2025-049 Mendocino County

It Should Continue to Address Its Strained Financial Condition and Can Improve Several Important Operational Processes

Published: December 18, 2025Report Number: 2025-049

December 18, 2025

2025-049

The Governor of California

President pro Tempore of the Senate

Speaker of the Assembly

State Capitol

Sacramento, California 95814

Dear Governor and Legislative Leaders:

As required by Government Code section 8546.11, my office conducted an audit of Mendocino County (Mendocino). This report concludes that Mendocino must take additional action to address its strained financial condition and improve several processes critical to its operations.

From fiscal year 2019–20 through 2023–24, Mendocino experienced trends that threaten its financial health, including expenditures that have grown more quickly than revenue and a decrease in its general fund reserve. Mendocino has faced a persistent deficit when developing its annual budget and will likely continue to face these deficits without further action. Moreover, Mendocino’s procurement and financial reporting processes leave it vulnerable to waste, fraud, and abuse. We found insufficient documentation or justifications for nearly half of the 30 expenditures we reviewed and found some expenditures violated prohibitions on direct funding of religious organizations and gifts of public funds. Mendocino also lacked adequate justifications for sole-source contracts, and county departments have split contract agreements across multiple years, allowing them to avoid certain requirements or approvals. Moreover, the Auditor-Controller-Treasurer-Tax Collector’s Office must take corrective action to address known deficiencies in its procedures that have contributed to late financial reporting.

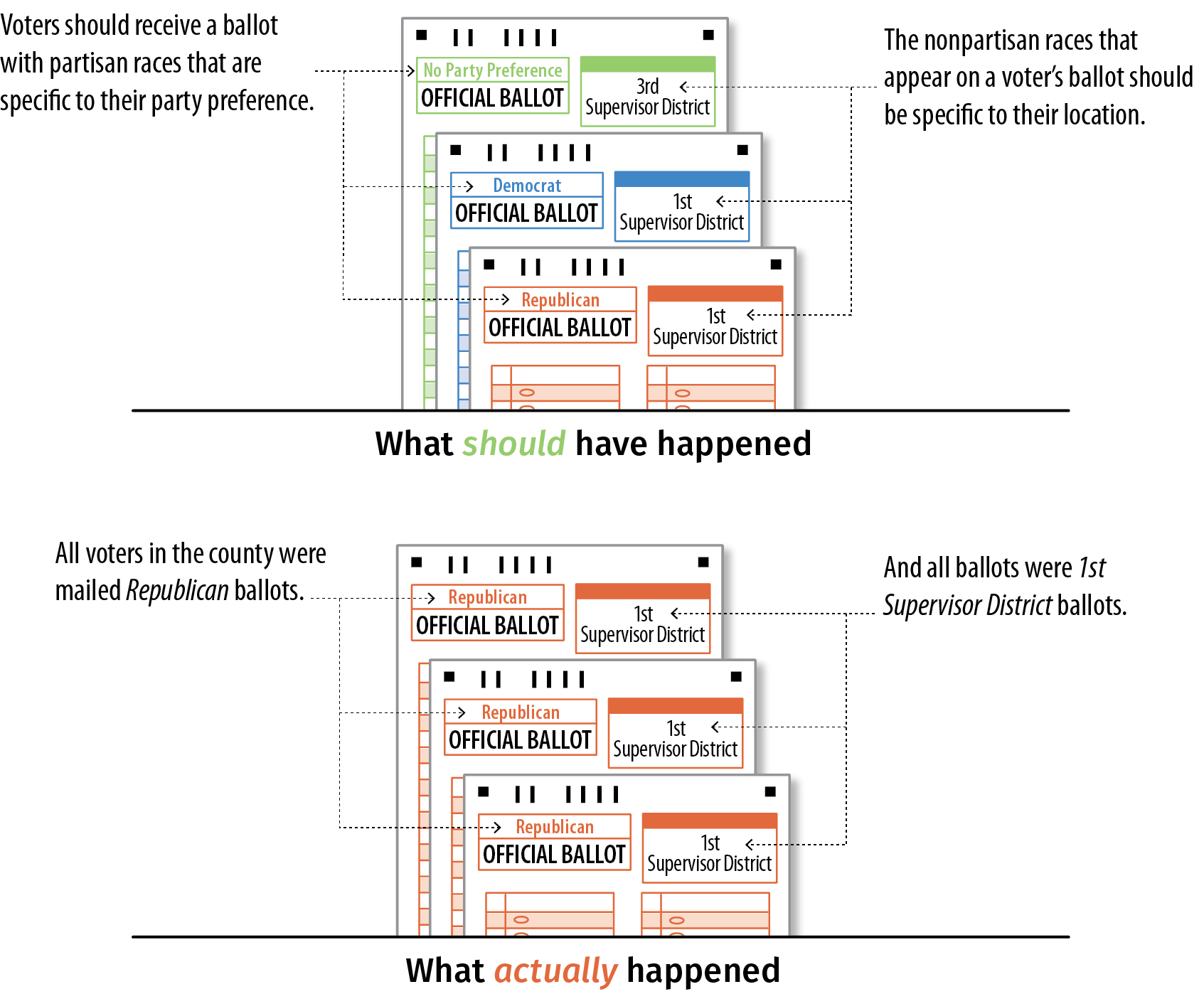

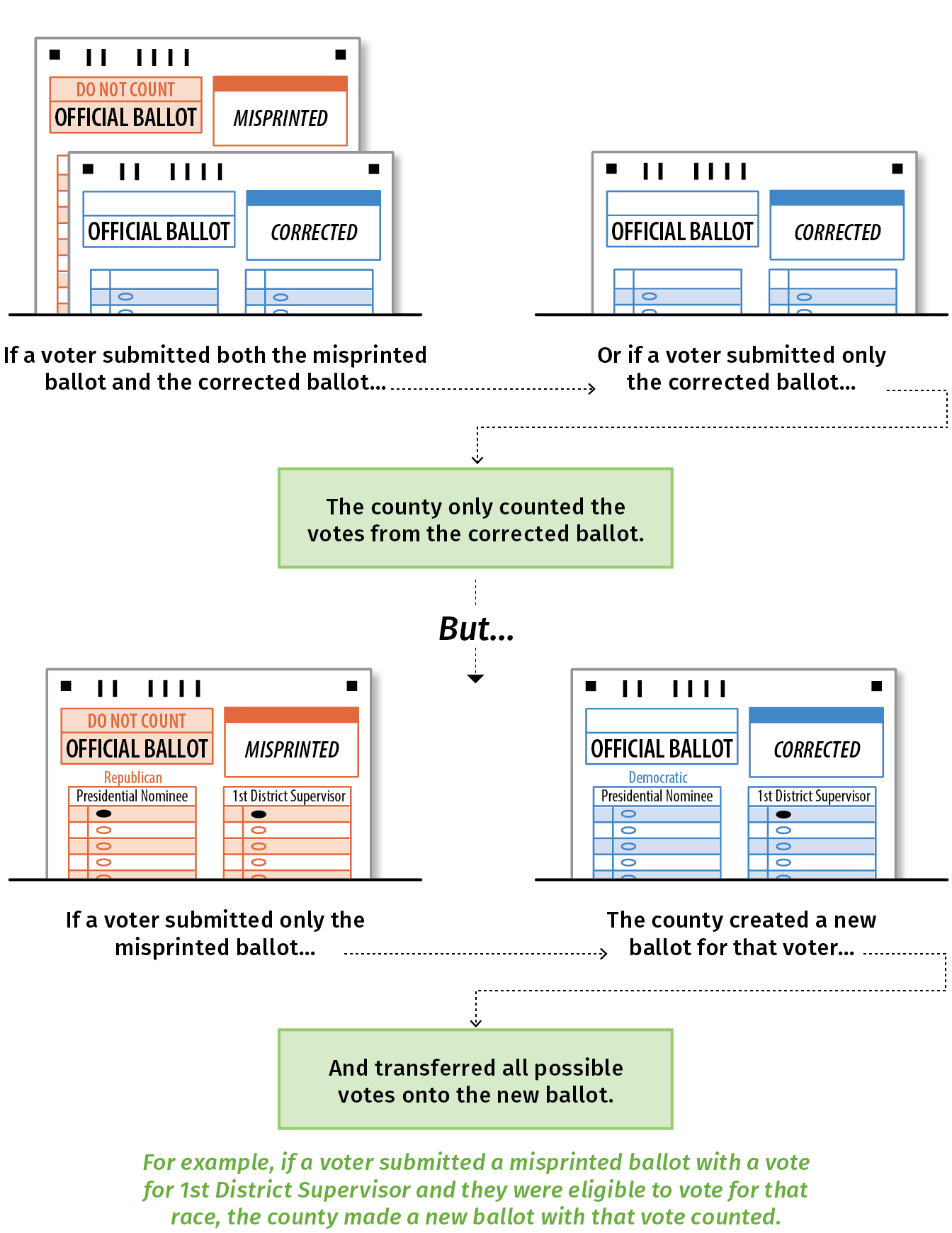

Finally, the county experienced two errors in the 2024 presidential primary election. The county’s Elections Office was not responsible for the first error, in which incorrect ballots were mailed to nearly all voters. However, the Elections Office assigned voters to incorrect voting precincts, causing some voters to receive incorrect ballots again. We found that as of the time of our audit, the Elections Office still had not ensured that it had assigned all voters to their correct precincts, which could lead it to issue additional incorrect ballots in the future.

Respectfully submitted,

GRANT PARKS

California State Auditor

Selected Abbreviations Used in This Report

| ACFR | Annual Comprehensive Financial Report |

| ACTTC | Auditor-controller-treasurer-tax collector |

| CEO | Chief executive officer |

| DGS | California Department of General Services |

| GFOA | Government Finance Officers Association |

| GIS | Geographical Information Systems |

| RFP | Request for proposal |

| RGS | Regional Government Services |

| SCO | State Controller’s Office |

| SOS | California Secretary of State |

| USDOJ | U.S. Department of Justice |

Summary

Key Findings and Recommendations

Mendocino County (Mendocino) is a county in northern California with a population of about 90,000. The county is governed by a five-member board of supervisors (board) that serves as the county’s executive and legislative body. The board appoints a chief executive officer (CEO) who is responsible for directing the overall operation of the county. Apart from the supervisors, there are four other elected officials that play key roles in the overall operations of the county. They are the assessor-clerk-recorder, the auditor-controller-treasurer-tax collector (ACTTC), the sheriff, and the district attorney. Recently, media reports have indicated that Mendocino has struggled financially and that errors occurred in the county’s administration of the 2024 presidential primary election (2024 primary election). Because of these concerns, the Legislature and the Governor amended state law to require our office to perform an audit of Mendocino in specified areas. This audit responds to that requirement and concludes the following:

Mendocino’s Financial Condition Is Gradually Declining and Requires Corrective Action

From fiscal year 2019–20 through 2023–24, Mendocino experienced three significant trends that threaten its overall financial health: stagnating tax revenue, expenditures that have grown more quickly than revenue, and a decrease in its general fund reserve. The county’s total tax revenue, which is its second largest source of revenue, remained relatively unchanged for the five-year period while expenditures from its general fund grew by more than 30 percent and its general fund reserve dropped slightly below the recommended minimum level. As these trends have occurred, Mendocino has dealt with issues related to its property tax system, which have contributed to untimely assessments of properties to determine their taxable value and uncollected past due taxes. The county estimated that as of December 2025 it had $30.6 million in uncollected taxes, penalties, interest, and fees related to defaulted properties. Also, for the past three fiscal years, Mendocino has faced a deficit when developing its annual budget. As a result, it has had to plan for the use of one-time funding and delays in spending to create balanced budgets. Although Mendocino has thus far been able to avoid the use of these one-time funds to address actual costs, we believe that it will continue to face persistent deficits if it does not take additional action to address its budget deficit, such as raising tax rates.

