damaged facilities. As a result, our audit recommended that the city develop a detailed plan for generating the revenue it needs to maintain services to the public, including a five‑year projection of revenue and expenditures that account for both the expected costs of current operations and planned expansions to operations. We also recommended that the city revise its budget‑change process to require departments to specify the financial and service‑related risks and benefits of approving or denying requests to increase or decrease a department’s funding.

The city has not developed a detailed plan to address the first of these recommendations. According to the city’s financial consultant, the city’s short-term work plan does not include efforts to identify specific new revenue because of limited resources and time. Nonetheless, the city’s finance director highlighted certain efforts the city has made to derive new revenue. Specifically, the city increased parking meter fees and has begun charging for specific recreational programs. Additionally, the city entered into a revenue-sharing agreement with a contractor, which will be responsible for administering alarm permits and collecting and sharing the fee revenue related to that service.

Also, beginning with the fiscal year 2020–21 budget, the city includes in its budgets a five-year projection of the general fund’s revenue that also identifies the additional revenue the city will need to generate to sustain its current level of services. This information allows the city council to be regularly informed about upcoming revenue needs, which aligns with the intent of our recommendation.

Calexico has adopted our second recommendation. The city developed and is using a new budget adjustment form that allows a department to explain the impact of not implementing a requested budget adjustment, including specifying financial and service-related risks. This detail provides clarity to the city about the costs and benefits of adopting or rejecting budget requests.

As indicated above, the city has consistently had enough revenue to cover its expenditures. The last time general fund revenue fell from one year to the next was in fiscal year 2019–20 when revenue dropped by about $320,000. Since that time, revenue has grown year over year and has been higher than the amounts the city projected in its financial forecasts. Therefore, although the city has not fully adopted our recommendations, we determined that it has sufficiently addressed this risk area.

HIGH-RISK AREA #5

Budgets Presented in a Format That Limits Residents’ Engagement

Status: We conclude that the city has partially addressed this risk area because it has provided Spanish-language translation for budget presentations. However, it has not translated text from its budget into a language that the majority of its residents primarily speak.

According to 2023 U.S. Census Bureau data, 93 percent of Calexico residents speak Spanish at home, and more than half of the Spanish‑speaking population speaks English less than very well. Despite these facts, our 2022 audit found that the city presented its key financial documents exclusively in English. To facilitate its residents’ participation in the budget process, we recommended that the city establish a policy before developing the fiscal year 2023–24 budget to make key portions of public financial documents, including proposed and adopted budgets, available in a sufficient number of languages to ensure that at least 75 percent of residents can obtain the documents in their primary languages. However, according to the city’s finance director, it has not implemented this recommendation because of the high cost of professional translation services, limited availability of providers, and the limited time available to prepare and publish budget materials for council meetings.

Although the city does not intend to implement this recommendation, the city’s finance director asserted that Calexico remains committed to ensuring that its residents have opportunities to understand and participate in the budget process, and the city will continue to evaluate options to further expand language access in ways that balance inclusivity, accuracy, and resource constraints. Since at least the time of the presentation of the fiscal year 2023–24 budget at a city council meeting, the city has provided verbal translation in Spanish of the presentation of the budget to the city council. However, the city’s three most recent budget documents were available only in English during the time of our review. As our 2022 report conveys, the city should make these translations a priority to ensure that the majority of the city’s residents can easily understand the city’s financial condition and its decisions. In 2022, we also recommended that the Legislature take action to encourage or require all municipal governments to make key portions of public budgetary documents, such as proposed and adopted budgets, available in a sufficient number of languages to ensure that at least 75 percent of their residents can obtain the documents in their primary languages. We believe there continues to be value in this recommendation.

HIGH-RISK AREA #6

Mismanagement of Grants

Status: We conclude that the city has partially addressed this risk area by hiring a grant manager and working with the California Department of Housing and Community Development (HCD) to address concerns over past grant management. However, it has not updated relevant policies and must continue to address remaining concerns from HCD.

Because of the city’s past mismanagement of certain grants, the State prohibited it from using funds it was awarded to benefit its residents and small businesses. HCD notified Calexico several times regarding concerns about the city’s management of grant programs. In 2015, HCD directed the city to take several corrective actions related to its management of the Community Development Block Grant (CDBG) program. In 2018, HCD notified the city that it needed to address findings from a State Controller’s Office audit related to the HOME Investment Partnership Program (HOME). Then, in December 2020, the city agreed that it would not use newly awarded HOME funds until it resolved findings from previous monitoring reviews. Because Calexico had not made progress in addressing HCD’s concerns, HCD notified the city in April 2022 that it would not be able to access funds from the Coronavirus Aid, Relief, and Economic Security (CARES) Act CDBG program—which was intended to help governments prevent, prepare for, and respond to the spread of COVID‑19—until it had resolved outstanding deficiencies. At the time of our 2022 audit report, many of the corrective actions HCD had directed the city to take were still outstanding. We recommended that Calexico submit a corrective action plan to HCD, hire a dedicated employee or consultant to manage HCD grants, and revise its policy to require that staff publicly inform the city council of any findings of noncompliance with grant requirements.

According to its finance director, Calexico did not create a corrective action plan or update its grant policy as we recommended. However, since the issuance of our original audit of Calexico, HCD allowed the city to use some CARES Act CDBG funding to rehabilitate a city fire station. Further, the city hired a grants manager in June 2025, and that individual is responsible for overseeing the management of the city’s grant funding to ensure compliance with grant requirements, which positions the city to avoid future grant compliance problems. The city also started holding monthly meetings with HCD in early 2025 during which the city discussed the progress it was making in addressing past monitoring findings. In August 2025, the city asked HCD to provide an updated status on the state of HCD’s review of Calexico’s progress in addressing these findings. HCD indicated that the amount the department was questioning from the CDBG program was less than $300,000—an amount that the city’s budget indicates it could afford to repay if necessary. Nevertheless, HCD’s representative stated that she did not anticipate that the city would need to repay any CDBG funding to the State but would only need to make certain adjustments to the way in which it accounted for the grant funds it had spent in previous years.

The city must continue to work closely with HCD to resolve these issues. However, the work remaining for the city is not a factor that leads us to conclude that the city should remain a high-risk entity.

