INTRODUCTION

Background

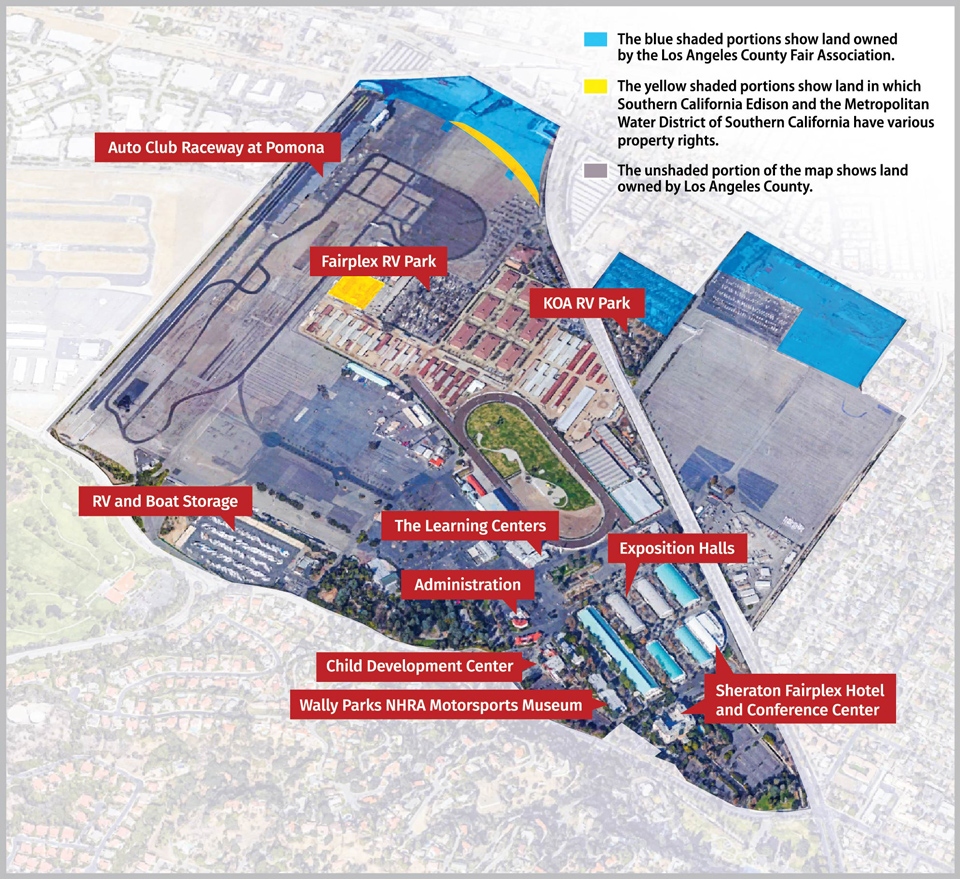

Incorporated in 1940, the association is a private nonprofit mutual-benefit corporation that operates the LA County Fair and other year-round activities on property that the county largely owns. The association and its predecessor have operated the fair on this property—currently known as the Los Angeles County Fair, Hotel, and Exposition Complex (Fairplex)—almost every year since 1922, except when the federal government used the land for war defense activities during World War II. Figure 1 shows the Fairplex’s current 543 acres.

Figure 1

Map of the Los Angeles County Fair, Hotel, and Exposition Complex Showing Los Angeles County’s, the Los Angeles County Fair Association’s, and Other Entities’ Property Rights in the Land

Sources: Los Angeles County records, Los Angeles County Fair Association records, and Google Maps.

The association’s mission is to promote the agricultural, horticultural, viticultural, industrial, and other interests of the county and the State. Its primary mission has remained the same since its founding, but its activities have evolved over time to keep up with the changing culture of the county. For instance, the association stated that it no longer conducts agricultural competitions at the LA County Fair because the county’s agricultural activities have declined significantly, although it continues to have agricultural exhibits.

Lease to Operate on County-Owned Land

The association’s predecessor ran the first LA County Fair in the city of Pomona in 1922. The county eventually acquired ownership of most of the 543-acre Fairplex located in Pomona, including land the association and its predecessor deeded to the county. Currently the county owns 502 acres, the association owns 36 acres, and other entities—including Southern California Edison and the Metropolitan Water District of Southern California—have various property rights in the remaining five acres.