The County’s Procurement and Financial Reporting Processes Leave It Vulnerable to Waste, Fraud, and Abuse of Public Funds

Mendocino has not exercised sufficient oversight of staff spending that would best protect it against waste, fraud, and abuse. We reviewed 30 total expenditures from across three county departments and found problems with the documentation or justification supporting nearly half of these expenditures. For example, staff purchased items such as a television without documenting the reasons why and did not reconcile advance payments to staff for travel with the actual costs of those trips. In addition, we found that Mendocino has not sufficiently overseen the use of the asset forfeiture funds spent by the Sheriff’s Office and District Attorney’s Office. As a result, we found that these offices were making donations of these funds without adequate safeguards against improper spending. In fact, we found donations to a religiously affiliated school that violate state and federal constitutional provisions, and we also found that the District Attorney’s Office made a gift of public funds when it spent $3,600 on an end-of-year gathering and dinner event for its staff and their guests. Finally, more than half of the 20 sole‑source contract agreements we reviewed lacked adequate justification to support that a sole-source contract was necessary, and county departments split contract agreements across multiple years, allowing them to avoid seeking competitive bids for agreements or obtaining board approval for the use of county funds on these contracts.

A Vendor Mistake and a Weak County Process Caused Ballot Errors in the 2024 Primary Election

During Mendocino’s administration of the 2024 primary election, the county’s ballot printing vendor issued incorrect ballots to nearly every one of the more than 50,000 voters in the county. Although the county responded quickly to issue corrected ballots, 691 voters submitted only the incorrect ballot when they voted. Shortly after resolving this error, the county discovered that it had not placed some voters in the correct voting districts and had to send another corrected ballot to 177 voters. We concluded that the county still has not placed all voters in the correct voting precincts, which can affect what races appear on their ballots.

We made recommendations to the county to take steps to address its declining fiscal condition, including engaging with its residents about raising additional revenue and making cuts to its expenditures. Additionally, we recommend that the county establish greater oversight over spending and create accountability for the use of asset forfeiture funds by having offices or departments that spend those funds report to the board annually about their use of the funds. Finally, we recommend that the county establish a more robust process for assigning voters to the correct voting precincts to protect the integrity of future elections.

Agency Comments

The board, CEO’s Office, Assessor-Clerk-Recorder’s Office, and ACTTC’s Office agreed with our recommendations and indicated they were willing to implement them. Although we did not make any recommendations directly to the Sheriff’s Office, it agreed with our conclusions. We also did not make any recommendations to the District Attorney’s Office, but that office expressed disagreement with our conclusions about its operations.

Introduction

Background

Mendocino is a county in northern California with a population of about 90,000. As Figure 1 shows, a five-member board governs the county. Each member of the board represents a district that comprises a distinct geographic area of the county. The board serves as the legislative and executive body in county government and determines the overall policies for county departments. It also appoints the CEO, who is responsible for implementing the board’s policies and, more generally, for planning, organizing, controlling, and directing the overall operation of the county. In addition, the CEO serves as the liaison between the board and department heads and elected officials. Several departments at the county—including Social Services, Behavioral Health, and Human Resources—report to the CEO.

Figure 1

Summary of the Organization of Mendocino’s Government

The figure is structured as a flowchart. At the top of the flowchart are the citizens of Mendocino County.

This flows via five arrows into five different elected offices.

These are the Accessor-Clerk-Recorder, the Auditor-Controller-Treasurer-Tax Collector, the Sheriff, the District Attorney, and the Board of Supervisors, which includes five members.

The Board of Supervisors oversees all the county departments not headed by elected officials. Under the Board of Supervisors is the Chief Executive Officer, which reports to the Board of Supervisors and manages the County departments, including Social Services, the Behavioral Health Department, and Human Resources, among others.

Source: Mendocino’s 2024–25 budget book.

Mendocino has four other elected officials: the assessor-clerk-recorder, the ACTTC, the district attorney, and the sheriff. Some of these officials serve in multiple roles related to county governance. For example, the county’s assessor-clerk-recorder is responsible for assessing taxable property, processing and maintaining legal records such as marriage certificates, and administering county elections.

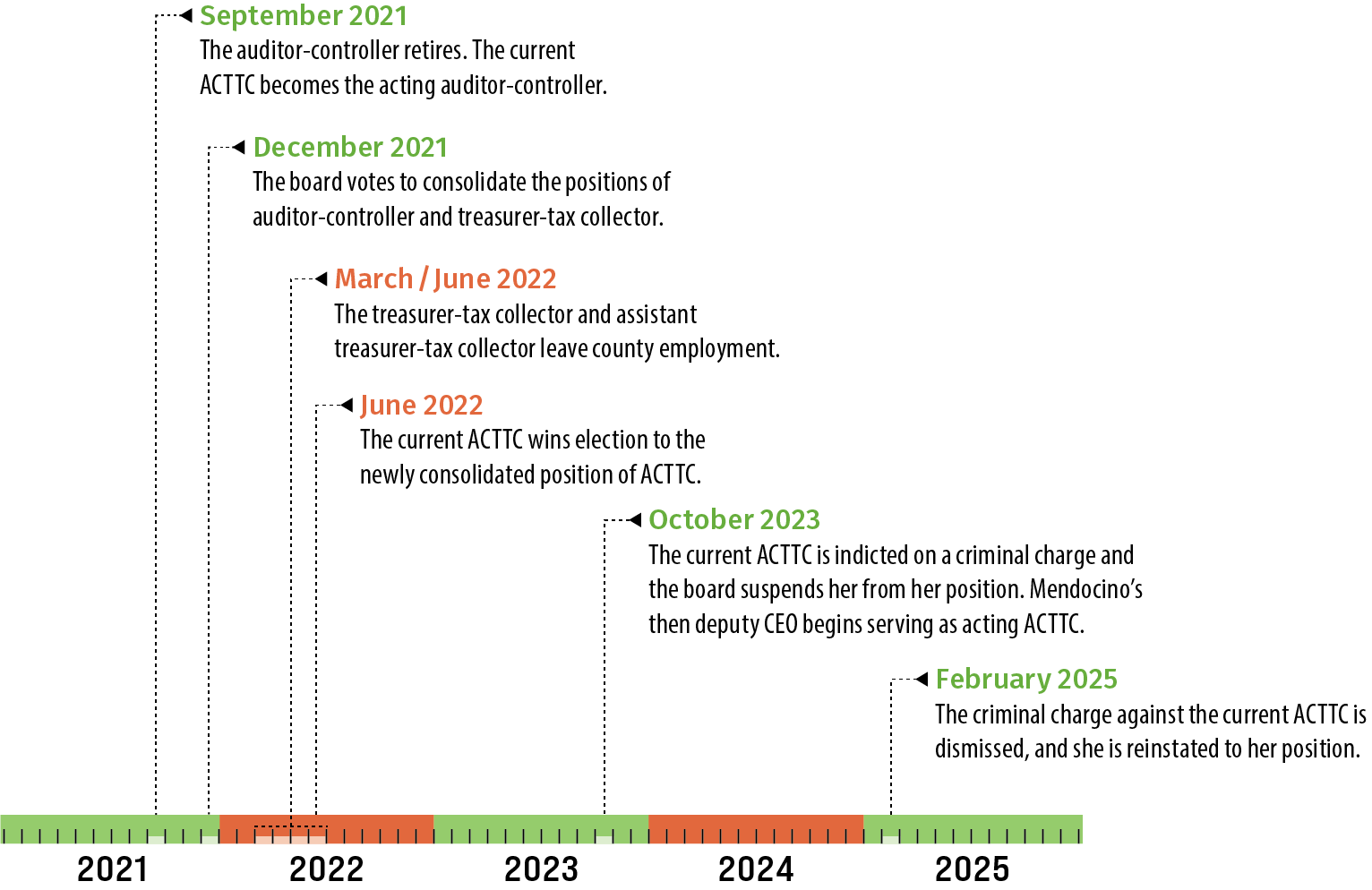

Mendocino’s board voted in 2021 to consolidate what were then two separately elected positions: auditor-controller and treasurer-tax collector. Consequently, Mendocino’s ACTTC is currently responsible for several functions critical to financial management, accounting, and financial reporting at the county, as the text box shows. In November 2025, the board voted to separate the two positions—an action that will take effect in January 2027.

Roles and Responsibilities of the ACTTC

- Exercising general supervision over the method of keeping accounts used by all entities under the board’s control.

- Responding to board orders to maintain statistics and prepare reports that are needed for the management of the county.

- Acting as financial counsel to the board and CEO.

- Receiving and disbursing funds into and from the county’s treasury.

- Preparing the county’s Annual Comprehensive Financial Report and the fiscal schedules for the county’s annual budget.

- Collecting, maintaining custody of, and investing county funds.

- Administering the collection of property and cannabis‑related taxes.

Source: State law and Mendocino’s budget book.

Financial Management of the County

Mendocino’s government provides or facilitates services for county residents in several different areas, including public protection, public assistance, and health and sanitation. Each year, Mendocino creates a budget showing the amounts it plans to spend in these and other areas. The budget process begins with each county department developing the proposed budget for its operations in the upcoming fiscal year. The CEO and ACTTC meet with departments to discuss their budgets, and the CEO then produces the proposed budget for that fiscal year. The board is responsible for adopting the county’s annual budget. State law requires all counties to adopt a balanced budget in which budgeted expenditures equal budgeted revenue. Thus, Mendocino must balance its projected expenditures against the revenue it expects to receive from sources such as taxes, fees, and the state and federal government.

To ensure uninterrupted operations during emergencies and to serve as a buffer during economic downturns, it is important for governments to maintain an unrestricted general fund balance. The Government Finance Officers Association (GFOA) has recommended governments maintain a minimum unrestricted general fund balance of no less than two months of general fund revenue or expenditures. Unrestricted funds are those funds that a government can use at its discretion and that are not restricted to only specific uses by law, regulation, or grant agreement terms. The GFOA cautions that this guidance is a suggestion for the minimum balance that governments should carry and that the actual amount that a government chooses should reflect that government’s unique circumstances. For example, governments dependent on more volatile sources of revenue without corresponding flexibility to adjust expenditures may need to keep a larger balance. In this report, we refer to the unrestricted general fund balance as a general fund reserve and discuss Mendocino’s general fund reserve later in this report.