HIGH-RISK AREA #7

Lack of Staff Prepared to Fill Key Roles

Status: We conclude that the city has not yet addressed this risk area because it has yet to develop a succession plan or cross-train its employees.

As part of our 2022 audit, we found that turnover and vacancies in key leadership positions had exacerbated Calexico’s challenges, including its grant management issues, and posed an ongoing risk. For example, because the city had not planned for staff succession, the individuals responsible for developing its fiscal year 2022–23 budget did not have training to do so. In another case, relying on a single person to perform the payroll function had led to errors and an increased risk of initiating or approving improper transactions. Further, our audit found that not properly cross‑training staff in its finance department had resulted in the city’s inability to independently complete certain basic functions. As a result, our audit recommended that the city identify essential tasks, develop a comprehensive succession plan, and provide cross‑training to prepare key staff—especially those in the finance department—to fulfill essential duties in the event of turnover or other absences.

The city’s financial consultant reported to us that the city has not developed a succession plan, identified essential tasks, or performed cross-training. According to the city’s financial consultant, it does not have enough management and mid‑level managers to properly implement a succession plan. Nevertheless, this situation leaves Calexico vulnerable in the event of turnover or other absences. Despite its limited resources and time, the consultant noted that with an intact management team, the city could work to complete such a plan. At the start of this audit, the city did not have a permanent city manager, but it later filled the position in July 2025. During that time, the city also filled the positions of public works director, fire chief, and human resources manager. As the city stabilizes its leadership, it would best position itself for the future if it developed and maintained a strong system of cross-training and planning for future absences or vacancies. Nonetheless, the city’s lack of progress in addressing this risk area does not override our determination of removing the city’s high-risk designation.

The City of Richmond Has Made Significant Progress in Addressing Its Risk Areas, and the State Auditor Is Removing the City’s High‑Risk Designation

| Risk Areas as Reported In November 2022 | State Auditor’s Current Assessment of Richmond’s Progress in Addressing the Risk Area* |

|---|---|

| Despite Recent Improvements, Richmond’s Long-Term Financial Stability Remains Uncertain | |

| 1. Possibly inadequate financial reserves | Fully Addressed |

| 2. Forecasted significant long-term deficit | Fully Addressed |

| 3. High debt burden | Partially Addressed |

| Addressing Its Poorly Funded Retirement Benefits and Below-Market Compensation Will Increase Richmond’s Expenses | |

| 4. Retirement obligations burden the city | Fully Addressed |

| 5. Missed opportunities to address retiree health obligations | Fully Addressed |

| 6. Cost of the city’s workforce | Partially Addressed |

| The City Has Mismanaged the Richmond Housing Authority | |

| 7. Housing authority mismanagement | Partially Addressed |

| 8. Missed mandatory deadlines | Partially Addressed |

| 9. The housing authority may owe taxes and penalties | Fully Addressed |

| The City Has Not Consistently Followed Its Contracting Policies or Updated Its Fees as Required | |

| 10. Insufficient documentation of best value | Fully Addressed |

| 11. Infrequently updated fees | Fully Addressed |

*In accordance with state law, we used our professional judgment to assess the city’s progress in addressing each of the risk areas in the table. We determined whether the steps the city took and the overall conditions relevant to each risk area meant that the city fully or partially addressed the risk areas, or whether substantial action relevant to the risk area was still pending. We explain the statuses identified in this table in more detail below.

Fully addressed: The city has taken sufficient action to address the risk area when we consider its effort in combination with the related conditions at the time of this audit.

Partially addressed: The city has taken positive action to address the risk area, but its effort is incomplete when we consider it in combination with the related conditions at the time of this audit.

HIGH-RISK AREA #1

Possibly Inadequate Financial Reserves

Status: In June 2023 we determined that the city fully addressed this risk area by revising its policy on financial reserves to require a 21 percent reserve.

Richmond’s reserve policy covering fiscal years 2022–23 and 2023–24 updated the city’s expected general fund reserve. The policy required the city to maintain a minimum reserve balance of 21 percent of the next fiscal year’s budgeted general fund expenditures, including its transfers out of the fund. Previously, the city only expected to maintain 15 percent in its reserves. Accordingly, based on information the city provided to us in June 2023, we assessed this risk area as fully addressed. During this audit, we determined that Richmond has met its expected reserve level. Specifically, at the end of fiscal year 2023–24, Richmond had more than $75 million in general fund reserves, which represents nearly four months of that fiscal year’s expenditures and is equal to 30 percent of its budgeted general fund expenditures for the following fiscal year.

HIGH-RISK AREA #2

Forecasted Significant Long-Term Deficit

Status: We conclude that the city has fully addressed this risk area by taking actions to control costs and ensure that it collects the correct amount of revenue.