Some Key Provisions Allowing Early Termination of the Ground Lease and Operating Agreement

The Ground Lease and Operating Agreement (lease) automatically terminates if the Los Angeles County Fair ceases to be held on the Fairplex property, unless the cause is due to events beyond the control of the Los Angeles County Fair Association (association).

Los Angeles County (county) may terminate the lease under any of the following conditions:

- The association fails to maintain required insurance coverage.

- The association fails to pay rent or other monetary amounts due after 10 days’ written notice from the county.

- The association becomes insolvent.

- The association loses its nonprofit status.

Source: The 1988 lease between the county and the association.

The association eventually realized that to pay for the property’s upkeep and the construction of new buildings, it needed a source of revenue in addition to the LA County Fair held annually in September. In 1948 the county entered into an agreement with the association under which the association paid an initial sum of $66,412 to the county but did not pay any annual rent to the county for use of the land. In 1988, however, the county and the association entered into the current 56-year lease, which provides the association with the option to renew the lease for up to 10 additional years. The purposes of the lease included enabling the association to operate the LA County Fair; to develop the Fairplex, in part through the construction of a hotel and convention facilities; to increase the use of the Fairplex; and to provide additional revenue to the county.

Under the terms of the lease, the association must annually pay the county a percentage of the gross revenues it receives from the use of the Fairplex. In addition, any improvements the association makes on county‑owned land at the Fairplex will become assets of the county upon termination of the lease. The county may terminate the lease early for the reasons presented in the text box. However, the county has oversight of the association’s activities only to the extent laid out in the lease. Currently, the county’s Chief Executive Office manages the lease.

The Association’s Business Structure

The association’s business structure has changed significantly since the county and the association entered into the lease in 1988. At that time, the association ran the annual LA County Fair and year‑round events, operated two RV parks and a child development center, and owned a subsidiary whose purpose was to conduct harness racing. However, the association subsequently entered into other business activities and created additional subsidiaries that it owns and controls, as shown in Figure 2. For example, the association’s hotel, conference center, and two RV parks are owned by and constitute business activities of the association itself and are legally indistinguishable from the association. In addition, the association has a variety of subsidiaries, including an equestrian auction company, a food and beverage company that serves as the LA County Fair’s master concessionaire, a party equipment rental company, and a storage company. The association also leases space at the Fairplex to unrelated organizations, such as the National Hot Rod Association, which operates the Auto Club Raceway at Pomona and a museum at the Fairplex.

Figure 2

The Business Structure of the Los Angeles County Fair Association and Its Related Organizations

Sources: The association’s audited financial statements, website, and publicly available tax filings, and the Secretary of State’s Office website.

* The hotel opened in 1992 and the conference center opened in 2012. The association operates two RV parks—one that opened in the 1950s and one that opened in 1986.

† The Fairplex Child Development Center opened in 1980 as a child care resource for Fairplex employees and was incorporated in its current form in 1997. It provides children and families with education and child care before the start of kindergarten.

‡ Fairplex Racing, Inc., was organized in 1986 for the purposes of conducting harness racing. It was renamed Fairplex Enterprises, Inc. (FEI), in 1998 and owns an interest in Barretts Equine Limited (Barretts).

§ Barretts was formed in 1990 and conducts equestrian auctions. The association controls Barretts through FEI and another subsidiary the association owns, Fairplex Esquire Sales, LLC, which was formed in 2002 to purchase the general partner interest in Barretts.

II Cornucopia Foods, LLC, was formed in 2004 and serves as the master concessionaire for the fair and other events during the year.

# Event Production Solutions, LLC, was formed in 2010 and rents event and party equipment.

** Fairplex RV and Boat Storage, LLC, was formed in 2010 and provides storage space for RVs and boats.

†† The association’s related nonprofit organizations are overseen by boards that include a subset of the association’s board members and executive management team, as well as others that are not involved with the association’s operations.

‡‡ Foundations at Fairplex was formed in 2004 to support and further the mission and programs of the Fairplex Child Development Center and The Learning Centers at Fairplex.

§§ The Learning Centers at Fairplex, formed in 1998 as the Fairplex Education Foundation, provides a wide spectrum of educational programs.