Throughout the year, Mendocino reports on its financial activities and condition. The CEO generally updates the board each quarter on the status of the budget for the current fiscal year, including projections of the revenue the county expects to receive in that fiscal year. Additionally, after the end of each fiscal year, Mendocino prepares its Annual Comprehensive Financial Report (ACFR), which provides information from its audited financial statements on the amount of funding received, spent, and available for each of its major funds. The finalized ACFR therefore provides critical information to county government officials and the public on Mendocino’s financial condition.

State Law Required an Audit of Mendocino’s Financial Controls and Elections

Recent media reports have indicated that Mendocino’s financial condition is poor or declining, citing the frustration of members of the board who stated that they did not know the county’s overall financial condition. Mendocino’s late financial reports prompted the State Controller’s Office to perform a review of Mendocino’s financial reporting that concluded in July 2024, and that review resulted in several recommendations for improvement. Additionally, the county encountered problems in 2024 during the administration of the primary election in which voters received incorrect ballots. Finally, in 2023 the ACTTC and another county staff member were indicted on charges of misappropriation of public funds. Those charges have since been dismissed.

These events have caused concern that Mendocino was not operating effectively. Accordingly, the Legislature and the Governor amended state law to require us to perform this audit by January 1, 2026. The audit was required to include a review of any potential waste, fraud, abuse, and mismanagement; the county’s administration of elections in 2024; and the county’s contracting and procurement. To evaluate Mendocino in these areas, we reviewed several county departments, including those administered by the CEO, the assessor-clerk-recorder, the ACTTC, the district attorney, and the sheriff. We identify the objectives for our audit in the Appendix.

Audit Results

- Mendocino’s Financial Condition Is Gradually Declining and Requires Corrective Action

- The County’s Procurement and Financial Reporting Processes Leave It Vulnerable to Waste, Fraud, and Abuse of Public Funds

- A Vendor Mistake and a Weak County Process Caused Ballot Errors in the 2024 Primary Election

Mendocino’s Financial Condition Is Gradually Declining and Requires Corrective Action

Key Points

- Mendocino County (Mendocino) faces a strained financial condition. Its tax revenue has remained generally unchanged over a five-year period, its expenditures are growing at a rate greater than its revenue, and its general fund reserve has declined.

- The county is behind in completing property tax assessments that would assist in identifying additional revenue and in collecting property taxes that have gone unpaid. Mendocino has struggled to complete property tax-related tasks since at least 2021 when it began using new software to assist its process. The county estimated that as of December 2025 it needed to collect $30.6 million in taxes, penalties, interest, and fees related to properties in default status.

- Mendocino faces a structural budget deficit that it is unlikely to resolve without further strategic action from its board of supervisors (board). Although the board has taken some steps to control expenditures, it will likely need to consider additional cuts to expenditures and methods of increasing revenue, such as tax increases.

Trends in Mendocino’s Revenue, Expenditures, and Reserve Are Straining Its Financial Health

Poor financial health can negatively affect a county’s ability to provide critical services such as public protection, health and sanitation, and public assistance to its residents. To assess Mendocino’s financial health, we analyzed the county’s financial trends from fiscal years 2019–20 through 2023–24. We found that the county’s ability to continue to provide its current level of services to its residents is at risk because of three significant trends: stagnating tax revenue, increasing expenditures, and a decrease in its general fund reserve.

Mendocino’s tax revenue did not grow significantly during the period we reviewed. As the text box shows, tax revenue was the second most common source of revenue for Mendocino’s governmental funds from fiscal years 2019–20 through 2023–24. The county’s largest source of revenue, intergovernmental revenue, increased in each year we reviewed, and the overall percentage of governmental fund revenue that was from intergovernmental sources was generally the same at Mendocino as we observed at some other counties. Accordingly, we have no concerns about Mendocino’s largest funding source. However, tax revenue remained relatively flat during the years we reviewed. Figure 2 shows the major tax revenue sources for the county and how much revenue they generated. Comparatively flat revenue growth from its second largest revenue source is a strain on Mendocino’s ability to maintain service levels for its residents, particularly because of the increasing expenditures we discuss later.

Mendocino’s Largest Revenue Sources for Governmental Funds and Average Annual Amounts

Intergovernmental Revenue (such as Medi-Cal or Mental Health Services Act funds)—$187.4 million

Tax Revenue (such as property and sales taxes)—$98.7 million

Other (such as fines or license fees)—$32.5 million

Source: Mendocino’s Annual Comprehensive Financial Report (ACFR) for fiscal years 2019–20 through 2023–24.

Figure 2

Mendocino’s Tax Revenue Remained Generally Consistent From Fiscal Years

2019–20 Through 2023–24

This figure shows a line graph with five lines representing different tax revenue trends at Mendocino County. The first line is Mendocino County’s total tax revenue, which has stayed generally flat from fiscal year 2019–20 to fiscal year 2023–24, rising from about $90 million to $105 million.

The total tax revenue is made up of four categories of tax revenue: Property Tax Revenue, Sales and Use Tax Revenue, Transient Occupancy Tax Revenue and Other Tax Revenue. These lines are shown below the total tax revenue line.

Property Tax Revenue, which makes up the majority of total tax revenue, rises from about $50 million to $65 million between fiscal year 2019–20 and fiscal year 2023–24. The line is generally steady except for a spike between fiscal year 2022–23 and fiscal 2023–24.

The second largest tax revenue type is Sales and Use Tax Revenue, which increased from about $25 million to $30 million between fiscal year 2019–20 and fiscal year 2023–24.

Transient Occupancy Tax makes up the third largest category and increased from around $5 million to $10 million between fiscal year 2019–20 and fiscal year 2023–24.

All other remaining tax revenue decreases from about $6 million to $2 million between fiscal year 2019–20 and fiscal year 2023–24.

Source: Mendocino’s audited financial statements.

During our audit period, Mendocino experienced the highest tax revenue growth in its property taxes. This revenue increased by about $11.5 million in fiscal year 2023–24, as Figure 2 shows. When we asked Mendocino’s acting assistant CEO (assistant CEO) about this increase, she explained that it was partially a result of the county’s concerted effort to collect supplemental property taxes because the county had a backlog of these tax bills. We discuss the county’s trouble with timely property tax collection in the next section. This effort caused the county to record a larger amount of revenue in fiscal year 2023–24. However, Mendocino has not projected that property tax revenue will continue to grow at this pace. When the county adopted its fiscal year 2025–26 budget, it projected that property tax receipts for fiscal year 2025–26 would be about the same as in fiscal year 2023–24.

The second significant trend Mendocino faces is the growth of its expenditures, which are increasing at a faster rate than its revenue. The county’s total revenue from all sources across all governmental funds—not only tax revenue—increased by 25 percent during the years we examined. However, expenditures from those same funds increased by 44 percent, or nearly twice as much as its revenue growth.

To review this trend more closely, we examined the change in revenue and expenditures within the county’s general fund. The general fund is the primary operating fund of the county and funds the county’s core services such as public safety and assistance. Although the county maintains other funds for specialized purposes, the general fund is the largest of the county’s governmental funds, accounting for more than half of the county’s revenue and expenditures from all governmental funds. As Figure 3 shows, revenue and all other funding flowing into the general fund increased by a total of about 20 percent, or about $43 million, during our audit period. However, over the same period, expenditures and all other funding flowing out of the general fund grew by 32 percent, or about $60 million.1

Figure 3

Mendocino’s General Fund Expenditures Increased Faster Than Its Revenue From Fiscal Years 2019–20 Through 2023–24

The graph shows two lines, one showing the changes in General Fund Revenue between fiscal year 2019–20 and fiscal year 2023–24 and the other showing changes in General Fund Expenditure between fiscal year 2019–20 and fiscal year 2023–24.

To the side of the line graph, the total growth of the two lines is shown. General Fund Revenue grew by 20% between fiscal year 2019–20 and fiscal year 2023–24 and General Fund Expenditure grew by 32% during the same period.

The graph shows that General Fund Expenditures and Revenues generally increased at a steady rate, but that General Fund Expenditures have grown faster than General Fund Revenues. The General Fund Revenue line spikes from fiscal year 2021–22 to fiscal year 2022–23, from about $215 million to $255 million. The reason for this spike is explained in the report text.

Source: Mendocino’s audited financial statements.

Note: We calculated general fund revenue by combining revenue and all other financing sources. We calculated general fund expenditures by combining expenditures and all other financing uses. Other financing uses in these fiscal years consisted only of transfers out of the general fund, and we concluded that the nature of Mendocino’s transfers out of the general fund was operational. Mendocino’s transfers were nearly entirely for the purpose of supporting its governmental activities, including debt service. The figure shows a substantial increase in revenue in fiscal year 2022–23. Mendocino’s assistant CEO explained that in that fiscal year the county changed how it accounted for state provided realignment funding and expressed her belief that the significant rise in general fund revenue in this fiscal year was primarily because of the county’s change in accounting method. Accordingly, the increase in revenue does not represent a substantial change to the total funding flowing into the county, but rather reflects a change to the county’s approach to accounting for these funds.

Although Figure 3 shows that Mendocino saw a significant bump in revenue of about $37 million from fiscal years 2021–22 to 2022–23, this increase was largely because of a change in accounting method. Mendocino’s assistant CEO explained that the county began accounting for state realignment funding differently in fiscal year 2022–23 and expressed her belief that the significant rise in general fund revenue in fiscal year 2022–23 was primarily because of the county’s change in accounting methods and not because of new revenue. Mendocino has kept its total general fund expenditures below revenue in most of the years we examined. However, if the trends we observed continue, that will no longer be the case, and Mendocino will need to determine whether it should cut service levels to match its revenue.

A significant factor in the county’s growing expenditures is the increase in the amount it spends on personnel. The amount the county spent from its general fund on personnel increased about $25.4 million, from $110.3 million in fiscal year 2019–20 to $135.7 million in fiscal year 2023–24, accounting for 57 percent of the total increase in general fund spending.2

Actions Mendocino took in recent years will cause continued upward pressure on its personnel costs. In late 2023 and early 2024, the county approved salary increases for many of the bargaining units representing its employees that would be phased in over a three-year period. These increases were generally linked to a market study the county performed to assess the amount to pay its employees. The results of the market study varied by position classification. For certain positions, the study identified that the county’s existing salaries were comparable to the market rate. In other instances, the study concluded that the county would need to pay some positions more than their current rate to equal the market. In some cases, the increase was greater than 10 percent. On average, the increase in wages needed to pay market rates throughout the county was about 4 percent. The information the county provided to us about its agreements with many of the bargaining units shows that the county agreed to increase salaries during a three-year period so that they are equal to or greater than the rates found by its market study by the end of the third year. We identified that these increases began to take effect in the final fiscal year we reviewed—fiscal year 2023–24—but their full impact will not be seen until the end of fiscal year 2025–26.