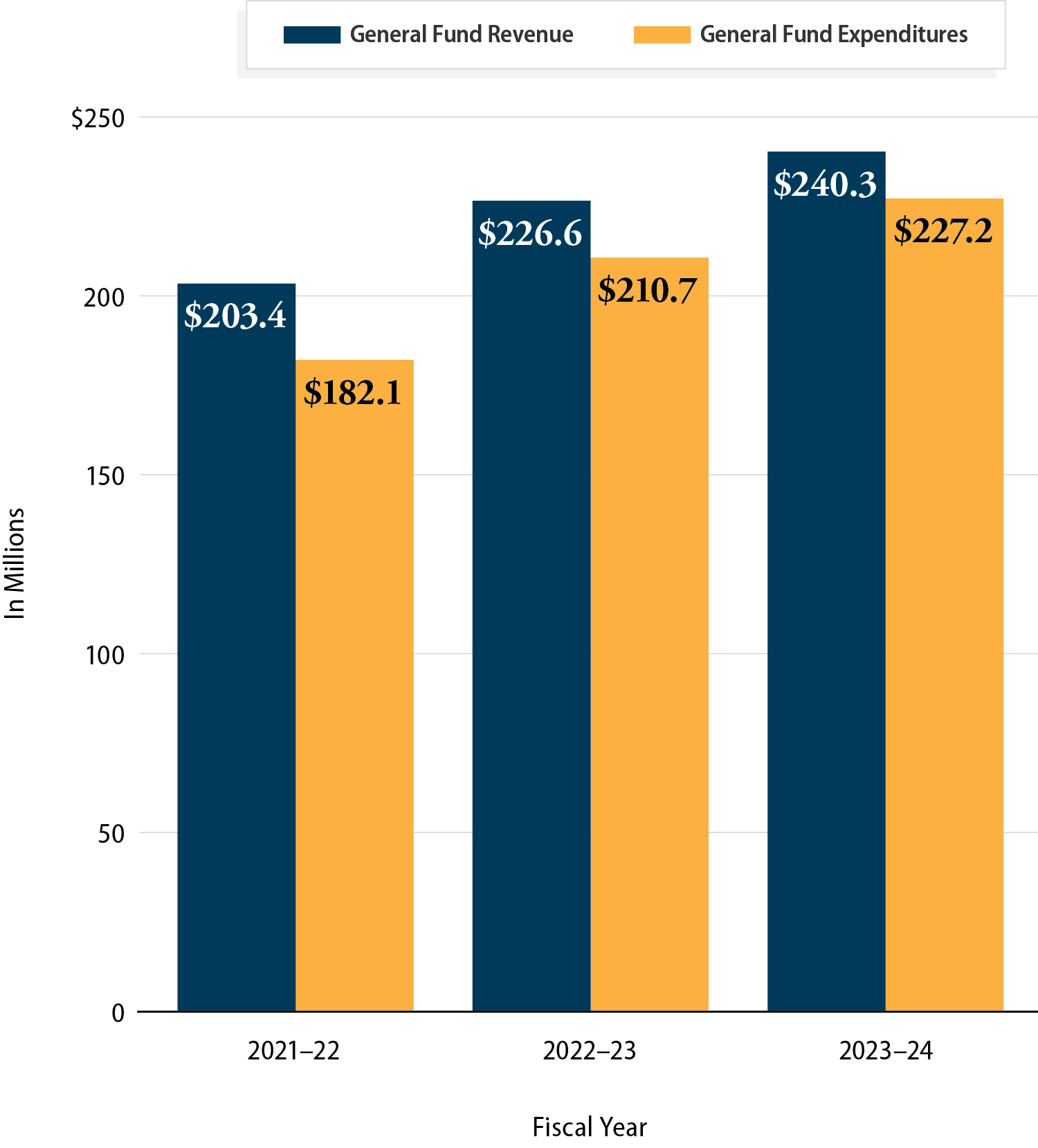

In 2022, we reported that Richmond’s recent budget projections predicted that the city would experience deficits in upcoming fiscal years. We recommended that the city propose budget actions to ensure balanced budgets and eliminate projected deficits. In the intervening years, the city has taken actions to reduce costs, and its revenue has increased. To account for a decrease in expected revenue in fiscal year 2024–25, the city adopted a balanced budget by reducing budgeted expenses related to public safety, equipment replacement, street paving, and legal services by a net total of $3.57 million. In 2020, Richmond voters approved Measure U, which applied a tax to a business’s annual gross receipts. The city reported that the new tax structure brought in an additional $5.3 million for the city in fiscal year 2021–22 and $7.7 million in fiscal year 2022–23. During this audit, we found that the city is monitoring compliance with tax provisions to ensure that it collects the correct amount of revenue. Since fiscal year 2021–22, the city’s annual general fund revenue has exceeded expenditures, as Figure 2 shows. Although the city’s budget continues to include projected deficits, Richmond has demonstrated that it is able to avoid deficits, and therefore we are no longer concerned about the city’s ability to maintain balanced spending.

Figure 2

Richmond Has Maintained General Fund Expenditures Below Its Revenues

Source: Richmond’s audited financial statements.

Note: We calculated revenue by combining the revenue and other financing sources into the general fund in each fiscal year. We calculated expenditures by combining the expenditures and transfers out of the general fund in each fiscal year.

A vertical bar graph titled “Richmond Has Maintained General Fund Expenditures Below Its Revenues.” It compares Richmond’s general fund revenue and expenditures for fiscal years 2019-20 through 2023-24. In fiscal year 2021-22, Richmond’s general fund revenue was $203.4 million, and its expenditures were $182 million. In fiscal year 2022-23, Richmond’s general fund revenue was $226.6 million, and its expenditures were $210.7 million. In fiscal year 2023-24, Richmond’s general fund expenditures were $240.3 million and its expenditures were $227.2 million. The source of this information is Richmond’s audited financial statements. This figure has a note that states: We calculated revenue by combining the revenue and other financing sources into the general fund in each fiscal year. We calculated expenditures by combining the expenditures and transfers out of the general fund in each fiscal year.

Richmond has also begun receiving payments from a recent agreement that provides further insulation against deficits in immediately upcoming budget years. Effective August 2024, the city entered into a tax payment agreement with Chevron U.S.A. Inc. (Chevron), in which Chevron agreed to pay the city $550 million over a 10-year period commencing in July 2025. The agreement states that these funds are identified as general fund revenue in the city’s budget and indicates that Chevron may not place any restrictions on how the funds are spent by the city. In June 2025, city staff presented options to the city council on how to use the increased general fund revenue, and ultimately the council decided to postpone using these funds until a later date, essentially creating a safeguard against any future economic uncertainties. The city received its first payment of $50 million in July 2025.

HIGH-RISK AREA #3

High Debt Burden

Status: We conclude that the city has partially addressed this area by avoiding any additional long-term debt and continuing to manage debt payments without significantly burdening its general fund.

In 2022, we found that Richmond had about $250 million in debt related to governmental activities and determined that the city’s debt service payments were a risk to the city’s overall financial condition. As of June 2024, the city had not borrowed to incur any new long-term debt obligations related to governmental activities since 2022. Over the last few fiscal years, the percentage of Richmond’s debt payments from the general fund has grown. In fiscal years 2019–20 and 2020–21, only about 5 percent of the total debt payments were made directly from the general fund.1 By fiscal year 2023–24, that percentage grew to about 17 percent. However, debt payments directly from the general fund represent only a small percentage of general fund expenditures. In fiscal years 2019–20 and 2020–21, the amount spent directly from the general fund on debt was equal to 1 percent of the general fund’s total expenditures. In fiscal year 2023–24, the debt payments represented 2 percent. Despite the increase, the overall percentage is still a comparatively low burden on the general fund. It remains important for the city to prudently manage its debt burden in the future. Adhering to the debt policy it adopted in October 2023 will likely help the city to do so. The policy indicates the types of debt the city will consider incurring and under what circumstances, as well as the approval process for agreeing to take on debt. For specific types of debt, the policy limits the percentage of the general fund revenue that the city can commit to debt service to 10 percent. Although the city still reports significant long-term debt, that amount has not increased, and the debt burden on the general fund has not grown beyond manageable levels. Accordingly, we conclude that this risk area is partially addressed.