Further, the association has three related nonprofit organizations that operate at the Fairplex—a child development center, an educational center, and an entity that supports the missions of the first two nonprofit organizations. The boards of these nonprofit organizations include association directors, association members, and association executive managers, as well as others not involved in the association’s business operations. The association exercises influence but does not directly control these related nonprofit organizations. For instance, seven of the 15 individuals who served as directors of the Fairplex Child Development Center in 2014 were also involved in the association’s operations. These individuals included the association’s former president, the association’s chief financial officer, three association members, and two association directors.

According to its audited financial statements, the association is exempt from federal income and state franchise taxes under Internal Revenue Code section 501(c)5—which provides for the exemption from federal income tax of labor, agricultural, or horticultural organizations—and corresponding state provisions. As a result, the association does not pay taxes on business related to its tax‑exempt purpose, which is to advance and promote the agricultural, horticultural, viticultural, industrial, and other interests of the county and the State. Consequently, it does not pay taxes related to conducting the LA County Fair. However, according to the association’s audited financial statements, certain entities consolidated within it are subject to federal income and state franchise taxes.

Differences Between the Association and Public Entities That Operate Other California Fairs

The California Department of Food and Agriculture (CDFA) provides fund administration and broad policy oversight to a group of fairs defined by state law as the Network of California Fairs. The Network of California Fairs currently includes 52 fairs that are run by state entities known as district agricultural associations (DAAs), whose primary purposes include holding fairs, expositions, and exhibitions; 19 fairs that are run by nonprofit organizations; six fairs that are run by county governments; and the California State Fair, which is operated by a state agency. The Fairs and Expositions Branch of CDFA oversees the Network of California Fairs, but has limited oversight of fairs that do not receive money from the state’s Fair and Exposition Fund, such as the association. We describe some key differences between the association and the more common DAAs in Table 1.

| District Agricultural Associations | Los Angeles County Fair Association | |

|---|---|---|

| District agricultural associations (DAAs) are state institutions. | The Los Angeles County Fair Association (association) is a nonprofit mutual-benefit corporation. | |

| DAAs may be formed either for the purposes of holding fairs, expositions, and exhibitions to exhibit the industries and resources of the State, or for the purposes of constructing, maintaining, and operating recreational cultural facilities of general public interest. | A nonprofit mutual-benefit corporation can be formed for any lawful purpose. The association’s primary mission is to promote the agricultural, horticultural, viticultural, industrial, and other interests of Los Angeles County and the State. | |

| DAAs are required to meet certain standards prescribed by the California Department of Food and Agriculture (CDFA). CDFA also has oversight over California fairs receiving money from the Fair and Exposition Fund. | Currently, the Los Angeles County Fair does not receive money from the Fair and Exposition Fund. Therefore, CDFA has limited oversight of the Los Angeles County Fair run by the association. | |

| DAAs may form an entity for the purpose of conducting fair horse racing and utilizing their racing facilities for such racing. | The association can carry on any other lawful business enterprise or activity that may seem connected to the association’s purpose. | |

| The Governor appoints DAA directors. | Under its bylaws, association directors are elected by the association’s members or directors. Association directors must be regular members themselves. |

Source: California State Auditor’s analysis of state law and the association’s articles of incorporation and bylaws.

The Association’s Financial Situation

As Figure 3 shows, the association receives most of its revenue from its fair-related activities, its hotel and conference center, its food and beverage concessionaire, and its year-round events. The association receives relatively little public funding or other assistance from the State or from local governments. For instance, the only such assistance the association received in 2015 was an $800,000 credit it applied against its annual rent payment to the county. We discuss this rent credit in greater detail in a subsequent section of the report. Of the $15.3 million in total state and local government public funding and other assistance the association received between 2006 and 2015, $9.1 million, or nearly 60 percent, directly related to the association’s construction of the conference center—$6.4 million in rent credits from the county and $2.7 million in public funding from the Pomona Redevelopment Agency (Redevelopment Agency). Another $3.3 million, or 22 percent, pertained to the Redevelopment Agency’s purchase of affordable rental space covenants at one of the association’s RV parks, which we describe later in this report. The remaining public funding was for other purposes, as described in Table 2.

Figure 3

The Los Angeles County Fair Association’s Revenue Sources by Major Category for 2015

Source: The association’s audited financial statements for 2015.

* Revenue from the LA County Fair held in September at the Fairplex.

† Combined revenue from the association’s hotel and conference center at the Fairplex.

‡ Revenue the association earns from activities conducted outside of the LA County Fair—including recreational vehicle (RV) shows, an annual Oktoberfest event, and sporting events—that are not represented in other categories in this figure.