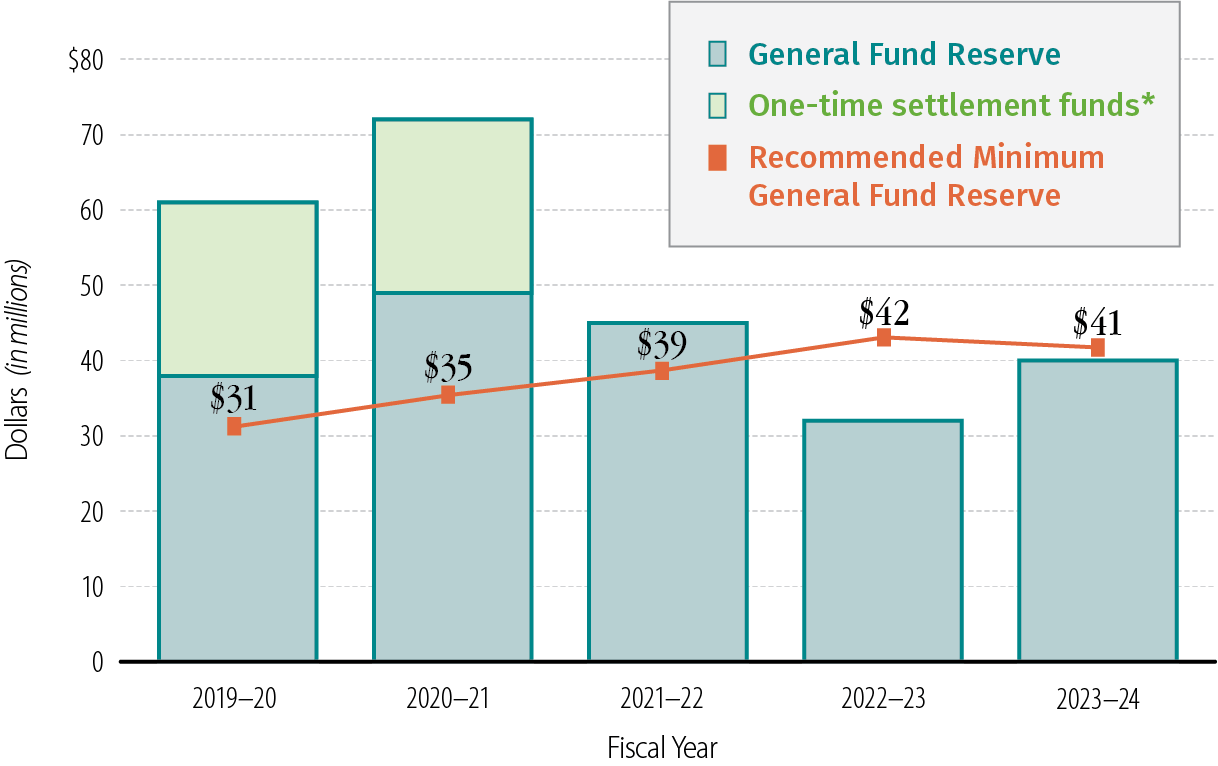

The final significant trend is the decline in the county’s general fund reserve. As we explain in the Introduction, the Government Finance Officers Association (GFOA) recommends that general purpose governments, such as Mendocino, maintain a general fund reserve equal to at least two months of general operating revenue or expenditures. The county’s reserve policy specifies that the county will maintain a general fund reserve of at least $10 million or 6.35 percent of the previous year’s general fund expenditures. The county tracks this reserve in a dedicated account, and as of June 2024, the balance of that account was $10.3 million. However, Mendocino has additional unrestricted funds reported in its financial statements as being in its general fund that it could access if needed, and we include those in our assessment of its general fund reserve. Specifically, we defined Mendocino’s unrestricted general fund reserve as equivalent to its unrestricted general fund balance. Nevertheless, even with our more expansive definition of the county’s general fund reserve, the county’s available funds fall just short of the GFOA recommended minimum, as Figure 4 shows.

Figure 4

Mendocino’s General Fund Reserve Fell Below the GFOA’s Recommended Minimum Amount in Recent Years

The bar graph shows five bars for each fiscal year between 2019–20 and fiscal year 2023–24. These bars show the county’s total general fund reserves for each fiscal year, and show that these reserves have generally declined from fiscal year 2019–20 to 2023–24. The first two bars (fiscal year 2019–20 and fiscal year 2020–21) are made up of both general fund reserves and one time settlement funds, while the bars representing the remaining years are comprised solely of general fund reserves. For the first two bars, one-time settlement funds comprise about one-third of the total reserves.

In addition to the bars, the figure shows a line representing the Government Finance Officer’s Association recommended minimum reserve amount, which is calculated based on Mendocino’s expenditure level for each fiscal year. From fiscal year 2019–20 to 2023–24, the amount is calculated as $31 million, $35 million, $39 million, $42 million, and $41 million.

The figure shows that Mendocino’s general fund reserves were above the recommended amount for fiscal years 2019–20, 2020–21, and 2021–22. Mendocino’s general fund reserves were below the recommended amount for fiscal years 2022–23 and 2023–24.

Source: Mendocino’s audited financial statements.

Note: We calculated the recommended minimum general fund reserve amount by using the GFOA’s recommended minimum for general purpose government reserves of two months of expenditures. We calculated expenditures by including all general fund expenditures and all other uses of financing from the general fund. The general fund reserve shown in the figure includes all unrestricted funds as reported in Mendocino’s audited financial statements.

* Mendocino continued to hold about $670,000 in one-time settlement funds in fiscal years 2021–22 through 2023–24 that we do not depict in this figure for those years due to its scale.

We can attribute most of the reduction in Mendocino’s reserve over time to a $22 million settlement Mendocino received from the Pacific Gas & Electric Company following the 2017 wildfires in the county. Mendocino recorded this funding in its financial statements for fiscal year 2019–20. Over the next two fiscal years, Mendocino moved more than $21 million of this funding from its reserve to be used by county departments and various districts in the county for a variety of projects, which caused its general fund reserve to decline significantly by the end of fiscal year 2021–22. However, the receipt and distribution of the settlement funding only partially explains the trend in Mendocino’s reserve. Mendocino has also used $4.5 million from its reserve to help finance expansion of its county jail and transferred $1.2 million to help provide increases in employee salaries and benefits in fiscal year 2022–23. The assistant CEO stated that in fiscal year 2024–25, the county repaid the funding it used to help finance the county jail’s construction.

Mendocino’s reserve policy is outdated and is not effective for guiding the county in its future consideration of how much to keep in reserve for unexpected circumstances. The county last updated its reserve policy in April 2012. Although the policy refers to GFOA’s guidance as a reference for setting the county’s reserve target, the policy refers to GFOA’s old guidance that GFOA has since replaced. The county’s policy continues to cite the GFOA’s recommended reserve level as between 5 and 15 percent of annual revenue or one to two months of expenditures, when in fact the GFOA has since changed this recommendation to be about 17 percent of revenue or expenditures. Further, the policy sets the county’s actual reserve target at an amount equal to the greater of $10 million or 6.35 percent of the county’s general fund expenditures in the previous fiscal year, an amount well below GFOA’s recommended minimum. Therefore, amendments to the county’s reserve policy are overdue and necessary to assist the county in determining the future actions it needs to take. At a minimum, the county should revise its policy in light of its current fiscal constraints, the instability of some of its funding sources, and the likelihood of unplanned expenditures and establish a reserve target at least at the GFOA recommendation of a minimum of two months of expenditures or revenue.

Mendocino Has Not Assessed Properties and Collected Property Tax Revenue in a Timely Manner

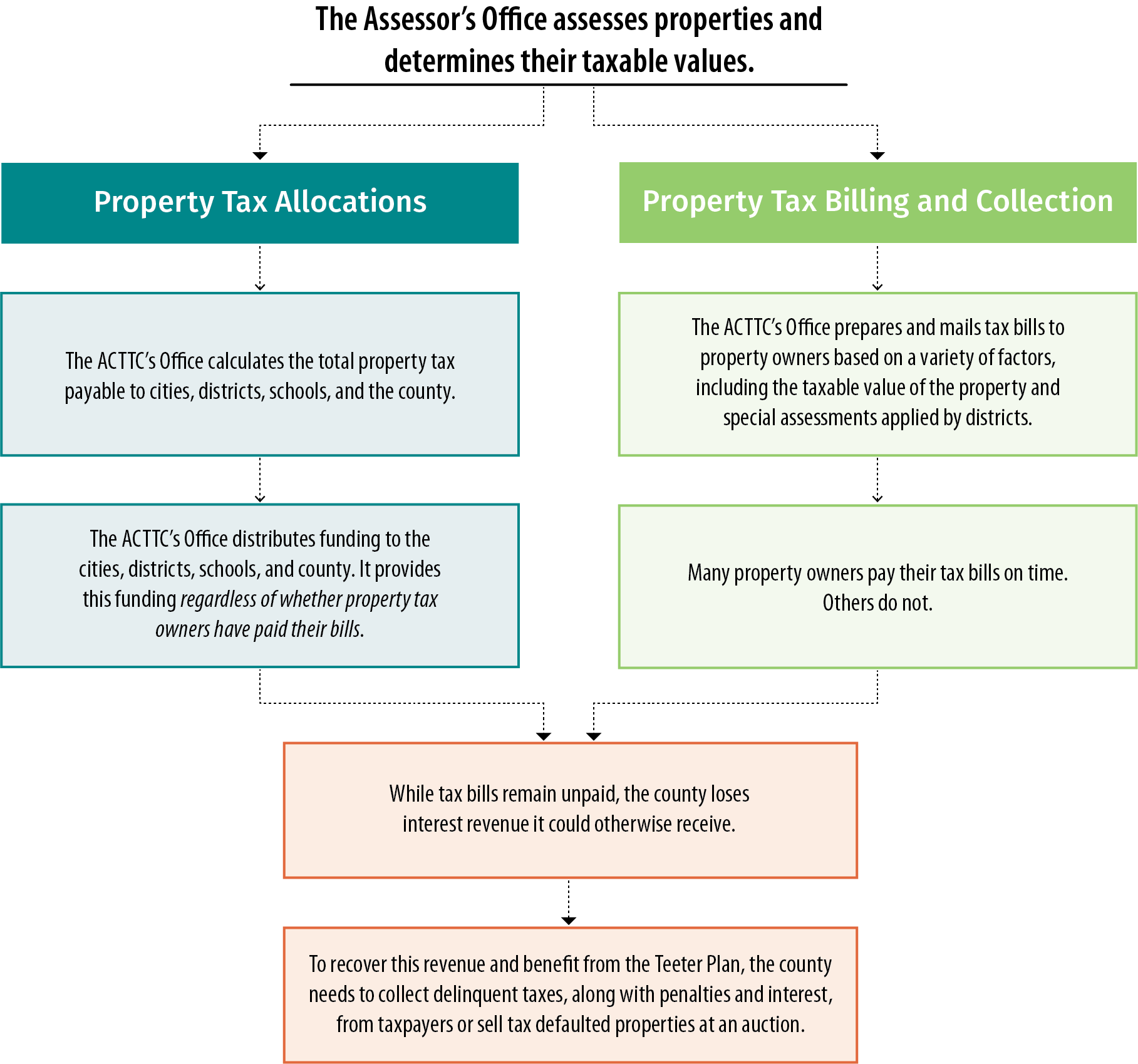

As we indicate in the previous section, the county depends on property tax revenue to support a significant portion of its operations. Two entities in the county collaborate to ensure that the county collects the appropriate amount of property tax revenue: the Assessor-Clerk-Recorder’s Office (Assessor’s Office), and the Auditor‑Controller-Treasurer-Tax Collector’s Office (ACTTC’s Office). Figure 5 shows Mendocino’s process for determining the amount of property taxes owed by property owners, collecting these payments, and distributing property tax funding to recipients throughout the county.