HIGH-RISK AREA #4

Retirement Obligations Burden the City

Status: We conclude that the city has fully addressed this risk area by briefing the city council on options to prefund pension obligations and beginning to make contributions to a pension trust.

In our 2022 report, we found that Richmond’s rising pension costs—the money it contributes annually to support its program to provide guaranteed benefits to retired city employees—were an additional risk to taxpayers and another potential barrier to maintaining balanced budgets. We recommended that city staff propose to the city council a funding policy for its pension trust fund and report on the estimated long-term savings from increasing the city’s direct payments to the California Public Employees’ Retirement System (CalPERS) compared to investing the same amounts in its pension trust fund. Our recommendation also suggested that staff members use this information to inform their own recommendations to the city council regarding funding targets for the pension trust fund and consider recommending that the city council increase the city’s payments directly to CalPERS.

In July 2023, the city’s staff presented a comparative analysis from a financial adviser regarding two funding options: contributing to the city’s pension trust or making payments directly to CalPERS. The adviser recommended to the city that it should make contributions to its pension trust, which it decided to do. The city has since updated its pension trust policy. The city’s current funding policy is to contribute to the trust fund 10 percent of its general fund year-end surplus and also contribute the savings that result from the city prepaying its unfunded pension liabilities. The city has contributed a total of $4 million toward its pension trust since May 2024, and it is making payments in alignment with its funding policy. Although this amount is relatively low compared to the remaining liability the city faces, which as of June 2023 was more than $370 million, the city has taken positive steps toward managing its pension liability. Based on its actions thus far, we determined that the city has fully addressed this risk area, although its future success will be dependent on continuing the beneficial practices it has implemented in recent years.

HIGH-RISK AREA #5

Missed Opportunities to Address Retiree Health Obligations

Status: We previously determined that the city had fully addressed this risk area by developing an OPEB trust fund policy. During this audit, we verified that the city was making payments into the trust fund.

Our 2022 audit found that although Richmond created trust funds to address its OPEB expenses, the funds’ balances were not at a sufficient level at that time. We recommended that Richmond implement a policy to identify funds that it should be contributing to the OPEB trust fund and annually assess whether available funds should be deposited into to the trust under the policy and then present proposals to the city council for contributing those funds. In 2023, we assessed this risk area as fully addressed because Richmond provided us with its OPEB trust fund policy as part of its corrective action plan update. During this audit, we determined that from October 2023 through March 2025, Richmond contributed nearly $3.7 million toward its OPEB trusts. Continuing to make these contributions will help the city keep OPEB funding risks at a manageable level.

HIGH-RISK AREA #6

Cost of the City’s Workforce

Status: We conclude that the city has partially addressed this risk area by conducting a workforce analysis that determined how many staff positions it needs. The city must now balance the need for additional staff with its fiscal constraints.

Our 2022 audit found that Richmond had not increased the salaries for some city positions for as long as seven years. The city’s budget administrator characterized this situation as one of the difficult steps the city had taken to promote fiscal sustainability. We recommended that the city perform a workforce analysis and consider eliminating vacant positions to reduce the cost of its workforce. In response, the city hired a consultant to perform a workforce analysis and presented those results to the city council in June 2024. The report found that Richmond was understaffed and would need 74 additional full-time positions to meet its service level expectations.

The deputy city manager stated that she and the city manager review vacancies monthly. She also stated that the city prioritizes public safety when filling vacancies. An internal vacancy report from the city’s human resources manager covering June 2025 showed that the city’s overall vacancy rate was 18 percent. The report showed that the vacancy rate for the fire department was 5 percent and for the police department was 18 percent. In June 2025, the city presented the status of its vacancies, recruitment, and retention efforts to the city council. The presentation identified obstacles to recruiting and retaining staff, and it also described the city’s efforts to address those obstacles, such as conducting recruitment campaigns, implementing new employee onboarding processes, and expanding employee benefits. We conclude that Richmond has demonstrated progress in this area. However, prudent management of the city in upcoming years will require balancing the city’s costs against its need to retain and attract individuals in order to effectively provide city services.

HIGH-RISK AREA #7

Housing Authority Mismanagement

Status: The city has partially addressed this risk area by dedicating staff to the housing authority. However, the city and the housing authority still need to publish the results of additional audits and transfer public housing properties to new managers.

The Richmond Housing Authority (housing authority), which is a separate legal entity from the city of Richmond, exists to provide affordable housing options. Although they are separate entities, the housing authority and the city are connected, and members of the city council serve on the housing authority’s board. In our 2022 audit, we identified that the city managed the housing authority’s financial operations. For this reason, the city’s financial statements include the housing authority as a component of the city. The city also fills shortfalls in the housing authority’s budget, essentially subsidizing the housing authority. For these reasons, our 2022 audit of the risks facing the city of Richmond included concerns regarding the housing authority.

Our 2022 report found that Richmond had ineffectively managed the financial operations of the housing authority for a decade. Since fiscal year 2016–17, the housing authority had not published the results of annual audits of its financial statements. In addition, the U.S. Department of Housing and Urban Development (HUD)—the federal agency that administers federal low-income housing programs—noted deficiencies in the housing authority’s financial practices, oversight, documentation, and accountability going back more than a decade. As a result, the housing authority agreed to transfer its programs and resources to other entities, such as other public housing authorities or nonpublic property managers.