§ Revenue from Cornucopia Foods, LLC, a for-profit entity wholly owned by the association that serves as its food and beverage master concessionaire.

II Revenue from the association’s other subsidiaries and business activities, including the RV and boat storage and party equipment rental companies that are wholly owned by the association.

# Revenue from Barretts Equine Limited, the equestrian auction business that the the association wholly controls.

| Public Funding | ||

|---|---|---|

| Public Entity | Amount | Description |

| Pomona Redevelopment Agency (Redevelopment Agency) |

$3.3 million—In 2009 the Redevelopment Agency agreed to provide $3.3 million to the Los Angeles County Fair Association (association) in exchange for the association leasing at least 50 spaces in a recreational vehicle park it operates at the Fairplex to residents with low to moderate incomes for a period of 55 years. The Redevelopment Agency also understood the association would be using the funds to improve the Fairplex, including to help pay for a conference center the association was planning to build at the Fairplex. $2.7 million—In 2009 the Redevelopment Agency agreed to provide $2.7 million to assist the association in building its conference center. The conference center opened in 2012. $675,093—In 2005 the Redevelopment Agency’s predecessor agreed to provide a rebate to the association—or a share of future tax increments—related to the renovation of its hotel. The Redevelopment Agency’s predecessor based this rebate on the increased occupancy taxes it expected to receive. These rebates totaled $675,093 for 2006 through 2010, when the term of the rebate expired. $436,075—The Redevelopment Agency entered into a tax-sharing agreement with the association under which the Redevelopment Agency agreed to pay a share of the debt that the association incurred when it made investments in fairground facilities in 1989. The amount shown represents the Redevelopment Agency’s total share for 2006 and 2007. The debt matured in 2007. |

|

| California Department of Food and Agriculture (CDFA) |

$537,976—State law at the time permitted CDFA to distribute Legislature-appropriated funds to pay toward unemployment insurance coverage for the Network of California Fairs. CDFA paid the association unemployment insurance subsidies from 2006 through 2010, when the Legislature discontinued authorization and funding for the program. $430,326—According to CDFA staff, CDFA used revenue until 2011 to offer facility support to fairs that conducted horse racing. The association received $179,055 in 2007 and $251,241 in 2009. $90,000—CDFA provided $35,000 to the association in 2006, $35,000 in 2007, and $20,000 in 2011 to support the fair’s general operations. $26,000—CDFA provided money to fairs for projects to improve fairground accessibility and accommodations for the physically disabled under a program that was discontinued in 2007. CDFA provided $26,000 to the association under this program in 2007. $13,000—In 2011 CDFA provided the association funding for infrastructure purposes. The association stated that it used this money on its fair facilities. |

|

| Los Angeles County (county) |

$450,000—In 2006 the county provided funding to the association to help it refurbish an exhibition building at the Fairplex. $218,516—In 2002 the county agreed to reimburse the association for capital improvements it made at the Fairplex to bring its facilities into compliance with the Americans with Disabilities Act. Within our audit period of 2006 through 2015, in February 2006 the county made only one payment to the association under this agreement. |

|

| Total State and Local Public Funding | $8,876,986 | |

| OTHER ASSISTANCE | ||

| County |

$800,000 per year from 2008 through 2015. The county agreed to provide the association an annual rent credit of $800,000 for 15 years, beginning in 2008 and ending in 2022. The county provided this credit, which will total $12 million, to help cover the costs of the conference center’s construction. |

|

Sources: Accounting records and other financial documents from the association, CDFA, the county, and the city of Pomona.

Although the association reported a net loss in five of the past six years in its audited financial statements, it reported positive income from its operations in every year throughout our audit period. According to the association, it evaluates its profitability based on its earnings before interest, depreciation, taxes, and amortization—presented as operating income in its audited financial statements—because the earnings reflect the actual cash the association has on hand to service debt and reinvest in capital. From 2006 to 2015, the association’s operating income ranged from a low of $4.9 million to a high of $11.9 million; in 2015 it was $6.8 million. As Table 3 shows, the net losses the association reported in its audited financial statements were mainly due to noncash amounts such as depreciation of its buildings and changes in the value of a bond-related transaction it entered into in order to keep its interest expenses predictable. In other words, its net losses were largely the result of accounting reporting requirements rather than inadequate revenue.