Figure 5

Mendocino’s Property Tax Process Involves Two Departments and Provides Funding to Governments Throughout the County

The flowchart starts with a first step of the Assessor’s Office assessing properties and determining their taxable value.

The flowchart then divides into two separate branches, indicating activities that happen concurrently with each other: 1) property tax allocations and 2) property tax billion and collection.

The first branch (property tax allocations) shows that the ACTTC’s office calculates the total property tax owed to cities, districts, schools and the county and then distributes funding to the cities, districts, schools and county. Crucially, it provides this funding regardless of whether property tax owners have paid their bills.

The second branch (property tax billing and collection) shows that, concurrently with the steps described previously, the ACTTC’s office also prepares and mails tax bills to the property owners based on a variety of factors, including the taxable value of the property and any special assessments applied by districts. While many property owners pay these tax bills on time, others do not.

The flowchart then converges to describe the effects of delayed tax collection. While tax bills remain unpaid the county loses interest revenue it could otherwise receive. To recover this revenue and benefit from the Teeter Plan, the county needs to collect delinquent taxes, along with penalties and interest from tax payers or sell tax defaulted properties at auction.

Source: State law, Mendocino’s ACFR, budget book, website, and tax revenue information.

California provides counties with different options for collecting and distributing revenue from property taxes. Mendocino has chosen to use the Teeter Plan. Under the Teeter Plan, Mendocino allocates property tax funding from a dedicated property tax fund to participating entities, such as schools and the county general fund, regardless of its actual receipt of property tax payments. The county then subsequently collects property tax payments and any late-payment penalties that taxpayers owe. Property tax payments, including those that are delinquent, are required to be deposited to the same property tax fund that the county used to provide allocations to participating entities. Because Mendocino provides property tax allocations before it collects property tax payments, the county must collect those payments in a timely fashion, or it risks forgoing interest income that it otherwise would have gained. If the county cannot collect tax payments, along with penalties and interest from delinquent tax bills, the county is able to recover the property tax revenue through an auction of defaulted properties. The county may succeed in recovering its revenue through an auction, or it may need to sell properties at a loss.

To facilitate its property tax assessment and collection process, Mendocino relies on software that serves as its central system for assessing the value of properties, calculating the amount of property taxes owed, and processing property tax bills (property tax system). In 2015, the county entered into an agreement with a vendor to obtain a property tax system to replace the system it was using at that time. Mendocino’s deputy CEO indicated that concerns over the long-term application and support of its previous system—which had minimal control over data integrity—led to the county’s decision to procure a new system. In early 2021, the county completed its conversion to the new system. However, Mendocino has since faced several problems using the new system that have contributed to delays in the receipt of property tax payments.3 As we explain later, the county must collect more than $30 million in unpaid property taxes, penalties, interest, and fees related to properties in default status.

Mendocino’s struggles with its new property tax system began shortly after the county started using it. To properly assess the taxable value of a property, the county needs to know specific information about it, such as the size of the land and the improvements made to the property. According to staff in the Assessor’s Office and the ACTTC’s Office, the information about some properties was not transferred properly to the county’s new property tax system, and the deputy CEO further explained that the integrity of the previous system’s data contributed to these errors. The county shared examples of these problems in the form of support tickets that it had submitted to its vendor.4 In one example, the county raised concerns that information about the land or improvements was completely missing for some properties. The vendor subsequently identified eight properties that were missing such information. In another case, the county identified that information about the size of the land for about 1,000 properties did not match the information in the county’s old system. The vendor’s staff determined that the vendor could automatically fix the information for about 200 of these properties, but Mendocino’s staff would need to manually correct the remaining 800.

Staff in the Assessor’s Office and the ACTTC’s Office provided examples of other problems that have affected their ability to assess property values and issue correct tax bills promptly. For example, the property tax system calculated incorrect tax bills, in some cases doubling the tax rate or the amount owed on select property tax bills. In some of these cases, owners had already paid the incorrect bill before the county could address the issue. County staff told us that there had been no evidence of the issue recurring and explained that, for one batch of incorrect bills, including those that some owners had paid, they reprocessed the bills in November 2025. In another example, specific to certain types of property tax bills, the property tax system did not identify the correct owner and instead generated bills to the wrong owner. Support tickets show that the county had raised this issue in various forms with the vendor at least three times. The county’s assistant treasurer-tax collector stated that this issue was resolved in October 2025.

Staff who administer property taxes explained that the problems they have encountered with the property tax system have slowed their ability to complete their work. Although the county adopted its system in early 2021, Assessor’s Office staff told us in 2025 that they must still manually input or correct property information when conducting assessments. One staff member stated that he has had to input information for nearly every parcel he has reviewed in the past four years. The assistant treasurer-tax collector similarly asserted that the unreliable data have resulted in delays to the county’s property tax process. One staff member told us that he spends approximately 30 percent to 50 percent of his time each week troubleshooting issues within the system, and the assistant treasurer-tax collector told us that she has a staff person whose time is almost entirely dedicated to analyzing issues and resolving fixes within the system.

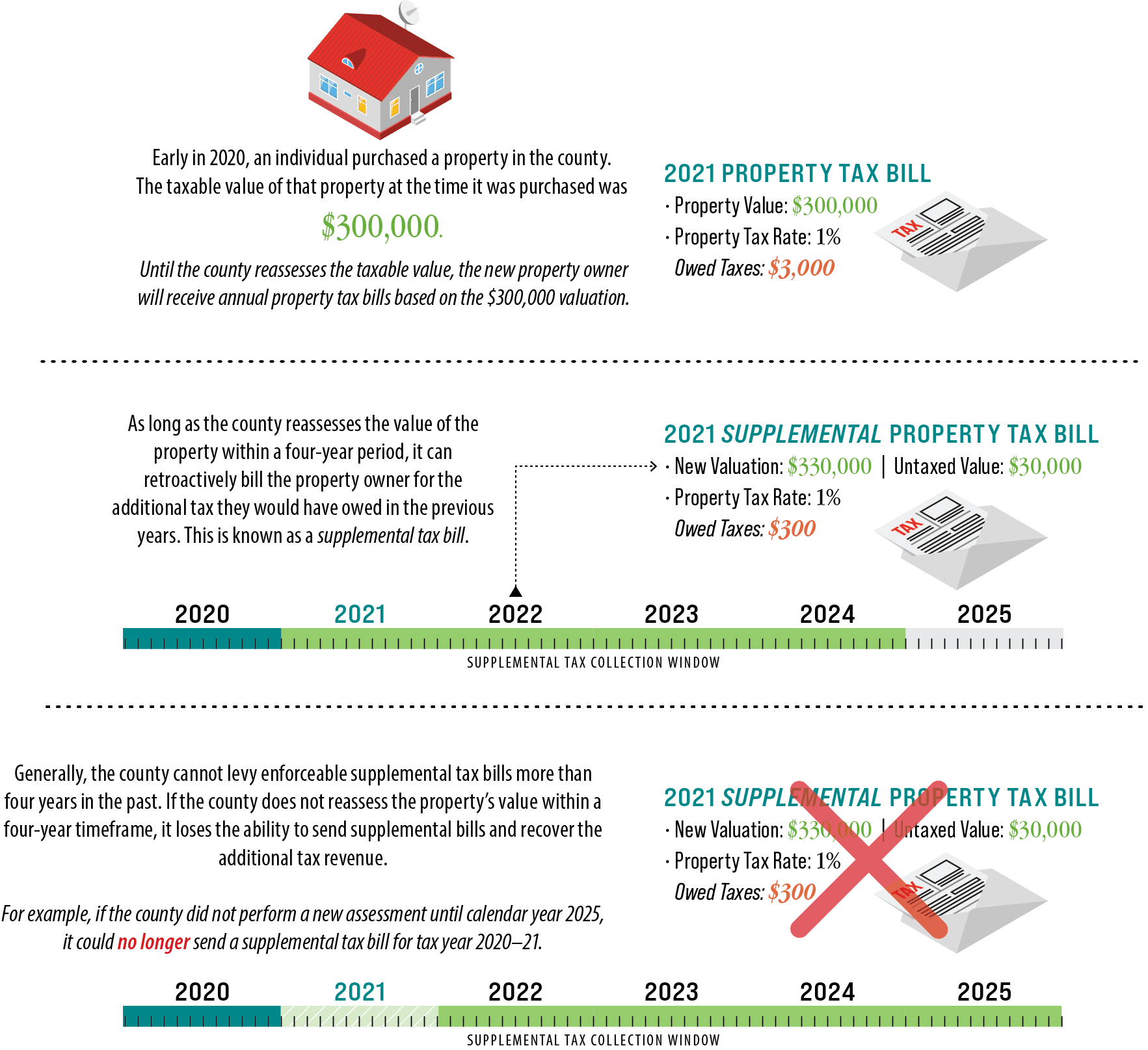

The county’s issues with its property tax system have contributed to untimely assessments of properties to determine their taxable value and to uncollected past due taxes. As Figure 6 shows, the county generally has only four years to assess a property’s value after certain qualifying events—such as the sale of the property to a new owner—before it risks losing revenue.

Figure 6

Mendocino Generally Has a Deadline of Four Years to Levy Supplemental Tax Bills

The figure creates a hypothetical scenario where an individual purchased a property worth $300,000 in 2020. Until the value of the property is reassessed, the new property owner will receive property tax payments based on this $300,000 value. If the property tax rate was 1%, they would owe $3,000 the year they purchased the property.

As long as the county reassesses the value of the property within a four-year period, it can retroactively bill the property owner for the additional tax they would have owed in the previous years. This is known as a supplemental tax bill.

If the county were to reassess the $300,000 property as being worth $330,000 after the individual purchased it, there would be untaxed value of $30,000 that the county could collect via a supplemental property tax bill. Given the 1% property tax rate from the hypothetical, this would mean the individual would owe another $300 on top of the original $3,000 paid.