Accordingly, in 2019, the housing authority and HUD agreed to a recovery agreement, in which the housing authority agreed to sell or transfer the operations of its public housing properties. In 2022, we recommended that the city make sufficient resources available to the housing authority to complete the activities required by the recovery agreement. We also recommended that the city enter into a written agreement with the housing authority defining each entity’s financial responsibilities and how the city plans to resolve past tax liabilities and prevent new unnecessary liabilities.

The city and the housing authority have demonstrated continued progress in addressing this risk area, but the housing authority still needs to transfer remaining properties and publish the results of incomplete audits. In 2023, the city entered into a written administrative services agreement with the housing authority, which describes the financial services the city will provide to the housing authority. The city has assigned more staff to the housing authority and has hired a financial consultant to help resolve its financial issues. With these additional resources, the housing authority has issued the results of some financial statement audits that had previously been incomplete. However, the housing authority still needs to publish the results of audits of its financial statements for all years since fiscal year 2020–21 and has not yet published the results of reviews of its internal controls over financial reporting for those same years.

Of the six properties included in the recovery agreement, the housing authority has substantively transferred management of three properties, but must transfer the other three properties to complete the recovery agreement.2 In its March 2025 recovery agreement update, the housing authority acknowledged that it has not completed all tasks in the agreement by the established deadlines but maintained that the delay, particularly in regard to transferring properties, reflected a careful review and negotiation process aimed at benefiting the housing authority and its residents. Therefore, we conclude that the city has partially addressed this risk area.

HIGH-RISK AREA #8

Missed Mandatory Deadlines

Status: We conclude that the city has partially addressed this risk area by dedicating resources to the housing authority’s efforts to complete the recovery agreement. However, tasks from the recovery agreement remain outstanding.

The recovery agreement between the housing authority and HUD outlined several tasks that the housing authority needed to fulfill and gave deadlines by which the authority was required to complete those tasks. All tasks were supposed to be complete by November 2022. However, we noted in that year that the housing authority did not do so by the required timelines in the recovery agreement. As previously discussed, we recommended that Richmond make sufficient resources available to the housing authority to complete all tasks in the recovery agreement. Although the city has provided resources to the housing authority by dedicating staff and hiring a consultant, substantive tasks continue to remain incomplete even after the agreed-upon deadline, including the transfer of properties. Therefore, this area remains partially addressed.

HIGH-RISK AREA #9

The Housing Authority May Owe Taxes and Penalties

Status: We conclude that the city fully addressed this area by ensuring that the housing authority’s past-due taxes and penalties were paid. We determined that the housing authority is not likely to incur similar tax liabilities in the future.

In 2022, we found that the housing authority owed the Internal Revenue Service $1 million in taxes and penalties from 2018 and 2019. Because the city used its general fund to cover deficits in the housing authority’s budget, the existence of outstanding taxes and penalties increased the financial risk to the city. The housing authority’s tax liabilities stemmed from its mismanagement of its housing voucher program. Specifically, the housing authority failed to report the required tax information about property owners who received federal funds through its housing voucher program, resulting in the housing authority owing $1 million in taxes and penalties. In 2019, the housing authority transferred responsibility for managing the housing voucher program to its county’s housing authority. As part of its fiscal year 2023–24 budget, the housing authority planned for, and ultimately issued, payments to resolve the taxes and penalties that it owed. Because the housing authority has brought reasonable closure to the potential for future tax liabilities, we conclude that the city has fully addressed this risk area.

HIGH-RISK AREA #10

Insufficient Documentation of Best Value

Status: In June 2023, we concluded that the city had fully addressed this risk area by instituting the use of new contracting forms and conducting training on related requirements. During this audit, we verified that the city continues to use the forms and provide training.

In 2022, we found that Richmond could not consistently demonstrate that it followed its contracting policies because it lacked documentation of such efforts. To ensure that it receives the best value when contracting for goods and services, we recommended that city staff immediately begin documenting, for all contracts, that they were following the contracting requirements in the city’s municipal code and in its contracting policies. We also recommended that Richmond’s finance department create a comprehensive checklist of required contract documentation that other departments must follow when conducting procurements. We previously determined that the city fully addressed this recommendation by creating a new contracting checklist that addresses our concerns as well as by developing a training program addressing its procurement requirements. As part of this audit, we reviewed attendance records to confirm that the city continues to provide training to its staff and confirmed that the city continues to use its contracting checklist.

HIGH-RISK AREA #11

Infrequently Updated Fees

Status: In spring 2023, we concluded that the city had fully addressed this risk area by enacting a new ordinance requiring that it regularly update service fees. During this audit, we verified that the city has updated its fees.

Our 2022 report determined that Richmond had not consistently updated its fees, thereby risking the need for the general fund to subsidize the difference in the cost of those services. We recommended that Richmond determine a cost-effective frequency for updating its master fee schedule to account for all allowable costs and update its municipal code as necessary. Our spring 2023 assessment reported that the city fully addressed our recommendation by approving a new ordinance that requires fees to be updated annually or as needed based on changes to the Bureau of Labor Statistics Employment Cost Index. As part of this audit, we confirmed that the city has continued to monitor and update its fees.

Although It Has Made Progress in Several Areas, the City of Compton Remains a High-Risk Entity

| Recommendations From October 2022 | State Auditor’s Current Assessment of Compton’s Progress in Addressing the Recommendation* |

|---|---|

| Priority One Recommendations | |

| 1. Implement charter amendments to facilitate open and competitive hiring | Pending |

| 2. Formalize specific responsibilities of the human resources department | Pending |

| 3. Require regular reports about the human resources department’s progress | Pending |

| 4. Fully staff the human resources department and city controller’s office | Partially Addressed |

| 5. Create and implement a fiscal sustainability plan | Partially Addressed |

| 6. Create and implement a capital improvement plan | Fully Addressed |

| Priority Two Recommendations | |

| 7. Complete and implement a cost allocation plan | Partially Addressed |

| 8. Adopt budgeting policies that incorporate best practices | Partially Addressed |

| 9. Implement an ongoing training program for city council members | Partially Addressed |

| Priority Three Recommendations | |

| 10. Establish a centralized purchasing office with a procurement officer | Fully Addressed |

| 11. Create a comprehensive, citywide purchasing manual | Pending |

| 12. Develop and approve a master sewer study | Fully Addressed |

| 13. Approve updates to charges for city services | Partially Addressed |

| 14. Approve a realistic payment plan for money borrowed by the general fund | Fully Addressed |

| 15. Issue all audited financial statements | Partially Addressed |

| 16. Develop and implement a plan to fund pension and OPEB costs and liabilities | Pending |

| 17. Resolve past audit findings | Partially Addressed |

| 18. Develop a policy for fire department overtime use | Pending |

Note: We present the issues related to the city of Compton differently than the other two cities in this report. This presentation is focused on the recommendations we made to Compton in our 2022 audit report, rather than on the risk areas. This format maintains consistency with the original report’s prioritization of specific actions the city should take and makes clear the relative importance of the issues facing the city.

*In accordance with state law, we used our professional judgment to assess the city’s progress in addressing each of the recommendations in the table. We determined whether the steps the city took and the overall conditions relevant to each recommendation meant that the city fully or partially addressed the recommendations, or whether substantial action relevant to the recommendation was still pending. We explain the statuses identified in this table in more detail below.

Fully addressed: The city has taken sufficient action to address the recommendation when we consider its effort in combination with the related conditions at the time of this audit.

Partially addressed: The city has taken positive action to address the recommendation, but its effort is incomplete when we consider it in combination with the related conditions at the time of this audit.

Pending: The city has not taken substantial action to address the recommendation and, at the time of this audit, the conditions that created high risk for the city continue to exist.

PRIORITY ONE RECOMMENDATIONS

Personnel and Staffing Risks (Recommendations 1 – 4)

Status: Noncompetitive hiring rules, undefined responsibilities in the human resources department, and high turnover remain unaddressed areas of concern for Compton. Thus, we conclude that these recommendations are pending or only partially addressed.

In 2022, we found that Compton had a weak hiring process. Specifically, we found that the city had neither developed minimum qualifications for the position of city manager, nor had it defined how it would evaluate candidates’ qualifications. We also found that the city’s charter and personnel rules prioritized internal appointments over open and competitive hiring processes for most city positions. In total, we concluded that these weaknesses meant that the city had not ensured that key staff were qualified to perform their duties. As a result, we recommended that the city propose amendments to its charter—and amend all related guidelines—to prioritize an open and competitive hiring process for all positions and develop detailed job qualifications for the city manager position.

Compton has taken insufficient action to address our concerns. Related to the city manager position and its job description, the city outlined the qualifications it desired in a city manager when it recruited for the position in 2023. However, the city has not incorporated these expectations into its charter. Further, in November 2022, Compton’s personnel board passed a motion that authorized open and competitive hiring for all upcoming recruitments. The city charter gives the personnel board the authority to allow open and competitive hiring for employees in certain positions, which are known as classified positions. The charter does not expressly give the personnel board the authority to make the same allowance for the rest of the city’s positions. During our audit, the city explained that the personnel board’s motion is not binding, so the city may choose to continue hiring internally through promotions without considering other candidates. Additionally, because the personnel board’s authority extends only to classified positions, its November 2022 motion does not conform to our recommendation, which encompassed all positions, including the city manager.

In March 2023, the city council adopted a resolution to place a measure before voters in the November 2024 election that would have amended the city’s charter to address our recommendation related to open and competitive hiring. However, the city council rescinded this resolution in July 2024. At that city council meeting, some council members said they believed it was unfair for city employees to be denied opportunities to rise through the ranks of city employment and instead allow for external candidates to take positions that rank above those employees.

Because the city’s charter continues to prioritize internal hiring, we conclude that Recommendation 1 remains pending.

Our 2022 audit also found that Compton struggled to fill critical vacancies, in part because its human resources department had not adequately performed several basic recruiting and hiring functions—such as performing a salary survey—which we attributed to the chronic understaffing of the department. In addition, we found that the city’s charter, municipal code, and personnel rules and regulations all neglected to specify the key responsibilities of the human resources director and the department. To address these findings, we recommended that the city formalize the key responsibilities of the human resources department and its director and require reports to the city council at least annually on the department’s progress in meeting these objectives and filling vacancies. The text box shows some of the specific tasks that we recommended the city include as part of the human resources department’s key responsibilities.

Responsibilities We Recommended That Compton Assign to Its Human Resources Department

• Regularly performing a salary survey for all positions

• Developing a process for maintaining and proactively reviewing job specifications

• Documenting and implementing a plan for recruiting

• Managing labor negotiations

• Setting and meeting clear goals for filling positions in a timely manner

• Formally assessing recruitment efforts

• Developing and maintaining a succession plan for key positions

• Documenting specific procedures related to the responsibilities listed above

Source: State Auditor report 2021-802.

During this audit, the city confirmed that since our 2022 audit it has not updated the city charter, municipal code, or the personnel rules and regulations to formalize the key responsibilities of the human resources department or its director. Nonetheless, the city has made limited progress toward accomplishing some of the tasks that we recommended its human resources department be assigned responsibility for performing. The city hired a consultant to conduct an updated compensation study, which was initially planned to be completed by June 2025 but which remained incomplete as of early August 2025. The city also hired a consultant to create a succession plan, but the plan was not finished as of August 2025. Finally, the city has not yet implemented annual reporting of the human resources department’s progress to the city council. Therefore, Recommendations 2 and 3 are still pending implementation.

In our 2022 audit, we also recommended that the city make efforts to fully staff the human resources department with qualified individuals. Our recommendation stemmed from the observations we made about the high rate of turnover in key leadership positions in the city. At the time of our 2022 audit, the city had employed six different individuals as the city manager and at least three different individuals as the city controller at various times during the previous six fiscal years. To address the frequent turnover and long-term vacancies in these and other key positions, we recommended that the city maintain a fully staffed human resources department to ensure that vacancies in key positions would be kept to a minimum.

Since fiscal year 2022–23, the human resources department has added four positions, and as of September 2025, all positions were filled. This is a significant improvement from the condition we found during the last audit. However, turnover in key leadership positions has continued to be a problem for Compton. Since our October 2022 audit, the city has had two more individuals serve in the capacity of city manager and two others fill the role of director of human resources. Consequently, the human resources department will need to make significant progress in the areas we describe above before the city will likely see the positive effects of having a fully staffed department.