The county cannot levy enforceable supplemental tax bills more than four years in the past. If the county does not reassess the property’s value within a four-year timeframe, it loses the ability to send supplemental bills and recover the additional tax revenue.

For example, in the hypothetical scenario being described, if the county did not perform a new assessment until calendar year 2025, it could no longer send a supplemental tax bill for tax year 2020–21.

Source: State law as applied to a hypothetical example.

We asked the county whether it has taken longer than four years to complete assessments, but the county was unable to provide an answer based on data from its property tax system. The county provided us with workload reports showing that its staff had more than 7,300 assessments to perform. However, after meeting with the county’s staff and comparing information in these reports to other information in the county’s property tax system, we determined that the workload reports could not tell us or the county how long these assessments had been pending completion. In other words, the reports the county can produce from its property tax system cannot help the county manage its workload in a strategic way. In the absence of being able to rely on more useful reports from the system, the assistant assessor provided examples of annotated work reports some staff create to triage their work, and the assistant assessor explained that other staff just work their assigned items in batches.

Although the county was unable to provide reliable data showing how many properties are at risk of not being appraised before the four-year deadline, the assistant assessor explained her belief that there are assessments that are past the four-year period, meaning that it is too late for the county to collect some of the tax revenue from those properties. The lack of reliable information about the workload the county faces is a significant hinderance to its ability to strategically manage its property tax assessments. The assessor shared with us that after meeting with us about this issue, another county contacted Mendocino and shared a reporting tool that the Assessor’s Office is planning to explore using to better manage its workflow. As of the conclusion of our audit, the Assessor’s Office was planning on implementing this tool sometime in 2026.

In addition to struggles with the property tax system, the assistant assessor explained that staffing challenges have contributed to the county’s delays in completing assessments. Specifically, she cited the loss of 10 assessment staff before the county converted to its new property tax system. She stated that the county went from 12 assessment staff to only two for a variety of reasons, including resistance to the new property tax system, but that the office since increased its size to 11 staff.

Compounding these problems, the assistant treasurer-tax collector indicated that the issues with the property tax system have distracted efforts to collect past due taxes from property owners. The list of properties in default status as of December 2025 that the county provided to us identifies that taxpayers owed $30.6 million in uncollected property taxes, penalties, interest, and fees pertaining to about 4,200 properties. $17.5 million of this owed amount was attributable to tax years 2023 through 2025. The assistant treasurer‑tax collector explained that she and her staff spend time developing solutions to issues with the property tax system, and that issues related to the property tax system cause delays to billings, payment plans, and other tasks. We noted that data published by the State Controller’s Office (SCO) demonstrates that Mendocino has had declining property tax receipts when compared to the total taxes charged over the last few fiscal years. Specifically, the county received 97.7 percent of the tax revenue it charged in fiscal year 2021–22 within that fiscal year, but that percentage declined in the following years, reaching 94.3 percent in fiscal year 2023–24.

The county could hold a property tax auction, at which it could auction off defaulted properties, to help recover some of its uncollected property tax revenue. In fact, state law requires county tax collectors to attempt to sell properties that are in tax default for a period of five years or more, or three years or more in the case of nonresidential commercial properties. However, as of November 2025, Mendocino had not held an auction since June 2019, which has been the longest period without an auction among all counties in California except for one other according to publicly available information about each county in the State.

When we asked the ACTTC and the assistant treasurer-tax collector why the county had not held an auction in recent years, they cited the COVID-19 pandemic, and the ACTTC explained that the county lost staff who were knowledgeable about conducting auctions. The assistant treasurer-tax collector also explained that concerns about the reliability of the property tax system’s data have delayed the county’s efforts to hold an auction. She stated that experiencing and addressing issues in the property tax system takes time, and the county must research each defaulted property individually to ensure that it has met all mandatory requirements needed to auction the property.

Nonetheless, Mendocino has begun to take steps to hold a property tax auction and expects it may do so by October 2026. For example, the ACTTC told us her office recently hired a position to research and familiarize themselves with the auction process. Additionally, the assistant treasurer-tax collector provided a timeline she created showing the steps the county must complete before conducting an auction, such as receiving board approval for the sale of properties. Although this timeline plans for the county to hold the auction in October 2026, the assistant treasurer-tax collector indicated that delays could push the actual date back to June 2027. Given the amount of time that has passed since Mendocino’s last property tax auction, we believe the county should continue taking the steps necessary to meet its target date of October 2026 and, if it encounters further barriers that result in delays, consider using an external contractor to assist in its efforts to hold the auction.

In addition to conducting a property tax auction, the county could benefit from creating its own written policies and procedures for conducting property assessments. The Assessor’s Office confirmed that it does not have such policies and procedures, although staff we spoke with stated that their creation would help decrease the county’s workload and reduce delays. Although the assessor and the assistant assessor told us that the Assessor’s Office plans to address the lack of policies and procedures when it has time, they also mentioned that they were not sure when they will do so. According to the office’s leadership, the office’s priority is entering and correcting property characteristics into the property tax system so the county can continue to collect property tax revenue. We acknowledge the importance of having correct information within its property tax system. However, the county’s overall effectiveness in performing property tax-related tasks would benefit from the establishment of consistent expectations and standards for how staff perform their work.

To Address Its Budget Deficit, Mendocino Will Need to Consider Increasing Revenue and Further Cutting Its Expenditures

Mendocino has had a persistent budget deficit that presents a challenge the county has not yet fully addressed. Specifically, for the past three fiscal years, Mendocino has faced increasing budget deficits ranging from $6.4 million in fiscal year 2023–24 to $17.8 million in fiscal year 2025–26. In response, Mendocino had planned to use one-time funding and defer costs, among other budgetary assumptions, to ensure that it adopted a balanced budget as state law requires. For example, to address a portion of its 2024–25 budget deficit, Mendocino planned to defer $1.2 million in information technology related costs and draw $3.3 million from funding it had set aside to respond to potential adjustments to retirement costs that it may need to make.

Although Mendocino has not needed to use some of these measures, the county remains at risk of having to do so in the future. Mendocino has not needed to draw from some one‑time funding sources it had budgeted for, such as the retirement funding described above. However, at the time the chief executive officer’s (CEO) office proposed the county’s budget for fiscal year 2025–26, the county projected it would have a general fund budget deficit of about $16 million in fiscal year 2026–27.5 Accordingly, the county will again need to consider how to close its deficit, including whether it needs to make spending cuts that could be detrimental to its services.

Many of the steps the county has taken to date to address its budget deficit have been attempts to control its costs. As part of its normal budget process, departments make annual budget proposals from which the county subsequently eliminates millions of dollars to align planned revenue and expenditures. Further, according to the testimony the CEO provided to the board in June 2025, the county has a backlog of deferred maintenance of about $8 million. In its budget for fiscal year 2024–25, the county noted that its facilities were in need of attention in its next capital improvement plan because they had reached critical stages and needed significant reinvestment in systems and structures. The county has also instituted what it calls a “strategic hiring process” that will limit how easily departments can fill vacant positions, and it has offered employees an incentive to resign from county employment—two measures that the county expects to result in cost savings.

However, key cost savings measures the county has used are temporary in nature or could ultimately result in increased costs in the future. For example, offering incentives to employees to separate from county employment and pausing non-essential hiring delay spending that will eventually occur if the county finds that it cannot operate effectively without filling those vacancies. Further, delayed maintenance on county assets or equipment will not necessarily result in long-term cost savings. A potential outcome is that the necessary maintenance will cost more if the county performs it behind schedule because of the worsened condition of the asset or equipment or increases to the price of repairs. To reset its base level of spending and truly affect the rate of growth in its expenditures, the county must consider ending some services or operations.

Although the county will likely need to continue to examine its spending to determine other areas in which it can achieve savings, we believe that it will also need to consider solutions that would increase its revenue. Mendocino’s sales tax rate is 7.875 percent, and it has a transient occupancy tax of 10 percent. Both rates place Mendocino near the middle of a group of 12 northern counties that we reviewed. We believe that the county will struggle to address its long-term fiscal instability without considering and applying revenue generating solutions such as, but not limited to, raising its tax rates to increase tax revenue.

Mendocino faces a persistent deficit that is unlikely to change without further strategic action. We acknowledge the board’s decision to employ a strategic hiring process, in which departments that want to fill vacant positions must first obtain board approval, as a significant step toward trying to manage county costs. However, the county cannot close its budget deficit solely through this one action. Until the county takes more comprehensive action to structurally balance its budget—such as expenditure reductions by ending or pausing certain operations or revenue increases through raising tax rates—the county will face annual uncertainty about the level of services it can provide to its residents. Accordingly, it would be in the county’s best interest to begin engaging with its residents—through a variety of approaches such as town hall meetings or surveys—about both revenue- and expenditure-related solutions to its fiscal problems.

Recommendations

To ensure that it maintains a reserve balance sufficient to facilitate its operations during emergencies and serve as a buffer during economic downturns, the county should, before its board adopts its 2026–27 budget, revise its policy on its general fund reserve to incorporate a new target reserve level. In doing so, the county should consider the stability of its revenue sources, the likelihood of unexpected expenditures, and the guidance published by the GFOA. At a minimum, the county’s new reserve level should be no less than the minimum recommended by the GFOA of two months of expenditures.

To ensure that the county does not lose property tax revenue because of delayed assessments, the Assessor’s Office should, by March 2026, develop tools such as aging reports showing the length of time since qualifying events, to assist in the management of its assessment workloads. These tools should, at a minimum, allow staff and managers to identify which properties are at highest risk for lost property tax revenue if the county does not assess them in a timely fashion.

To recoup unpaid property tax payments to the degree possible, the ACTTC should continue to take steps to resume holding regular default tax property auctions by October 2026. If the ACTTC’s Office needs external assistance to hold the auction on time, it should obtain such assistance.

To ensure its staff’s ability to appropriately and efficiently resolve issues with its property tax system, the Assessor’s Office should, by June 2026, document clear policies and procedures pertaining to property tax assessments and the management of property tax-related information in its system.

To ensure that it addresses its persistent budget deficit, the board should, by March 2026, create a schedule outlining the steps it will take to address its stagnant tax revenue and increasing expenditures. This schedule should include board meetings or town halls with the express purpose of discussing the spending areas the county wishes to prioritize for reduction and options for the county to increase revenue, such as by increasing tax rates. The board’s goal should be for the 2026–27 budget it adopts to reflect the results of this process to the maximum extent possible.

The County’s Procurement and Financial Reporting Processes Leave It Vulnerable to Waste, Fraud, and Abuse of Public Funds

Key Points

- We found problems with the supporting documentation for nearly half of the 30 expenditures we reviewed. Specifically, we noted that county departments did not consistently obtain required approvals for purchases, such as purchases from online retailers, or document the reasons for purchases, such as for a television, making it unclear if they were made for justifiable reasons.

- Mendocino has not exercised adequate oversight of the Sheriff’s Office’s and District Attorney’s Office’s use of asset forfeiture funds. We found that each office made donations to private entities without adequate safeguards, had violated prohibitions against direct funding of religious organizations, and that the District Attorney’s Office made a gift of public funds by spending $3,600 on an end-of-year gathering and dinner event for its staff and their guests.

- County departments have not justified their use of sole-source agreements for services. Of the 20 sole-source agreements we reviewed, 14 did not have justifications that adequately explained why a sole-source procurement was necessary. Also, the county has split contract agreements over multiple years and therefore has not had to seek competitive bids or board approval of certain agreements. For example, the county executed four separate one-year agreements, each for $25,000, with the same vendor for the same services. Had the county combined these procurements into a single agreement, it would have required board approval.

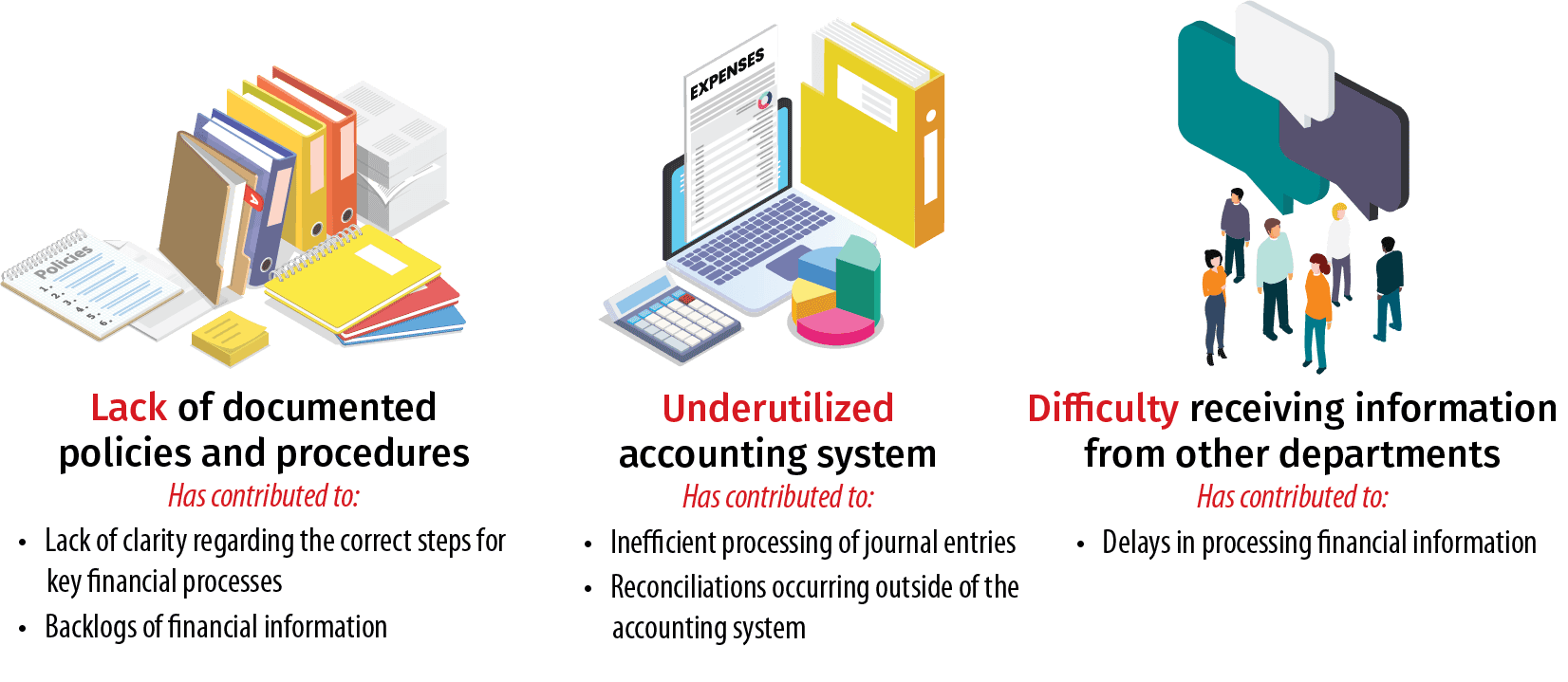

- The ACTTC’s Office has not ensured that the county’s financial statements are audited and published in a timely manner and must still take corrective actions to address deficiencies in its procedures and practices that previous reviews have highlighted as problematic, such as the absence of policies directing staff to reconcile bank records.

Mendocino Has Weak Processes for Ensuring That Department Purchases Are Necessary and Appropriate

Documenting and adhering to clear policies and procedures for spending funds are critical steps a public entity must take to effectively guard against waste, fraud, and abuse. Such policies and procedures should establish clear rules for who can spend funds, who must approve these expenditures, and the documentation that the entity will keep to demonstrate that its spending is appropriate. To establish such a system of safeguards, public entities can consult a variety of sources of best practices, including the GFOA and the U.S. Government Accountability Office.

Mendocino has two primary policies that address expenditures of county funds. The first relates to the acquisition of goods and services. Mendocino has established a single policy governing purchasing, leasing, and contracting, as well as a set of guidelines that further define the county’s related processes. These documents establish the various mechanisms by which the county’s staff can make purchases, such as using county issued purchase cards (p-cards). They also create spending limits for the different purchasing mechanisms and describe who is involved in the review and approval of specific types of purchases. The second main policy relates to how the county will pay for travel- and meal-related costs pertaining to county business. Like the parameters established by the purchasing policy, the travel and meals policy creates rules governing when travel is reimbursable, what meals will be paid for during county travel and other functions, and the processes for getting travel and travel-related costs approved.

To review Mendocino’s adherence to its expenditure policies and assess its vulnerability to waste, fraud, and abuse, we reviewed a selection of a total of 30 expenditures made by three county departments from fiscal year 2020–21 through fiscal year 2024–25. These departments were the Mendocino County Department of Social Services (Social Services), the Mendocino County District Attorney’s Office (District Attorney’s Office), and the Mendocino County Sheriff’s Office (Sheriff’s Office). We reviewed expenditures from Social Services and from the Sheriff’s Office because they were among the largest in the county’s budget and, in the case of the District Attorney’s Office and the Sheriff’s Office, we reviewed these offices because they do not report to the CEO.

We focused our selection on expenditures that each department made within its delegated purchasing authority or as part of travel. Specifically, we judgmentally selected 10 expenditures each department’s staff made using p-cards, as a part of travel, or through purchase orders. P-card and purchase order purchases are expenditures departments can make with less scrutiny by external reviewers or approvers, such as the CEO’s Office or board. By their nature, these types of expenditures individually are small dollar amount transactions compared to other expenditures the county makes. However, we focused our review on these expenditures because of our determination that the control environment made them more susceptible to waste, fraud, or abuse of public funds. These expenditures were also relatively common occurrences. For example, the p-card and travel expenditure data we obtained showed that these three departments spent at least $2.5 million through 9,800 purchases over the five-year period we reviewed. In addition, we selected expenditures when the nature of the expenditures made them higher-risk in our professional judgment. For example, we selected travel-related expenditures incurred by county employees and expenditures from vendors that seemed different from a department’s normal spending patterns or that offered goods that seemed unrelated to the department’s general business needs.

Our review identified concerns in 13 of these 30 expenditures, which Table 1 lists. The problems we found reveal gaps in Mendocino’s oversight of spending that leave it vulnerable to waste, fraud, and abuse. The problematic expenditures generally had weaknesses in their supporting documentation or were missing required approvals. For example, Social Services spent about $500 at an online retailer. The expenditure approval form the county prepared for this purchase stated that it bought seat cushions for three employees. However, Social Services did not have an itemized receipt that confirmed what it actually purchased. Additionally, the approval form was missing one of the two required approval signatures. Although this purchase may have been reasonable and appropriate, the lack of documentation and approval raises concerns about the nature of the purchase and the potential misuse of public funds.

In two other examples totaling about $370, the county provided Sheriff’s Office employees with advance payments for travel expenses but could not show that it had later reconciled these payments to the employees’ actual travel costs. The county’s meal policy says that employees who receive an advance payment must provide receipts for their expenses within 30 days of the end of their trip. However, we did not see this happening in these two cases, which were the only travel advances we selected for review. For example, the Sheriff’s Office provided one of its staff with $200 in advance of a trip they were scheduled to take. The office calculated this amount using the maximum possible reimbursement for which the employee was eligible under the county meal policy. However, the Sheriff’s Office had no evidence that it had, after the trip, followed up to ensure that the employee had taken the trip and remained eligible for the costs for which the office had prepaid. If the Sheriff’s Office does not reconcile travel advances to the employees’ actual travel, it risks inappropriate payment to its employees.

In another example, the county did not maintain documentation that would ensure that it could demonstrate the reasonableness of its purchase. In this case, the District Attorney’s Office used a p-card to obtain a 75-inch television for $1,099. The corresponding documentation did not include a justification for the acquisition or indicate that any staff followed up with questions about this purchase when reviewing it. The District Attorney’s Office explained to us that the television was a replacement for a broken unit in its conference room—an explanation that we found reasonable. However, we would have expected the office to include that justification in the supporting documentation for the initial payment request, thereby reducing the risk that someone could make such a purchase for personal gain. Governments should guard against the public perception that employees are wastefully or fraudulently spending public funds by maintaining thorough documentation of the reasons for the purchases they make.

Our findings indicate that the county does not have an effective structure to fully document and approve delegated purchases. As a result, the county is unnecessarily vulnerable to wasteful, abusive, or fraudulent spending for these types of procurements.

We also determined that four of the expenditures we reviewed were questionable uses of public funds, and they all involved a source of funds known as asset forfeiture, which is a specialized funding source. Because of the nature of these expenses and Mendocino’s lack of oversight of them, we expanded our review to include 40 additional expenditures from this funding source. We describe our concerns about these expenditures and Mendocino’s oversight in the next section.

The County Lacks Adequate Controls to Ensure the Appropriate Use of Its Asset Forfeiture Funds

Both the Sheriff’s Office and the District Attorney’s Office receive and use asset forfeiture funding, which the text box defines. As of June 2025, these two offices collectively held about $1.5 million in asset forfeiture funding. These funds were funds seized under the parameters of California’s Uniform Controlled Substances Act (Substances Act).