The other department we recommended the city fully staff was its city controller’s office. We recommended this as a higher priority so that the city could ensure that the controller’s office would be able to fulfill its duties. As of August 2025, the controller’s office had a vacancy rate of 24 percent. In December 2024, Compton reported to us that it was using temporary help and hired licensed accounting firms to ensure that it could manage the workload of the city controller. Because the city controller’s office still faces staffing shortages, our assessment is that Recommendation 4 is only partially addressed.

Financial Planning Risk (Recommendation 5)

Status: We conclude that the city has partially addressed this recommendation by creating a fiscal sustainability plan and beginning to implement that plan’s recommendations.

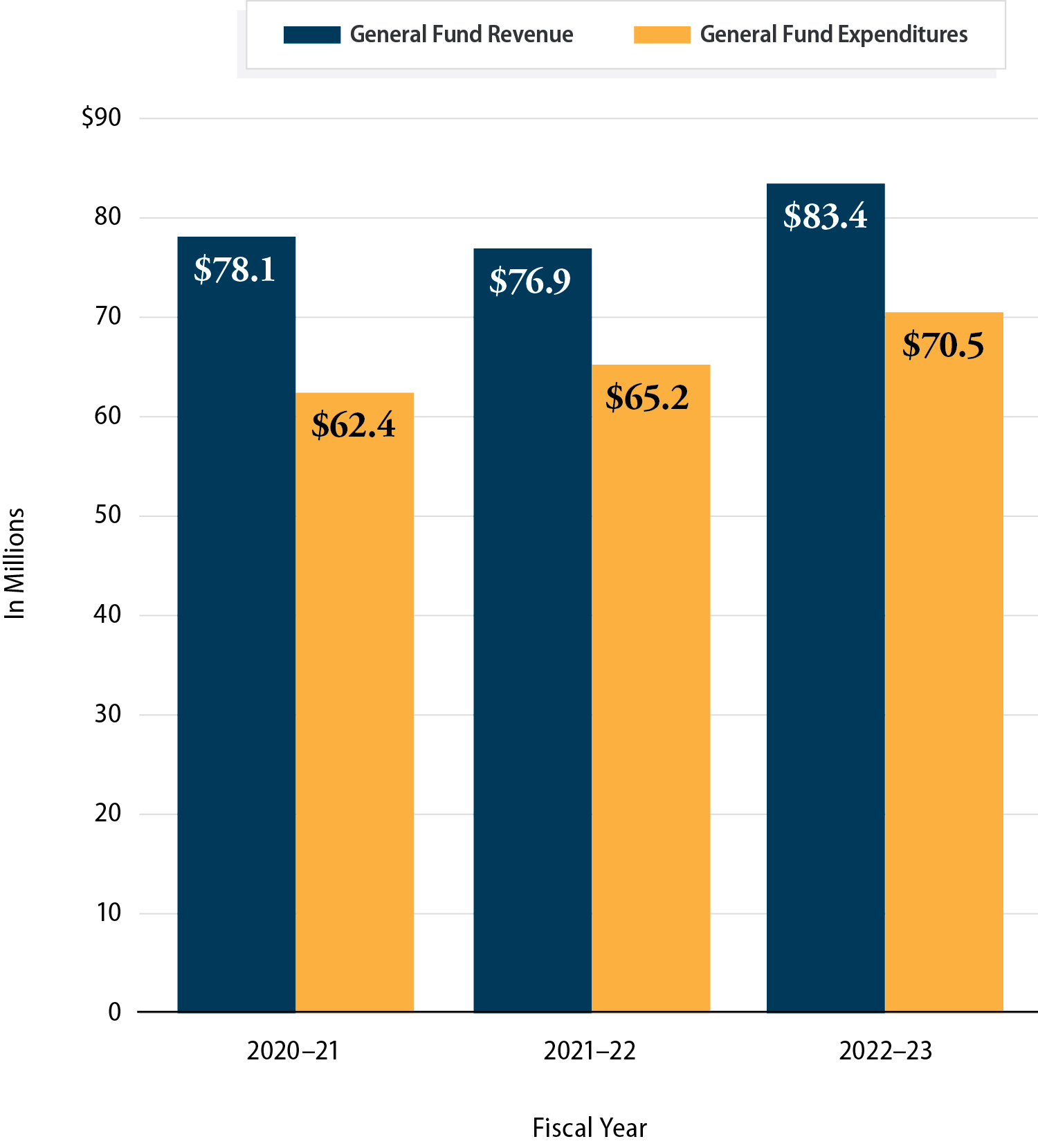

To ensure accountability for Compton’s fiscal recovery process, our 2022 report recommended that the city adopt a fiscal sustainability plan by July 2023. We specifically recommended that the plan address the city’s approach to increasing revenue, decreasing expenditures, and eliminating fund deficits. The city hired a consultant to develop the plan, which was provided to the city council in January 2025. The consultant reported that because financial transactions for unaudited years were incomplete at the time of its review, it was difficult to understand the city’s financial trends for revenue and expenditures. Because of the inability to perform substantive trend analysis and the city’s frequent staffing turnover, the consultant had reduced confidence in the city’s historical trends based on the financial records. For example, the consultant presented financial information for an 11-year period from fiscal years 2013–14 through 2023–24 and remarked that information from fiscal year 2016–17 and portions of other years was unaudited. Figure 3 presents general fund information from the city’s most recent audited financial statements.

Figure 3

Compton Has Kept Expenditures Below Its Revenue in Its General Fund

Source: Compton’s audited financial statements.

Note: Audited financial statements for fiscal year 2022–23 were the most up-to-date available at the time of our audit. We calculated revenue by combining the revenue and transfers into the general fund in each fiscal year. We calculated expenditures by combining the expenditures and transfers out of the general fund in each fiscal year.

A vertical bar graph titled “Compton Has Kept Expenditures Below Its Revenue in Its General Fund.” It compares Compton’s general fund revenue and expenditures for fiscal years 2020-21, 2021-22 and 2022-23. In fiscal year 2020-21, Compton’s general fund revenue was $78.1 million and its expenditures were $62.4 million. In fiscal year 2021-22, its general fund revenue was $76.9 million and its expenditures were $65.2 million. In fiscal year 2022-23, its general fund revenue was $83.4 million and its expenditures were $70.5 million. The source of this information is Compton’s audited financial statements. This graph has a note that states: Audited financial statements for fiscal year 2022–23 were the most up-to-date available at the time of our audit. We calculated revenue by combining the revenue and transfers into the general fund in each fiscal year. We calculated expenditures by combining the expenditures and transfers out of the general fund in each fiscal year.