Asset Forfeiture Funding

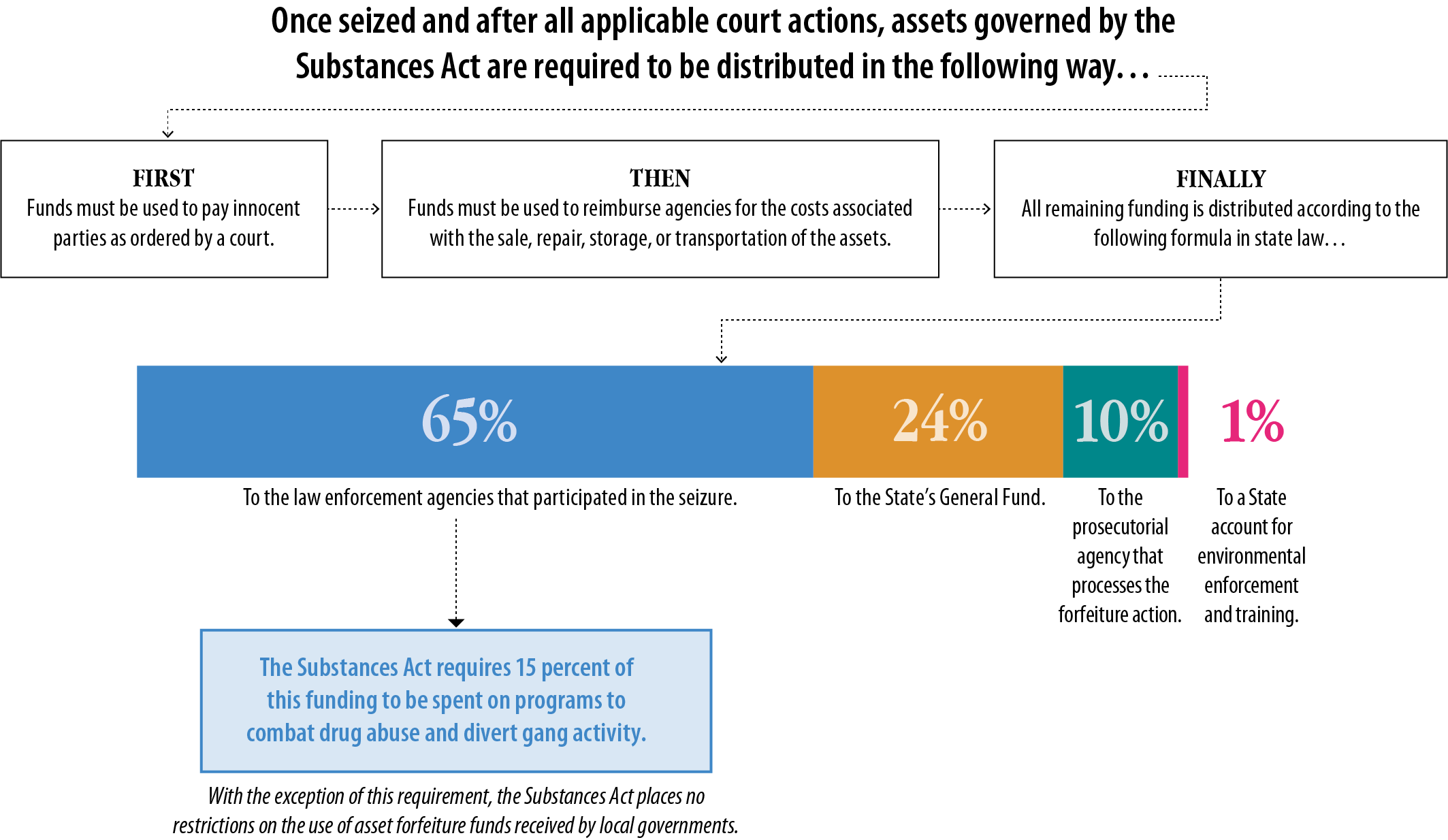

Asset forfeiture refers to cash, property, and other items associated with a criminal offense (assets) that the government seizes and liquidates. The net proceeds are distributed according to state law, as Figure 7 details.

Source: State law and a 2024 report from the Legislative Analyst’s Office.

Asset forfeiture funds are especially sensitive public funds for at least two reasons. The first is how the county comes to possess the funding. Unlike other government revenue, asset forfeiture funding derived from the Substances Act is the result of a seizure of someone’s property. The Substances Act establishes several safeguards over the seizure of assets, including that the principal objective is law enforcement, that seizing agencies must avoid the appearance of impropriety in the acquisition and sale of property, and that the potential for revenue must not jeopardize the due process rights of citizens. The GFOA recognizes that asset forfeiture funding is sensitive to public perceptions, noting that if seizing assets generates revenue for government agencies, those agencies have an incentive to seize more.

In addition, asset forfeiture funding is especially sensitive to public perception because the Substances Act places few restrictions on its use, as Figure 7 shows. The GFOA highlights that if the agencies that seize property get to use the funds in whatever way they want, it creates an incentive to seize additional assets. Thus, an agency’s appropriate use of asset forfeiture funding is critical to maintaining the public’s trust in government. Because of the sensitive nature of asset forfeiture funding, the GFOA recommends that governments adopt financial policies that define the proper use of these funds. However, Mendocino does not have a policy specifically about asset forfeiture funds and, aside from requiring fixed assets over $5,000 to be procured through the county’s requisition process regardless of funding source, its general purchasing policy does not specify any criteria particularly for asset forfeiture funds.

Figure 7

State Law Prescribes How Asset Forfeiture Funding Is Allocated

The figure shows how asset forfeiture funds are divided.

Once funds have been seized and any application court actions, assets governed by the substances act are required to be distributed by the following formula.

First, the funds must be used to pay innocent parties as ordered by a court.

Secondly, any remaining funds are used to reimburse agencies for the costs associated with the sale, repair, storage or transportation of the assets.

Finally, all funds that remain after the first and second payouts are distributed according to the following formula in state law.

65% of the remaining funds go to the law enforcement agencies that participated in the seizure. Of this 65%, 15% is required to be spent on programs to combat drug abuse and to divert gang activity. With the exception of this requirement, the substances act places no restrictions on the use of asset forfeiture funds received by local governments.

24% of the remaining funds go to the State’s General fund.

10% of the remaining funds go to the prosecutorial agency that processes the forfeiture action.

Finally, the last 1% goes to a State account for environmental enforcement and training.

Source: State law.

As we note in the previous section, four of the expenditures we determined were problematic were made with asset forfeiture funds. Because of these expenditures, the overall sensitive nature of these funds, and our assessment of the lack of controls related to these funds, we expanded our review of the Sheriff’s Office’s and District Attorney’s Office’s use of asset forfeiture funds. We randomly selected 20 additional expenditures from each office from July 2020 through June 2025. In total, from these 40 expenditures and the judgmentally selected expenditures we referred to in the previous section, our review included 22 asset forfeiture expenditures made by the Sheriff’s Office and 24 made by the District Attorney’s Office. Overall, our review found three main categories of expenditures.

More than half of the expenditures we reviewed from each office represented the category of purchases that appeared reasonably connected to the offices’ business needs. These included tactical gear for the Sheriff’s Office, office equipment for the District Attorney’s Office, and the publication of public announcements in connection with asset forfeiture activities. The county’s accounting system did not consistently include documented reasons for these purchases, with supporting documents sometimes being only an invoice for the purchase. However, we concluded from the nature of the expenditures and other supporting documents and explanations that the offices subsequently provided to us at our request that the expenditures were likely reasonable uses of the asset forfeiture funds.

The second category consisted of two expenditures made by the District Attorney’s Office that had questionable public value or connection to the office’s mission and purpose. The District Attorney’s Office spent more than $570 on 40 water bottles from the California District Attorneys Association and also purchased a satchel from an antique store for about $70. The documentation for these purchases did not convey what business or public purpose they served. When we asked the District Attorney’s Office about the satchel expenditure, it stated that the district attorney had made this purchase after finding the satchel at an antique store. The District Attorney’s Office explained that this was an evidence collection satchel that was embossed with the seal of a law enforcement department from Lake County. According to the District Attorney’s Office, the district attorney purchased the satchel because it should not be possessed by non-law enforcement personnel, and then he returned the item to the Lake County law enforcement agency. Despite this explanation, we question this purchase because it was not connected to an ongoing investigation or prosecution or for the benefit of the District Attorney’s Office or the citizens of Mendocino.

Finally, the third category of expenditures involved donations of asset forfeiture funding that the Sheriff’s Office and the District Attorney’s Office made to private entities, which Table 2 lists. Providing public funds to private organizations as donations raises questions about whether these public funds are being provided as a gift, which is prohibited under California’s constitution. In general, the distribution and use of public funds must be for a public purpose. We are concerned about these donations because they indicate that public funding is being provided to private entities with little oversight or accountability. In fact, none of the donations we reviewed appeared to place any restrictions on the recipient to use the donated funds for only specified public purposes. Further, the offices do not appear to have established certain safeguards that would protect the county from making a gift of public funds in the form of a donation.

Instead, we found procedural weaknesses in the way these offices made these donations. Both offices have an application form that they ask organizations that are seeking a donation to complete. The form requires prospective recipients to provide information such as the name of the organization and its tax-exempt status, a description of its purpose, specific details about why it is seeking a donation, and financial details. However, among the 10 total donations we reviewed as part of our selections, only four had substantively completed applications. The remainder did not include details about the organization, the organization’s financial information, or for three donations the application form did not exist. These inconsistencies indicate that the process for considering the applications is not rigorous or uniform.

Moreover, these donations were not considered and approved in a manner similar to other county awards. When a county department decides to execute a contract and provide funding to a vendor, the CEO and county counsel must also approve of the agreement. Additionally, for personal services contracts exceeding certain dollar thresholds, the contract award results from a review of proposals by an evaluation committee made up of more than one individual. Each of these steps ensures that no single individual controls who is awarded public funding. Although these donations were processed administratively like other county payments, neither the Sheriff’s Office nor the District Attorney’s Office could demonstrate that the donations resulted from a structured process like that used to award contracts. Instead, the evidence we reviewed indicated that the sheriff and the district attorney had decided on the recipient and amount for each of their respective donations.

Consequently, the offices lack safeguards to prevent donations that are motivated by political or personal financial interests. When we reviewed the campaign disclosures and personal financial interest disclosures that both the sheriff and the district attorney had filed with the county, we found no evidence that the donations we reviewed were connected to either the sheriff’s or the district attorney’s political or personal financial interests. However, in the absence of procedural safeguards, the offices risk such inappropriate activity.

Two donations we identified separately from our selected expenditures emphasize the importance of safeguards over the use of these funds. During our review of expenditure records, we found that the Sheriff’s Office and the District Attorney’s Office each made a $5,000 donation of asset forfeiture funds to a local religiously affiliated school in February 2024. We believe that these donations violated state and federal constitutional prohibitions on direct funding for religiously affiliated schools. The offices made these donations without conditions for how the school must use the funding, and they did not provide the funding to the school through an established governmental program. In effect, these donations were direct subsidies of a religiously affiliated school, a prohibited activity. We observed no pattern in the data we reviewed of the Sheriff’s Office using asset forfeiture funds to regularly support religious organizations during the period we reviewed and observed in those data that the District Attorney’s Office had provided one other donation to the same religiously affiliated school and another to a church, the circumstances of which we did not review in detail. Nonetheless, the donations to the religiously affiliated school reveal the types of improper spending that can occur when only limited safeguards are employed to ensure proper spending.