Nonetheless, the report presented a variety of information about the city’s financial condition and outlook. The consultant made several recommendations to the city, including in the areas that we recommended the fiscal sustainability plan address, namely, how the city could increase revenue and decrease expenditures. Examples of the consultant’s recommendations include outsourcing the city’s efforts to ensure tax compliance and adopting revised budget policies. According to the city controller, the city is currently reviewing the fiscal sustainability plan and has not fully implemented all of the recommendations but has taken action to address some of them. For example, Compton has contracted with another consultant to analyze sales and use tax, transient occupancy tax, and utility users tax administration, all of which are recommendations from the fiscal sustainability plan. As a result of the city’s efforts, we conclude that Compton has partially addressed Recommendation 5. It will be important for the city to continue making progress in implementing its fiscal sustainability plan.

Infrastructure Risks (Recommendations 6 and 12)3

Status: The city has fully addressed our recommendation to update its capital improvement plan by developing the update and funding projects from that plan. It has also recently finalized a master sewer study, as we recommended. However, infrastructure risks remain, and we make additional recommendations in those areas.

In our 2022 audit, we identified infrastructure issues that presented significant health and safety risks. The audit identified that Compton’s lack of an updated capital improvement plan (CIP) had contributed to the disrepair of its infrastructure. As a result, we recommended that the city develop, and the city council approve, an updated CIP and immediately begin implementing its updated CIP for needed infrastructure projects.

The city adopted a five-year CIP in November 2023. To determine whether the city has implemented its plan, we verified that the city’s fiscal year 2024–25 adopted budget included funding for projects in the CIP. For example, the city provided us with a breakdown of the allocations by project for the public works capital outlay budget, and the projects matched those in the CIP. Therefore, we conclude that the city has fully addressed Recommendation 6.

Our 2022 audit found that the city’s pavement management program reported that half of Compton’s streets were in poor or very poor condition. In 2024, the city released an updated report, which found that 44.4 percent of Compton’s streets were in poor or very poor condition. The city measures the distress type, extent, and severity of the pavement and conveys the data through a Pavement Condition Index (PCI). The PCI is a condition rating that ranges from 100 (a new pavement section or recently overlaid or reconstructed pavement) to 0 (a section that has structurally failed and deteriorated dramatically). The weighted average PCI is considered “Poor” or “Very Poor” when below 60, “Fair” between 60 and 74, and “Good” or “Very Good” above 74. Compton’s PCI is 60.8, less than a point above the lowest level in the “Fair” category, and it remains the second-worst average PCI compared to 12 neighboring cities.

The 2024 report identifies the required levels of funding to maintain roads at the current PCI and to increase the PCI to an average of 65. The report projects that with the city’s current $10 million annual budget allocation for pavement maintenance and rehabilitation, it will reach an average PCI of 65.3 in fiscal year 2028–29. The city engineer confirmed that this is the city’s target goal. However, a PCI rating of 65.3 would still rate Compton as third worst among the 12 neighboring cities cited in its pavement management report. Consequently, the city’s goal is insufficient to address our concerns regarding its street conditions. Thus, we are recommending that Compton develop plans to significantly improve its poor and very poor street conditions by 2029 and continue to dedicate the funding needed to do so.

In 2022, we found that the city’s water wells and other water infrastructure were decaying and in need of significant upgrades to ensure a sufficient supply of quality water. At the time, two of the city’s eight water wells were not in use. This was concerning because, according to the city’s 2022 water master plan update, if one or more of the remaining six wells go out of service, Compton would need to use imported water to supplement the groundwater supply to meet maximum demands.

The city confirmed that in June 2025, only four wells were operational. According to the city engineer and internal weekly updates, the two wells identified in the water master plan update as nonfunctional were being worked on but remained nonfunctioning, and two other wells were also nonfunctioning. As of August 2025, there had been no update to the 2022 water master plan. In September 2025, the city informed us that one of its nonfunctioning wells was now operational.

In August 2025, the city engineer stated that the four consistently functioning wells were sufficient to maintain Compton’s water system under normal operating conditions. However, he indicated that during a large-scale fire event in October 2024, the city had to rely on the Los Angeles Metropolitan Water District to support firefighting and meet system demand. We found that Compton had to import water on 10 different occasions since 2023. Because the condition of the city’s water infrastructure has declined since the time of our 2022 report, we conclude that the city must do more work to improve its water infrastructure.

In 2022, we found that another critical area of infrastructure that the city had not adequately addressed was its aging sewer system. Over a 15-year period, Compton had reported to the State Water Resources Control Board more than 40 incidents in which the city’s sewage had spilled or overflowed, posing a risk to public health and the environment. According to a 2016 judgment from a case between Compton and the Los Angeles Regional Water Quality Control Board (water control board), Compton agreed to complete a list of 48 projects by specified completion dates. Although all of these projects were scheduled to be completed by the end of 2024, the city confirmed that it has completed only three projects thus far.

In January 2025, Compton completed a Sewer System Management Plan for the State Water Resources Control Board, which fully addresses Recommendation 12. The plan includes details regarding maintenance and operation, design and performance provisions, and spill emergency response, among other topics. It also incorporates recommendations from the city’s internal audit of its implementation of the Sewer System Management Plan. If the city implements these recommendations and adheres to this plan, it will address the risks that we identified in our 2022 report. Additionally, since the release of our audit report in October 2022, no further spills have occurred. Nevertheless, this area remains a risk to the city until it makes more progress in completing the required projects from the 2016 judgment. We believe that the city should address the findings and recommendations from its Sewer System Management Plan and ensure that in doing so, it completes projects included in the 2016 judgment.

Recommendations:

To ensure that it sufficiently improves street conditions, Compton should develop plans to significantly improve its poor and very poor street conditions by 2029 and dedicate the funding needed to do so.